London-based full-service investment bank NKB, which is focused on blockchain technology, released its detailed research report on Cardano ADA. NKB has four divisions namely Wealth and Asset Management, Advisory, ICO, and Principal Investment. The bank offers tailor-made solutions for institutional investors, corporates, and High Net-worth Individuals (HNI).

London-based full-service investment bank NKB, which is focused on blockchain technology, released its detailed research report on Cardano ADA. NKB has four divisions namely Wealth and Asset Management, Advisory, ICO, and Principal Investment. The bank offers tailor-made solutions for institutional investors, corporates, and High Net-worth Individuals (HNI).

The bank’s research division brings “the standard procedures from traditional finance and applies them in the newly developing crypto economy.” NKB strictly follows the guidelines of the European Commission’s Markets in Financial Instruments Directive (MiFID II) and operates “as if the crypto space was already regulated, complying with regulations for the investment research and financial advisory in the EU.”

Some of the important points from NKB Research’s report on Cardano (ADA) is as follows:

”

Cardano – Fundamental Details

- The Cardano decentralised blockchain is an open source platform which uses a proof-of-stake algorithm called Ouroboros. The algorithm has consensus generated by coin-holder voting. Slot leaders, who hold a native platform coin ADA, generate new blocks in the blockchain and confirm the transactions.

- The Cardano blockchain has two main layers: 1) ADA cryptocurrency which operates on the Cardano Settlement Layer (CSL), and which is a ledger supporting transactions; 2) The Cardano Computation Layer (CCL) which supports smart contracts and decentralised applications.

- The Cardano blockchain may be easier to update via soft forks compared to Ethereum, which has those two layers intertwined. The two layers CSL and CCL are connected by side chains.

- Cardano uses the Haskell programming language with a high degree of fault tolerance. The ADA cryptocurrency is developed around a Recursive InterNetwork Architecture (RINA).

- The Cardano blockchain was released on 29 September 2017. The team is located in Japan, USA, and Hong Kong.

Cardano – Settlement layer

- Cardano SL (or Cardano Settlement Layer) is a cryptographic currency designed and developed by Input-Output Hong Kong (IOHK) in conjunction with the University of Edinburgh, the University of Athens and the University of Connecticut.

- The Cardano team has developed the secured proof-of-stake algorithm called Ouroboros.

- The main idea of the Ouroboros proof-of-stake protocol is that a node is selected to make a new block, with a probability proportional to the amount of coins this node has.

- If a node has a positive stake (>0), it is called a stakeholder. If a node is chosen to make block it is called a slot leader.

Cardano Roadmap

- Testnet era: all functionality, including the reward mechanism, is activated; all participants test the network by downloading software and providing feedback.

- Byron phase or Bootstrap era: the network operates in “bootstrap mode”, people who purchased ADA redeem their coins, the stake will automatically get delegated to a pool of trusted nodes that will maintain a network. During this period no block rewards will be issued. The network is currently operating in Bootstrap mode.

- Shelley phase or Reward era: a normal operation mode of the network.

Cardano Use Cases

The Cardano platform allows a wide range of applications to be run on the platform. The essential infrastructure is under development, however, the sustainable research-driven approach by IOHK will allow the essential part of the infrastructure to be ready in 2018. The team is aiming to evolve Daedalus, the Cardano SL wallet application, into a universal cryptocurrency wallet featuring automated cryptocurrency trading and cryptocurrency-to-fiat transactions.

Some of the use cases under development are given below:

- Proof of university diplomas in Greece, a joint project with the national research and education network of Greece GRNET, is the first use case for Cardano. The use case of a register may be developed widely, given the compliance layer of the platform.

- Cardano planned initial smart contract applications such as a casino and an integration with the mobile gaming market, in its ICO documentation.

- Cardano debit cards are planned in the roadmap to provide users with ADA available everywhere.

- The first ICO which can potentially use Cardano was launched in March 2018. Traxia is creating a decentralized global trade finance system where invoices are converted into smart contracts and traded as short-term assets. The Traxia project is currently built on Ethereum technology but will be migrating to Cardano in Q4 2018, when Cardano’s Goguen goes live.

