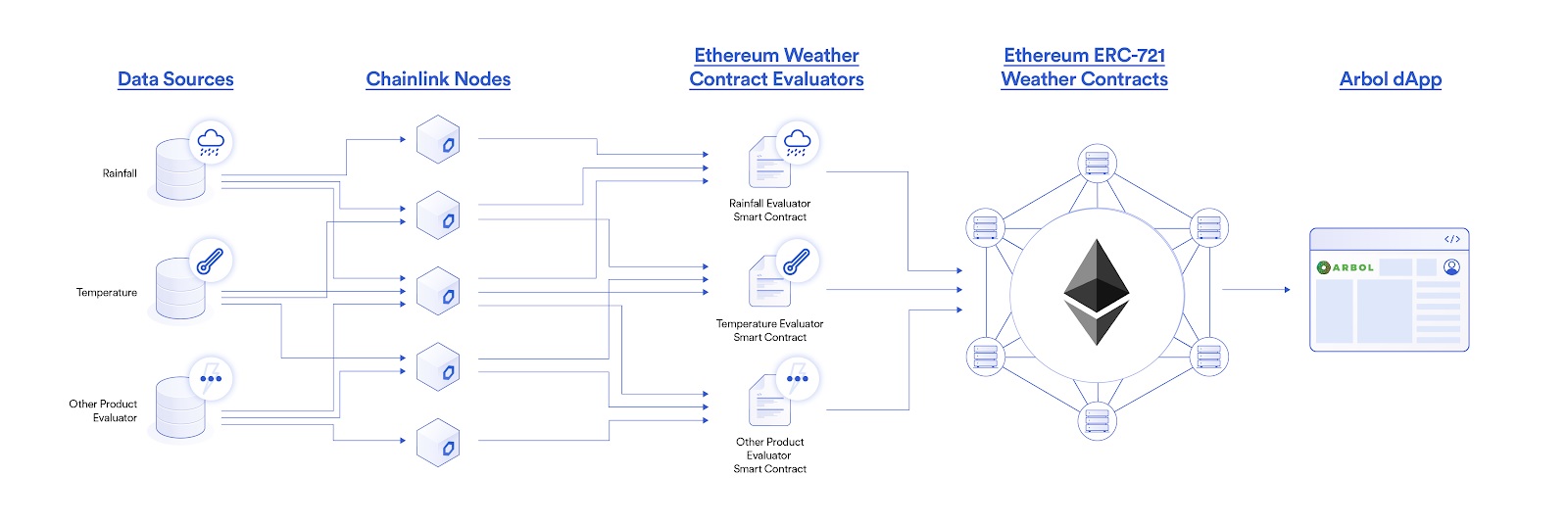

Chainlink data oracles are being integrated by Arbol platform, which facilitates farmers to offset risks related to weather. Siddhartha Jha, CEO of Arbol, has highlighted the use of blockchain technology to resolve an issue that impacts billions of individuals across the world.

Chainlink data oracles are being integrated by Arbol platform, which facilitates farmers to offset risks related to weather. Siddhartha Jha, CEO of Arbol, has highlighted the use of blockchain technology to resolve an issue that impacts billions of individuals across the world.

“It’s crazy that so much of the world’s livelihood, it’s about two to three billion people, they estimate, is affected by weather day to day.”

Weather unpredictability impacts farmers the most. Many lose their livelihood due to extreme weather conditions and may end up starving without food. Even though farmer insurance provides relief and has been around for decades, as per Jha, it is not easily accessible for a majority of farmers.

“If you had less than two hundred thousand dollars in premium to spend, you actually had no real access.”

Jha has pointed out that Arbol makes offers easy access while making hedging cost effective. The use of blockchain ensures instantaneous settlements and payouts, which is impossible in a centralized world where farmers have to wait for weeks if not for months.

Farmers can offset the risk of losing crops due to extreme weather conditions by acquiring a hedge, for illustration, if temperature attains a predefined level, payout will be made automatically. By including Chainlink’s weather data feeds (oracle), the company’s platform has become robust and decentralized.

Jha pointed out that the platform has gone live in February and has already witnessed considerable demand from farmers:

“We have done over 210 transactions, about $13 million of notional risk. This is with farmers growing a huge array of crops from corn, soybeans, to fruits and other specialty crops. We have worked with agribusinesses hedging their supply chain risk.”

Even though Jha stressed that the platform is intended to serve real-world scenarios, he hopes that in the years ahead, it could turn out to be a lucrative decentralized financial product:

“These weather portfolios are excellent investments for the DeFi community, if you have it in tokenized form, if you tokenized the weather risks; these portfolios, the yields are quite attractive. Risk — reward is great because it’s very diversified and also not correlated to stock and bond markets.”

Jha revealed that his firm has completed few transactions using stablecoins, but a major portion of users opt for traditional fiat payments currently.