In the dynamic realm of financial technology, Fideum emerges as a trailblazing force committed to narrowing the gap between traditional finance and blockchain technology. Through its strategic alliance with Mastercard, Fideum aims to transform digital finance, ensuring greater accessibility, security, and efficiency for users on a global scale. At the forefront of this evolution is the introduction of the Fideum token, embodying the essence of innovation in digital finance.

In the dynamic realm of financial technology, Fideum emerges as a trailblazing force committed to narrowing the gap between traditional finance and blockchain technology. Through its strategic alliance with Mastercard, Fideum aims to transform digital finance, ensuring greater accessibility, security, and efficiency for users on a global scale. At the forefront of this evolution is the introduction of the Fideum token, embodying the essence of innovation in digital finance.

Setting a New Standard: Fideum and Mastercard Collaboration

The collaboration between Fideum and Mastercard represents a significant milestone in the financial industry, establishing a new benchmark for the fusion of traditional and digital finance. Leveraging Mastercard’s extensive global reach and Fideum’s blockchain expertise, the partnership seeks to elevate the financial infrastructure, providing unparalleled services to retail and institutional clients alike. This alliance not only amplifies Fideum’s offerings but solidifies its position as a frontrunner in the digital finance space, envisioning a future where financial transactions are more inclusive, efficient, and secure. Recognized as the overall winner of the Mastercard Lighthouse Finitiv, Fideum is poised to expand its presence across the Mastercard Ecosystem.

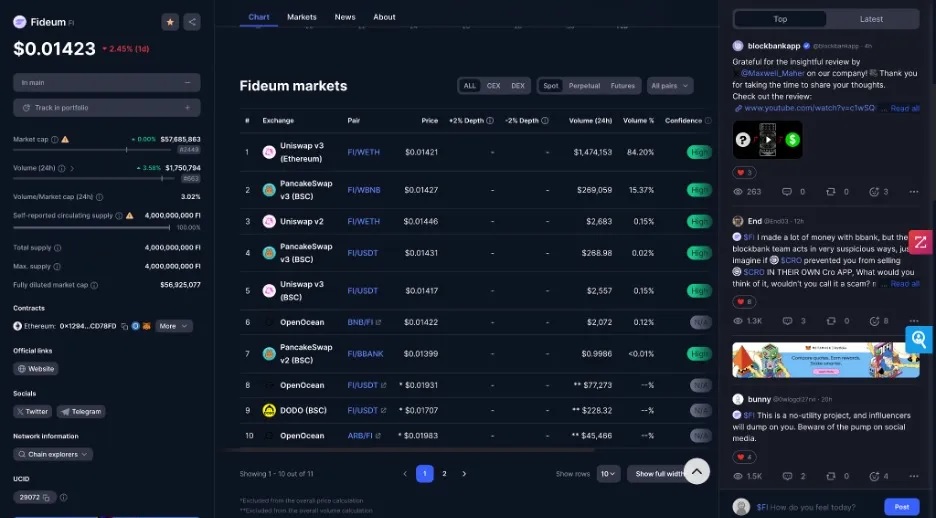

The Fideum Token: Powering a Comprehensive Digital Finance Experience

Central to Fideum’s ecosystem is the Fideum token, a digital asset designed to fuel and facilitate the platform’s diverse services. Its integration into Fideum’s infrastructure enables users to seamlessly engage in a variety of transactions and services, spanning payments to investments. Beyond its role as a utility token, the Fideum token plays a crucial part in ensuring liquidity and stability within the platform’s digital asset exchanges. This token exemplifies Fideum’s commitment to delivering a comprehensive and user-friendly digital asset experience.

Versatile Digital Finance Solutions: Fideum’s Suite of Offerings

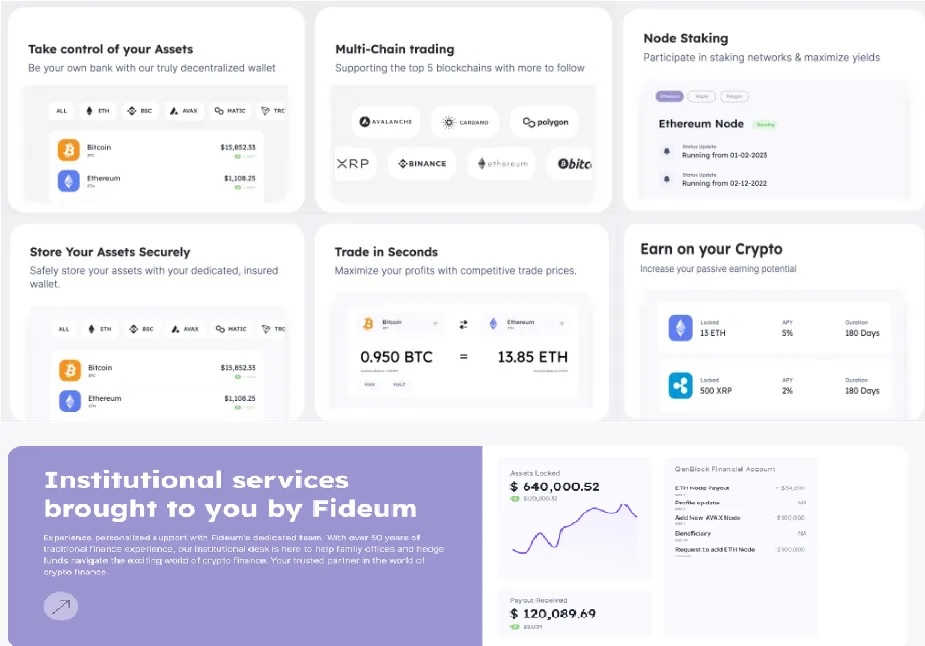

Fideum offers a suite of digital finance solutions tailored to meet the intricate needs of today’s financial ecosystem, including B2C, B2B, and B2B2C offerings. From microservice architecture enhancing operational efficiency to customized institutional solutions and innovative user engagement tools, Fideum showcases versatility and adaptability to diverse financial requirements. This comprehensive approach sets a new standard for excellence in digital finance services.

Empowering Financial Freedom: Fideum’s Multi-Currency Wallet

Experience financial freedom with Fideum’s revolutionary decentralized, anonymous, and non-custodial multi-currency wallet. Securely store and manage digital assets across various chains such as ETH, BSC, Avalanche, and Polygon. Take control of your financial future with our cutting-edge wallet technology.

Achievements and Future Plans: Fideum’s Impact on Digital Finance

Fideum’s journey is marked by notable achievements, including acquiring global licenses, establishing strategic partnerships, and witnessing substantial user base growth. Success in the Mastercard Lighthouse program underscores Fideum’s influential market position and its potential to shape the future of finance. These accomplishments highlight Fideum’s excellence, resilience, and impact on the digital finance arena, incorporating a full range of compliance features within the application.

Commitment to Transformation: Fideum’s Forward-Thinking Approach

Fideum remains committed to transforming the global financial landscape through continuous integration of blockchain and digital assets. Future plans include enhancing the app experience, launching Fideum.com for institutional services, and expanding the token ecosystem. This forward-thinking approach underscores Fideum’s dedication to innovation, envisioning a financial environment where digital assets are as ubiquitous and user-friendly as traditional currencies.

Fideum’s Leadership in Fintech Innovation

Fideum stands at the forefront of fintech innovation, driven by a commitment to security, compliance, and user empowerment. As the company continues to redefine financial services for the digital age, it invites stakeholders to join in its journey toward creating a more inclusive and efficient financial ecosystem.