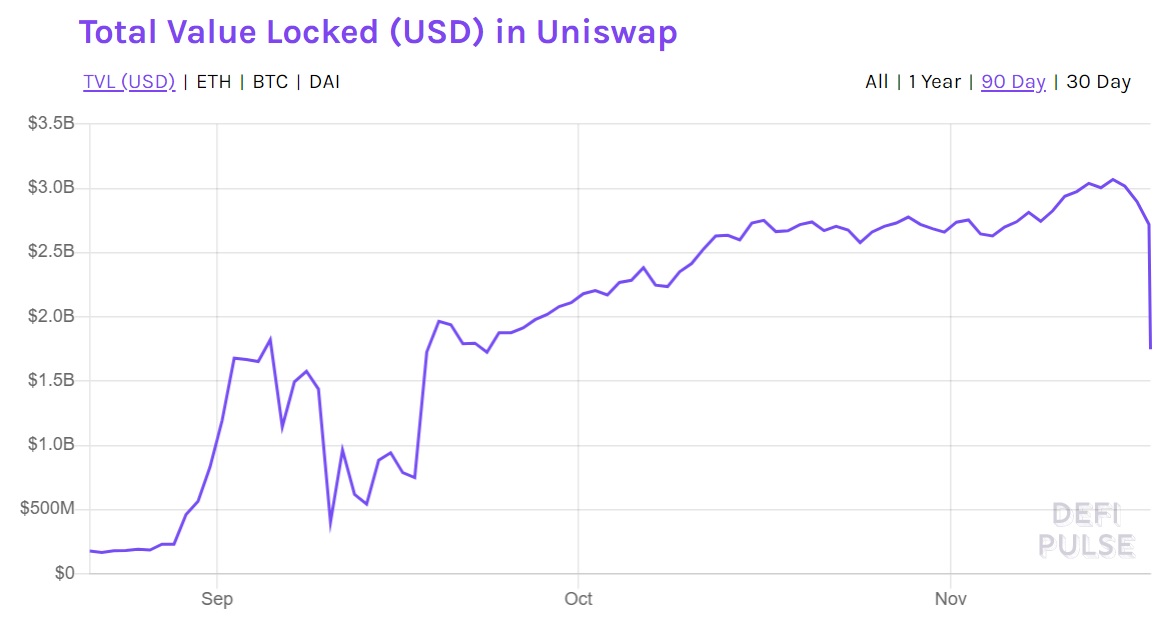

In the past 24 hours, the total value of assets locked in popular decentralized exchange Uniswap has plunged by 38% against the backdrop of the end of its UNI liquidity rewards program.

In the past 24 hours, the total value of assets locked in popular decentralized exchange Uniswap has plunged by 38% against the backdrop of the end of its UNI liquidity rewards program.

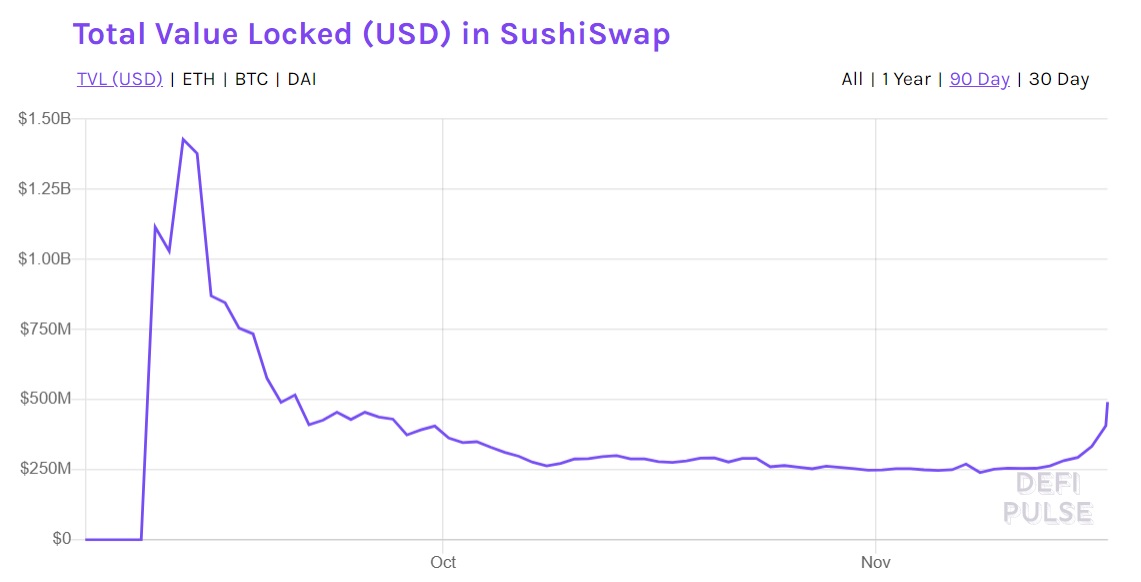

In the meantime, decentralized exchange SushiSwap has recorded a doubling of its TVL and is vigorously taking measures to increase liquidity.

At the time of writing this article, Uniswap’s TVL has dropped by 43% from the all-time peak of $3.07 billion recorded only three days ago. The TVL in Uniswap was $1.75 billion at the time of writing this article and continues to decline.

Token holders, considering the steep drop in Uniswap’s liquidity, has opted for voting a fresh governance plan that calls for bringing back rewards for liquidity providers in the form of UNI tokens.

The latest plan, put forth by Cooper Turley of crypto-based music playing platform Audius, suggest slashing the quantum of UNI rewards by 50% in comparison with the earlier scheme.

While 2.50 million UNI tokens were earlier disbursed to the liquidity providers of Uniswap’s WTBC/ETH, USDT/ETH, USDC/ETH, and DAI/ETH pools every month, the latest plan would result in setting aside 1.25 million UNI to every pool on a monthly basis for two months, translation to 10 million tokens in aggregate, or about 4.6% of UNI’s prevailing liquidity.

1) Dear guests,

We are happy to reveal our improved permanent Menu a thread for our valued LP. pic.twitter.com/m5cy93txbD

— SushiChef (@SushiSwap) November 16, 2020

The community will initially vote on a “snapshot poll,” which must obtain 25,000 votes in support of the plan within three days in order to move to a secondary “consensus check” poll with twice the necessary vote quorum in a span of five days. If the “consensus check” receives 50,000 votes in favor, the proposal of Audius will transform into a complete “governance proposal” that must receive 40 million votes in favor before getting implemented.

The plan was put forth on the same day competing decentralized exchange SushiSwap rolled out fresh incentives for offering liquidity to the four pairs that lost incentives from Uniswap. The latest rewards program substitutes the platform’s earlier rotational “menu of the week” incentive plan.

Under the current circumstances, SushiSwap seems to be benefiting from the termination of Uniswap’s earlier rewards program, with SushiSwap’s TVL rising by nearly 100% in a week to roughly $500 million, from the earlier $260 million.

SushiSwap drew criticism after launching a “vampire mining” hit on Uniswap in the first week of September that temporarily pushed SushiSwap as the top decentralized exchange in terms of liquidity.

Nevertheless, SushiSwap’s supremacy did not last longer, with the covenant’s TVL losing over 80% to $265 million, from $1.43 billion, in a matter of one month and remained range bound until a week before.