In a significant development, the Central Bank of Saudi Arabia has unveiled a strategic partnership with Ripple, a renowned blockchain firm, aimed at revolutionizing cross-border settlements. This move underscores the bank’s commitment to enhancing its financial infrastructure through cutting-edge technology.

In a significant development, the Central Bank of Saudi Arabia has unveiled a strategic partnership with Ripple, a renowned blockchain firm, aimed at revolutionizing cross-border settlements. This move underscores the bank’s commitment to enhancing its financial infrastructure through cutting-edge technology.

The Central Bank of Saudi Arabia’s recognition of Ripple as a partner for cross-border settlements highlights the increasing importance of innovative solutions in the global financial landscape. RippleNet, a decentralized global payments network, will play a pivotal role in facilitating seamless cross-border transactions. The utilization of the cryptocurrency XRP for swift payment settlement adds an extra layer of efficiency and speed to the process.

Collaboration Pioneers Swift Payment Settlements Amidst Evolving Blockchain Landscape

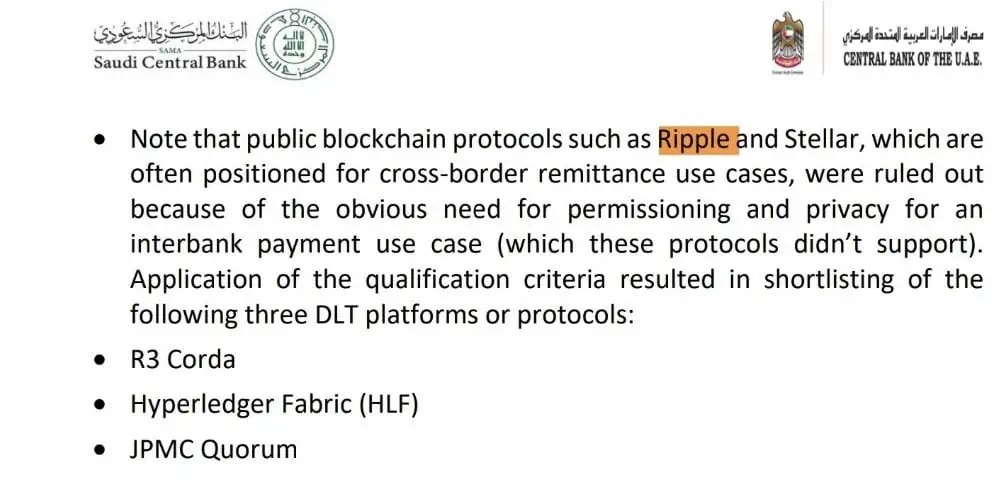

An intriguing disclosure emerged on social media, revealing that the Central Bank of the U.A.E. is actively exploring blockchain protocols for interbank payments. In the process of evaluation, certain blockchain platforms were excluded due to their inherent limitations. Notably, public blockchains like Ripple and Stellar were sidelined due to their lack of necessary permissions and privacy features. The shortlist of potential contenders comprises R3 Corda, Hyperledger Fabric (HLF), and JPMC Quorum, all of which exhibit promising attributes for the envisioned use case.

Recalling events from 2018, the Saudi Arabian Monetary Authority (SAMA) inked a historic agreement with Ripple, signaling a paradigm shift in the realm of central banking. The collaboration initiated a pioneering pilot program, positioning SAMA as the world’s first central bank to embark on such a groundbreaking initiative. Through the adoption of Ripple’s ‘xCurrent’ software, Saudi banks participating in the program will be able to achieve instantaneous settlement of both inbound and outbound payments. This innovation holds the potential to redefine global money transfers by drastically reducing settlement times.

The decision of SAMA to adopt Ripple’s xCurrent solution marks a significant stride toward embracing the transformative capabilities of blockchain technology. This aligns with a broader trend observed among financial institutions that are increasingly recognizing the potential of blockchain in revolutionizing payment systems. Dilip Rao, Ripple’s Global Head of Infrastructure Innovation, lauded SAMA’s forward-looking approach and highlighted the inherent benefits of blockchain technology. He emphasized that this technology has the power to dismantle barriers in trade and commerce, thereby fostering growth opportunities for businesses and offering enhanced experiences for consumers.

Ripple is not partnered with Amazon.

The ‘breaking news’ circulating is a Ripple case study in AWS (cloud computing/api’s) (subsidiary of Amazon proper) and is over three years old, references old product suite (via/current/rapid)

Amazon has never stated they will use $XRP pic.twitter.com/f5EYNlV8Gk

— King Solomon (@IOV_OWL) August 15, 2023

Amidst these dynamic developments, a tweet by Genfinityio CEO King Solomon dispelled the rumors surrounding a supposed partnership between Ripple and Amazon. Clarifying the situation, the tweet indicated that the news circulating was misconstrued, as it merely presented a case study involving Amazon Web Services (AWS). King Solomon’s tweet emphasized that the case study was over three years old and referred to outdated product suites. The distinction was critical to understand, as AWS, a subsidiary of Amazon, is actively engaged in a wide array of blockchain integrations that are separate from the misleading narrative.

King Solomon’s tweet served to highlight the potential pitfalls of sensationalist reporting prevalent in certain crypto news outlets. The misleading headlines lacked the necessary depth and context to substantiate the claims. This instance underscores the importance of discerning news sources and exercising caution while consuming information, especially in the digital age where misinformation can spread rapidly.

In conclusion, the collaboration between the Central Bank of Saudi Arabia and Ripple holds promising prospects for reshaping cross-border settlements. This alliance not only signifies the bank’s commitment to innovation but also underscores the role of technology in transforming traditional financial systems. Simultaneously, the clarification surrounding the Amazon-related rumors highlights the necessity of critical thinking and careful consideration when engaging with news in the rapidly evolving landscape of blockchain and cryptocurrency.