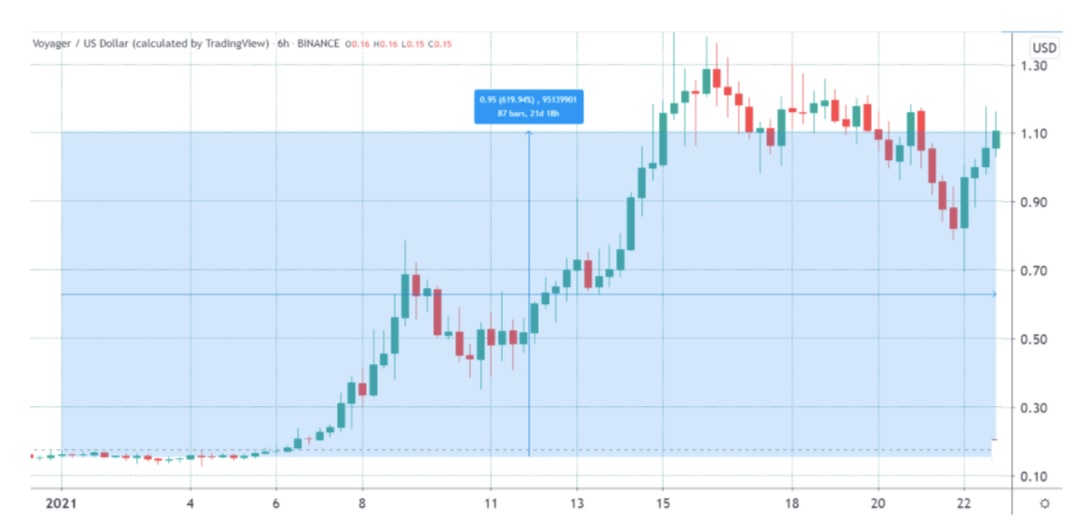

Since the beginning of 2021, VGX has rallied 620% and on January 15, the token hit a new all-time peak of $1.48. Furthermore, along with a fiat gateway, the platform also provides market-related data, cryptocurrency research, interactive charts, and a maximum of 9% interest on stablecoins, in addition to returns for Bitcoins and other alt coins data that are staked or held in exchange wallets.

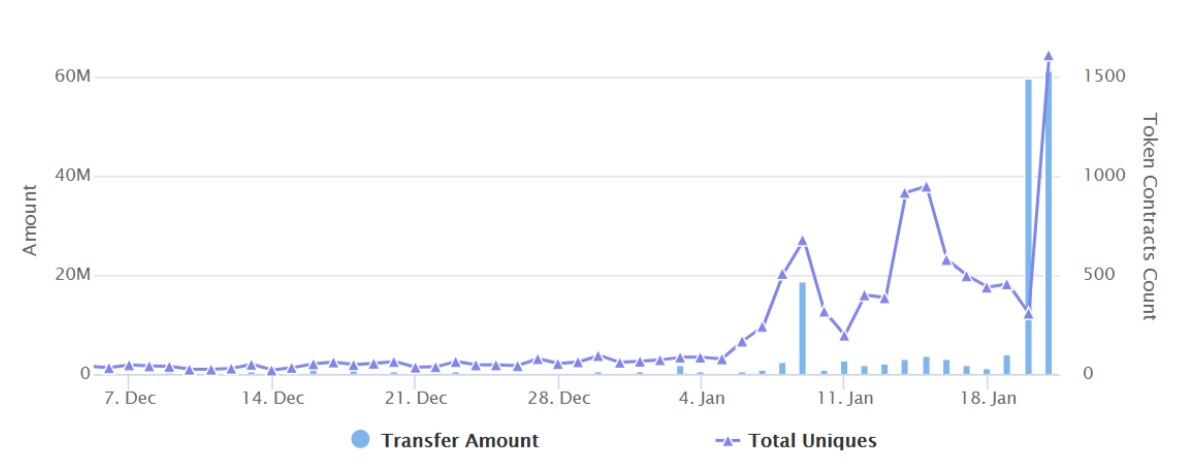

On-chain data indicates picking up of activity only a few weeks back, with the quantum of daily active addresses exceeding 1,500 as transfers speedily touched $60 million. The Invest Voyager app permits traders to receive interest without freezing their tokens and users staking a predetermined quantity of VGX token are eligible for higher yields.

Additionally, Voyager Digital Ltd. (CSE:VYGR), a Canadian company with a market capitalization of C$600 million and a fully regulated Enterprise, owns the platform.

