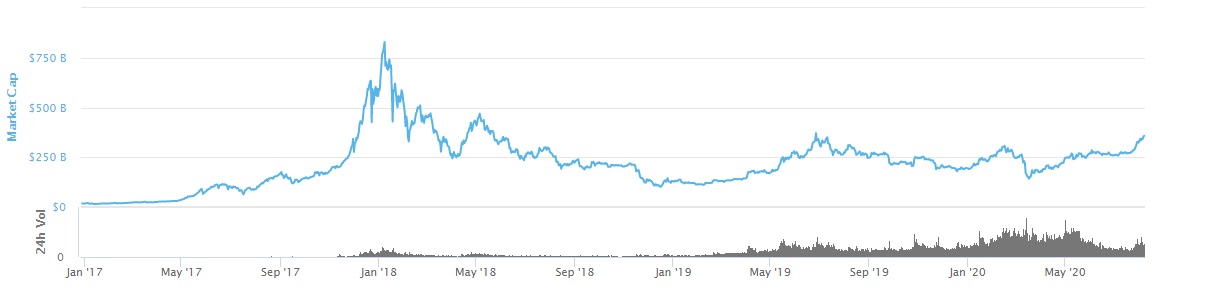

Bullishness in the cryptocurrency market has brought down the dominance factor of Bitcoin (BTC) to a yearly low of 59.9% against altcoins, with the overall market cap rising to $356.62 billion.

Bullishness in the cryptocurrency market has brought down the dominance factor of Bitcoin (BTC) to a yearly low of 59.9% against altcoins, with the overall market cap rising to $356.62 billion.

In mid-May, the dominance factor of Bitcoin stood at 67%, down from 69.9% in September 2019.

It is the highest level since Q1 2017. The dominance of Bitcoin has decreased when the overall cryptocurrency market cap is trying to break through stiff resistance after hitting yearly highs.

If the cryptocurrency market cap increases by $14 billion then the overall market cap would touch $370 billion, a level seen in May 2018.

In spite of Bitcoin’s surge in July to break above the psychological level of $10,000, the market cap of altcoins rose to $140 billion for the first time in almost two years.

July trading report published by Binance also reflects rebound in the altcoin markets, with altcoins appreciating by about 32% to account for 40% of overall volume on Binance futures.

Binance credited the robust accomplishment of altcoin to the rising popularity of Ethereum blockchain powered DeFi (decentralized finance) covenants and Ether (ETH) purchases in expectation of ETH staking.

In July, the value of assets frozen in DeFi apps doubled from $2 billion to $4 billion. The ten top DeFi tokens account for a market cap of about $7 billion and comprises of top 50 cryptocurrencies.