In between global market rout, numerous top Bitcoin (BTC) and other crypto based insurance funds are signaling huge stress.

In between global market rout, numerous top Bitcoin (BTC) and other crypto based insurance funds are signaling huge stress.

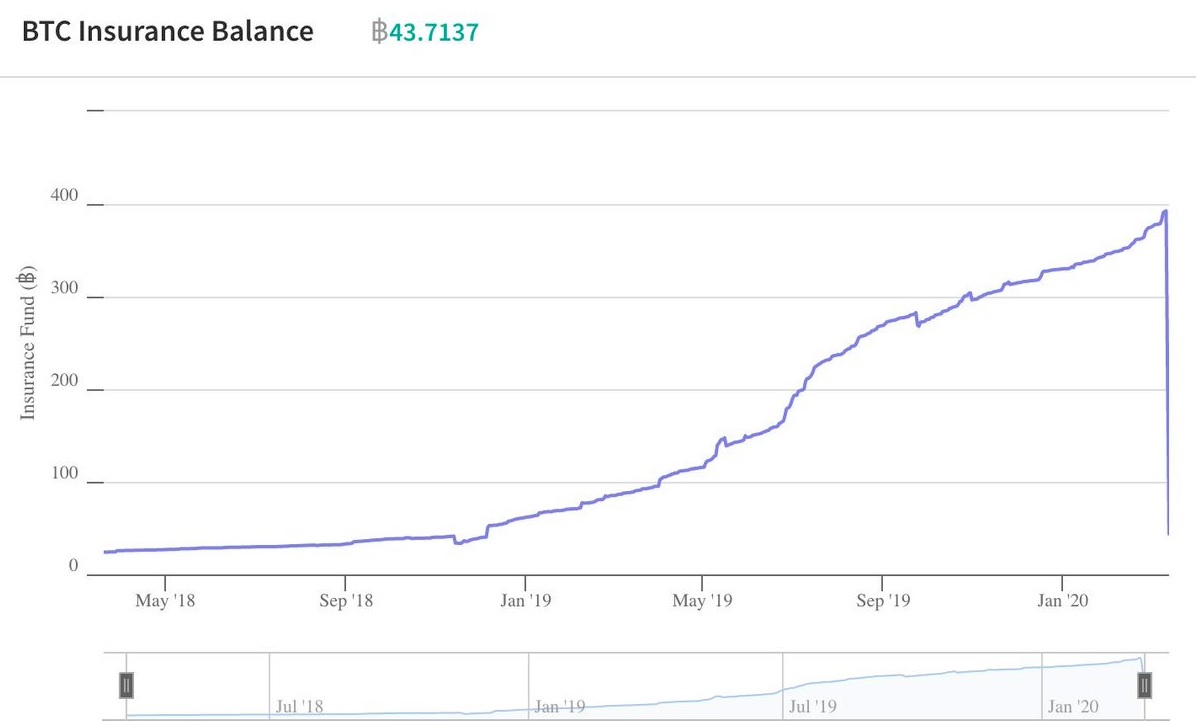

As of date, Bitcoin derivatives exchange Deribit posted a startling decline in the outstanding balance related to its Bitcoin insurance fund.

Deribit reported balance of 183 BTC, a decline of 53% from 391 BTC in a period of three days.

Similarly, the Binance Insurance Fund posted a tweet disclosed that it had spent more than $6 million in a day to prevent auto-deleveraging (ADLs) on its board.

The exchange guaranteed that “In the event that the insurance fund continues to deplete, we will inject new funds and continue protecting our users.”

The #Binance Futures Insurance Fund has used over $6,000,000+ in the past 24 hours reducing ADL’s.

In the event that the insurance fund continues to deplete, we will inject new funds and continue protecting our users.

Sign up to #BinanceFutures here:

➡️ https://t.co/jkiHuCnnVe pic.twitter.com/ISzDtahFGx— Binance (@binance) March 13, 2020

Data from Binance discloses that the value of its insurance fund had decreased by more than 50% overnight, declining to 6,227 from 12,864 Tether (USDT) between March 12 and March13.

Binance is yet to give an official statement on this matter.

Between March 11 and 12, info from crypto derivatives trading platform BitMEX shows that the value of its daily insurance fund dropped negligibly to 33, 881 BTC, from 35,508 BTC.

Furthermore, info from cryptocurrency exchange OKex indicates that 1,009.50 BTC was added to its BTC/USD Futures Insurance Fund, with 475.2 BTC pulled out subsequently to settle a bankruptcy loss.

Between February 24 and March 9, no withdrawals from the fund were made. The balance for Huobi’s Bitcoin Insurance Fund, in the meantime, reflects a growth to 1,327 BTC, from 1,121 BTC.

The exchange, nevertheless, does not offer a split view of the info that would expose the routine in which deposits and withdrawals were carried out within the same period. In early January, noted Bitcoin supporter Andreas Antonopoulos had mysteriously envisioned this week’s financial tumult and its probable effect on the crypto sector.

Andreas Antonopoulos at that time said “When people get scared, when there is a recession like that, they pull back their investments, and they’re going to pull back from crypto too.”

Earlier this week, many conventional markets faced their worst selloff since 1987 and Bitcoin followed suit by plunging over 60% to even record $3,600 on certain cryptocurrency exchanges.

Whistle blower such as Edward Snowden has given their opinion on whether to buy the dip. Snowden said

“This is the first time in a while I’ve felt like buying Bitcoin. That drop was too much panic and too little reason.”

At the time of writing this article Bitcoin was trading at $5,786.53, down 8.4%, as per CoinGecko.