There is another story to the Canada TSX exchange listing. By taking over an inoperative shell firm, Voyager successfully administered a reverse merger in February 2019. Notably, no amount has been paid so far for the takeover involving shares of the company. Back in October 2019, Voyager inked a partnership with Celsius Network to administer a share of its customers’ assets. Through this process, the broker successfully diversified the staking offering.

Another major landmark was the acquisition of Circle Invest last February adding up over 40,000 accounts. Circle Invest, which was earlier associated with the USD coin (USDC), a stable coin, apart from Poloniex exchange, even though both Ventures had been divested a while ago.

Interestingly, the acquisition was carried out without any form of cash payment but settled through Voyager Digital shares. These advancements have caused an increase in client accounts and also talk an activity, comparable to Coinbase. Voyager’s regulated status and fiat on-ramp could make it the preferred exchange for the US-based new entrants in cryptocurrency market.

Presently, Voyager cryptocurrency exchange can be accessed by citizens of all the US states, except New York, the Astor firm awaits BitLicense from the New York regulator. Back in October 2020, Voyager Digital bought France-headquartered LGO, a fully licensed Europe based cryptocurrency exchange targeting institutional level investors.

Hugo Renaudin, CEO of LGO, detailed that the France Enterprise would suspend operations of its dedicated institutional level cryptocurrency exchange as LGO would function under the Voyager brand and concentrate on retail investors.

The aggregate trading volume on Voyager’s platform touched $120 million in November 2020, while assets under administration exceeded $485 million on January 15. Until now, over 200,000 users have installed the Android and iOS applications and further entry into Europe should boost the client base of the platform.

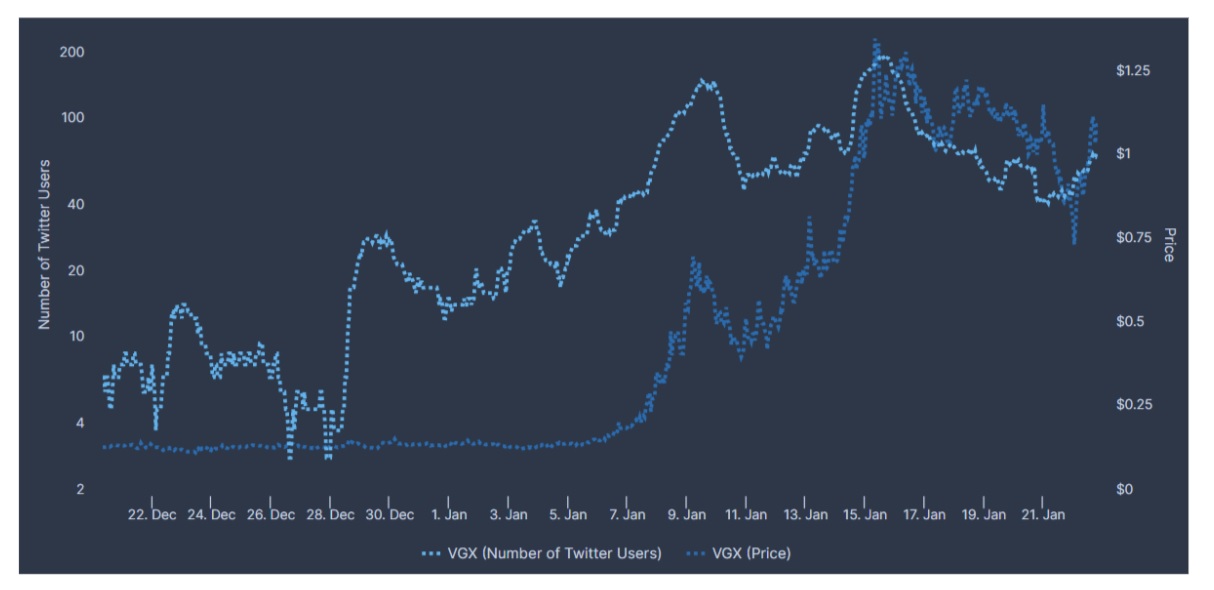

Data provided by TheTIE, a distinct platform facilitating social analytics, indicate that the latest price surge was headed by a rise in social network activity. Barring a handful of uses alleging KYC related withdrawal problems, the overall opinion about Voyager and VGX is a positive one.

The platform has turned out to be popular because it is operated by a fully licensed broker who offers an annual yield of 9.5% on stablecoins do US citizens. For the value of VGX token to appreciate, a debit card with cashback offers, discount on withdrawal fees, and higher interest for stakers might be necessary.