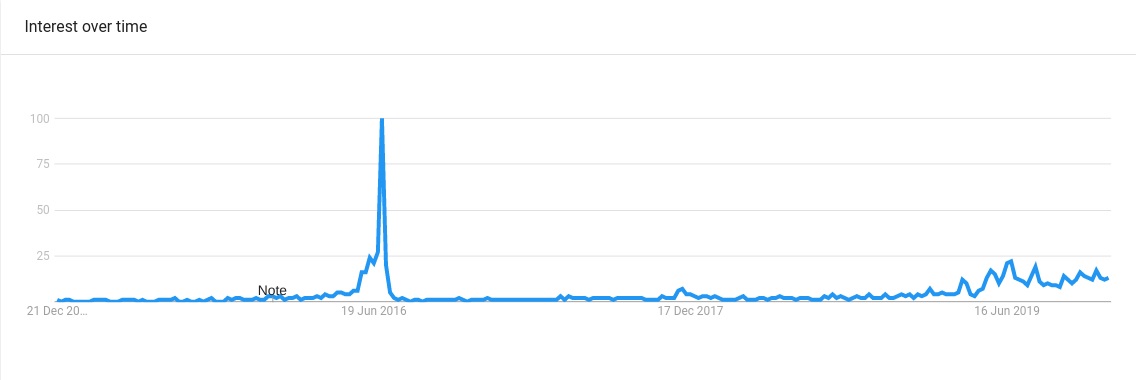

Bitcoin’s halving of block reward in May 2020 is being watched closely by investors and crypto enthusiasts. As per info from Google Trends on December 17, global searches for “Bitcoin halving” have considerably grown during 2019, before halving takes place.

Bitcoin’s halving of block reward in May 2020 is being watched closely by investors and crypto enthusiasts. As per info from Google Trends on December 17, global searches for “Bitcoin halving” have considerably grown during 2019, before halving takes place.

In the past five years, search volumes increased considerably in 2016 when previous ‘Bitcoin halving’ took place.

On the contrary, search for “Bitcoin” have decreased in the past few months, reflecting the disinterest connected with the crypto’s price fall. When Bitcoin rebounded in November, the search volumes increased once again.

Nevertheless, analysts did notice crypto market’s increasing interest about halving. Tuur Demeester, Adamant Capital co-founder, commenting on the info, pointed out that many of them believe that halving will fuel another rally.

Demeester tweeted “It’s very clear that retail interest in BTC is nonexistent and investor sentiment is pretty bad right now. Question is whether the halvening could provide a bullish narrative – the Google trends data imo suggests it could.”

Haha no that’s not what I mean. It’s very clear that retail interest in BTC is nonexistent and investor sentiment is pretty bad right now. Question is whether the halvening could provide a bullish narrative – the Google trends data imo suggests it could.

— Tuur Demeester (@TuurDemeester) December 17, 2019

Halving specifically reflects a situation where the number of “new” Bitcoins given to miners for every block of transactions decrease by 50%. Next year, the reward is expected to decrease from 12.5 BTC to 6.25 BTC. Some crypto think tanks have alleged that miner behavior is already undergoing a change because of this.

Of late Bitcoin continues to bounce after touching $6,500, which confirms the fact that miners will defend a particular floor price that is required for running their operations without loss.