Cardano Monetary Policy

- At the launch of Cardano, it was sold for 25,927,070,538 ADA tokens. There were 5,185,414,108 vouchers distributed to three entities of the Cardano community — IOHK, Emurgo, and the Cardano Foundation, making the total amount of ADA available at the launch as 31,112,484,646 ADA.

- ADA tokens are capped at an arbitrary 45,000,000,000 ADA. There are 13,887,515,354 ADA to be issued after the launch through mining.

- One ADA equals 1,000,000 Lovelaces. ADA has six decimal places.

- The ADA token is named after Augusta Ada King-Noel, Countess of Lovelace (nee Byron), an English mathematician known for her work on Charles Babbage’s proposed mechanical general-purpose computer, the Analytical Engine.

- The Cardano blockchain is named after Gerolamo Cardano, an Italian polymath famous for his work on probability, binomial coefficients, and binomial theorem.

- In the future, Cardano will have treasury funded with newly-minted ADA and transaction fees. The treasury will be governed by ADA holders.

- The minimal fee at the Cardano blockchain is defined as 0.155381 ADA plus 0.000043946 ADA/Byte multiplied by the size of the transaction. The formula for the fee calculation is not the final one as the team is researching this area and some amendments might be implemented.

Cardano Team

The Cardano blockchain is built around three entities:

- The Cardano Foundation, which is a promoter, educator and standard body for the blockchain and its apps. The foundation provides a formal specification and standardization process.

- Input Output Hong Kong (IOHK) is the founder and the engineering company which designs the platform. IOHK has a strong team and designs the protocol. Two co-founders of IOHK are Charles Hoskinson, formerly the CEO of the Ethereum project and founder of Invictus Innovations and IOHK, and Jeremy Wood, former operations manager at Ethereum and co-founder of Input Output Hong Kong.

- Emurgo, a business partner of the project will incentivize growth on Cardano by funding start-ups building dApps on the blockchain.

Despite the optimism surrounding the Cardano project, there are several concerns:

- The heavy academic approach may result in a delay of the project with other less technologically prominent projects taking over the market share.

- The whitepaper and Cardano website promise many different features, some of them may be hard to realise.

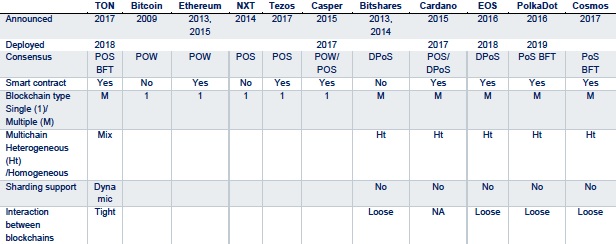

How Cardano Fares In Comparison With Other Blockchain Platforms?

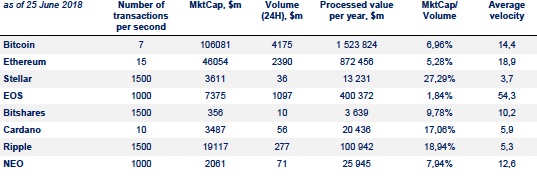

- The Cardano protocol is aiming to provide a superior processing capacity of the network in terms of the number of transactions.

- The design of the Omniboros POS protocol also assumes high security compared to other POS protocols.

- Thus, scalability and security, as well as low cost, make this blockchain a good option for the decentralised apps as well as a payment system.

- Compared to other POS-based blockchains, Cardano also has an additional layer which allows implementation of regulatory requirements.

- The transition of Ethereum, the platform which currently dominates the ICO market, from POW to POS (Ethereum’s Casper has already been released as a link between POW and POS), represents a potential risk for other platforms under development. Ethereum has the widest adoption among platforms and many projects use software already created on Ethereum that essentially eases the development of new projects.

Cardano – Potential Risks

- The regulatory environment may change over time, implying a different requirement for the platform.

- Delay with the development creates a pressure from competitive projects.

- Adoption of the blockchain by developers may be slow.

- Technical implementation of all announced features may be delayed or not realized in full.

- ADA token may lose its value.

- The governance system may modify the initially proposed blockchain.

”