In the past two months, Cardano investors emerged from their hibernation. Since the start of November, these big ADA wallets have amassed hundreds of millions of dollars in crypto tokens in the last six weeks. These factors may have lasting effects on the value of the crypto asset as time passes.

In the past two months, Cardano investors emerged from their hibernation. Since the start of November, these big ADA wallets have amassed hundreds of millions of dollars in crypto tokens in the last six weeks. These factors may have lasting effects on the value of the crypto asset as time passes.

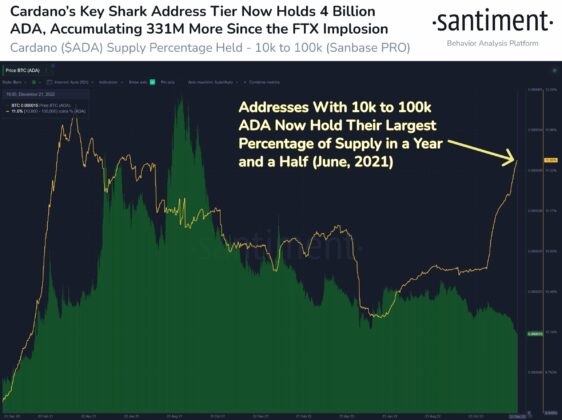

On-chain data aggregator Santiment published a Twitter graph depicting the trajectory of Cardano sharks’ accumulation. These online wallets possessing between 10,000 and 100,000 ADA significantly grew their total balances by over 10% during the period of six weeks, beginning on November 7.

At the beginning of November, approximately 10.5% of the entire ADA supply was kept in these wallets. Nevertheless, only about two months later, after adding over 330 million ADA tokens valued at $83 million to their wallets, this proportion is currently 11.60%.

The rapid rise in their holdings followed a lengthy period of dizzying buildup and sales by the sharks, prior to which there was an uptick. The majority of the purchasing also occurs during times when the value of ADA has fallen to depths that many would perceive to be a “bargain.”

This level of accumulation often has a beneficial effect on the value of a cryptocurrency including ADA. Nonetheless, considering the current circumstances and Cardano’s downward path, the stockpiling hasn’t had the expected impact.

Instead of a price turnaround and ultimate rebound, ADA seems to trend at $0.25, a low position relative to its all-time peak of $3.10. Furthermore, the absence of beneficial advancements on the Cardano blockchain network has been detrimental to its argument.

Another danger associated with accumulation patterns similar to this one is the probability of subsequent sell-offs. If these big buyers decide to liquidate, they might have a greater effect on the value of ADA proportional to the number of crypto tokens they own. Consequently, this vulnerability is also included in the cost of the cryptocurrency.

In the following two months, the neighborhood anticipates prices to increase by more than 80 percent. If this occurs, ADA might reach an average price of $0.4 in the first quarter of 2023. Nonetheless, if the asset fails to maintain a price over $0.25 by the end of 2022, it might fall another 20%.

While preparing this article, the average exchange rate for ADA was $0.25. The price has increased by 2.71 percent in the past 24 hours, while transaction volume has increased by 47 percent to $218 million over the exact time frame.