The International Monetary Fund (IMF) has issued a list of norms for emerging markets and developing economies in order to maintain monetary sustainability in the midst of worldwide cryptocurrency acceptance. The IMF trusts in the potency of cryptos as a vehicle for quick and inexpensive cross-border transactions, noting the significant rise in the value of cryptocurrency industry since May 2021 regardless of the negative tendencies.

The International Monetary Fund (IMF) has issued a list of norms for emerging markets and developing economies in order to maintain monetary sustainability in the midst of worldwide cryptocurrency acceptance. The IMF trusts in the potency of cryptos as a vehicle for quick and inexpensive cross-border transactions, noting the significant rise in the value of cryptocurrency industry since May 2021 regardless of the negative tendencies.

According to the study, the major factors of cryptocurrency adoption are great profits, low transaction fees and speed, and decreased Anti-Money Laundering (AML) requirements. To manage the financial stability issues that have arisen as a consequence of increasing trade in cryptos, the IMF advises that lawmakers “enforce world standards for cryptos and improve their capacity to track the cryptocurrency environment by resolving shortfalls.”

“Presented with cryptoization concerns, emerging countries should tighten macroeconomic policies and explore the advantages of launching central bank digital currencies.” According to the IMF study, the cryptocurrency market value has eclipsed Bitcoin (BTC), with a significant rise in stablecoin offers.

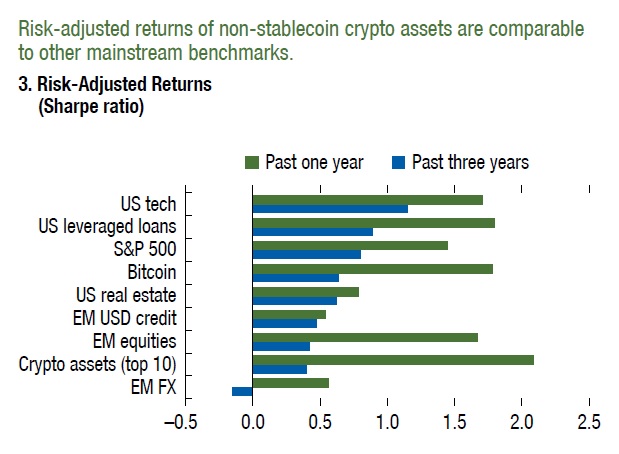

According to three years of IMF statistics, risk-adjusted yields of non-stablecoin cryptos such as Bitcoin are similar to rest of the traditional standards such as the S&P 500, as seen in the figure below: In addition to central bank digital currency (CDBC) issuance, the IMF suggests “proportionate supervision to the threat and in accordance with those of worldwide stablecoins.”

De-dollarization measures, in conjunction with the CBDC adoption, will assist governments in addressing macro-financial concerns. Notably, the IMF revealed its intention to “step up” surveillance of cryptocurrencies in July 2021. An earlier IMF study touting the advantages of cryptos stated that “payments will become simpler, quicker, cheaper, and more usable, and will traverse borders quickly. These enhancements may promote efficiency and inclusiveness, with significant advantages for all.”

The IMF had already scheduled a meeting with Salvadoran President Nayib Bukele to explore the consequences and prospects of widespread Bitcoin adoption.