By tracking CCi30, the Princeton, NJ-based Cryptos Fund enables investors to gain exposure to the entire blockchain sector. Minimum acceptable investment from qualified investors is $10,000. The fund does not charge subscription, redemption or performance fees. The management fee depends on the investment and starts at 0.99%.

Why investing in Cryptos Fund is profitable?

Since 2015, Bitcoin is up by a factor of 0.42. However, the CCi30 is up by a factor of 154, because the other cryptocurrencies have actually done much better than Bitcoin, with a higher Sharpe ratio. Therefore, investing in the index allows to profit from the unpredictable raise of some cryptocurrencies, while limiting the losses deriving from the fall of others.

Computing index value.

The market capitalizations of cryptocurrencies are quite volatile, and thus the “top 30” have to be computed frequently. A full computation of the constituents is performed every quarter, followed by a reweighing of the constituents in the index monthly. In addition, the volatility of the space makes it unreasonable to compute the top thirty cryptocurrencies based on the market cap on a single day. So, the index creators smoothed the data by using an exponentially weighted moving average of the market capitalization. Bitcoin accounts for about 35% of the total capitalization of the market. This makes a proportionally-weighted index not so useful, so the index creators decided to weigh each component proportionally to the square root of its (smoothed) market capitalization.

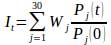

The index value is calculated using the formula

Where It is the value of the index at time t, Wj is the weight of the jth name in the index, and Pj is the price of the jth name as a function of time. On rebalancing dates, the weights are normalized in such a way that the index value is the same, whether it is computed with old or with new weights.The index is calculated in realtime.

About CCi30

CCi30 was created and is maintained by a team of mathematicians, quants and fund managers lead by Igor Rivin, Professor of Mathematics at Temple University and Regius, Professor of Mathematics at St. Andrews University, and Carlo Scevola, economist and director of Hermes Asset Management.

Dr. Igor Rivin, the Chief Research Officer said

“The blockchain sector is still in its infancy and has enormous growth potential. Institutional investors have just started to enter this sector; we expect more and more players of the caliber of George Soros to join the field in the future. We believe that following the CCi30 index is a smart way to invest in cryptocurrencies. While we have no crystal ball, we feel that this is the most prudent way to explore the market.”

Jeffrey Zorn, the Chief Security Officer, said

“The fund is the best instrument for participating in the growth of cryptocurrencies and the blockchain technology, which is one of the three most important inventions of the last 50 years, together with silicon and the internet. Cryptos Fund provides the highest levels of security: counterparty risk has been completely neutralized, and the assets are held in our proprietary cold storage, with redundant facilities and military-level physical protection.”

Jeffrey Zorn is a global security expert, Major, USMC, recipient of the Bronze Star Medal with Valor device, and former military aide to the U.S. president at the White House.