Dhruv Bansal, co-founder of Unchained Capital recently published the first part of a research paper entitled ‘Bitcoin Data Science: Hodl Waves‘. Working with his team, Bansal analyzed the Bitcoin network's ledge of Unspent Transaction Outputs (UTXO) for the past few years. The result was that he traced one of the reasons why Bitcoin (BTC) lost quite a bit of value.

Dhruv Bansal, co-founder of Unchained Capital recently published the first part of a research paper entitled ‘Bitcoin Data Science: Hodl Waves‘. Working with his team, Bansal analyzed the Bitcoin network's ledge of Unspent Transaction Outputs (UTXO) for the past few years. The result was that he traced one of the reasons why Bitcoin (BTC) lost quite a bit of value.

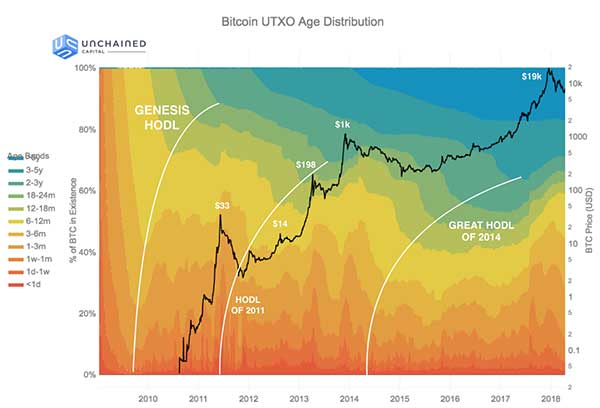

This research is based on the idea of the blockchain's Unspent Transaction Outputs which are time stamped.

These UTXOs indicate when they were last used and this can reveal patterns in the trading of bitcoin. It would normally be impossible to do an analysis like this with other forms of assets but this was possible with bitcoin since BTC is meticulously tracked by the Bitcoin network. The analysis came up with a chart of the transactions and the research team led sby Bansal noticed something strike in the patterns.

The important discovery made by Bansal and his team was that a pattern happened every time bitcoin rallied. These patterns are called ‘Hodl Waves’ and are created when large bitcoin market transactions happen due to market spikes and the UTXOs go on to age with new owners, indicating that the Bitcoin is just being held.

The first Hodl wave happened in the Genesis period when Bitcoin was starting out. This lasted from January 2009 through June 2011. The price started at zero then jumped to $33. The wave happened because a lot of the early adopters just held on to their coins, even if they did not have much value.

The next Hodl wave started when the price rose from $33 to $1,000. This was the period between 2011 to 2013. The next big wave happened in 2014, which started off with the 2013 $1,000 rally to the 2017 spike of $19,000. For example, when Bitcoin jumped to $1,000, around 60% of the coins in existence were older than a year. In the next market high, when Bitcoin pushed past the $19,000 mark in December 2017, 40% of bitcoins were older than 12 months.

Three Reasons For Increased Bitcoin Usage

The research found three main reasons for the increased usage of bitcoins. First, there was the Bitcoin Cash and Segregated Witness hard fork that made people nervous. Next, the prevalence of initial coin offerings, which encouraged people to invest their Bitcoin. Finally, bitcoin traders wanted to make high capital gains which caused a number of bitcoin holders to sell them to get the cash.

In a statement, Bansal said

After every great rally, there's been a great Hodl. As the data shows us, there is already the development of another generation of holders settling in for the long haul