People are speculating about Bitcoin (BTC) reaching six figures now that it has rebounded from multi-month slump and proven that a positive trend is in effect. PlanB’s Stock-to-Flow model forecast would finally be met if Bitcoin goes on a parabolic rise to $110,000.

People are speculating about Bitcoin (BTC) reaching six figures now that it has rebounded from multi-month slump and proven that a positive trend is in effect. PlanB’s Stock-to-Flow model forecast would finally be met if Bitcoin goes on a parabolic rise to $110,000.

The pseudonymous analyst claims that “Elon Musk’s energy FUD and China’s mining clampdown” are some of the reasons responsible for the model’s 50% or greater inaccuracies during the last five months, in addition to gold scarcity and value.

The expectations of bulls are mostly based on the US Securities and Exchange Commission’s approval of an exchange-traded fund. Several requests are awaiting assessment between October 18 and November 1, although the agency has the option of delaying making a final judgment.

The $830 million options expiration on October 15 was heavily influenced by the 20% price rise that began on October 4 and most certainly erased 92% of the put options. Investor mood may have been bolstered as a result of China’s mining clampdown, and data indicates that the United States is responsible for 35.4% of the global Bitcoin hash rate.

Aside from that, the US states of Texas and Ohio are also likely to get new massive Bitcoin mining facilities, thus increasing the United States’ share of the cryptocurrency market even more. The bulls had greater clout after last week’s projected $370 million net profit on the BTC options expiry, as shown by Friday’s $820 million expiry.

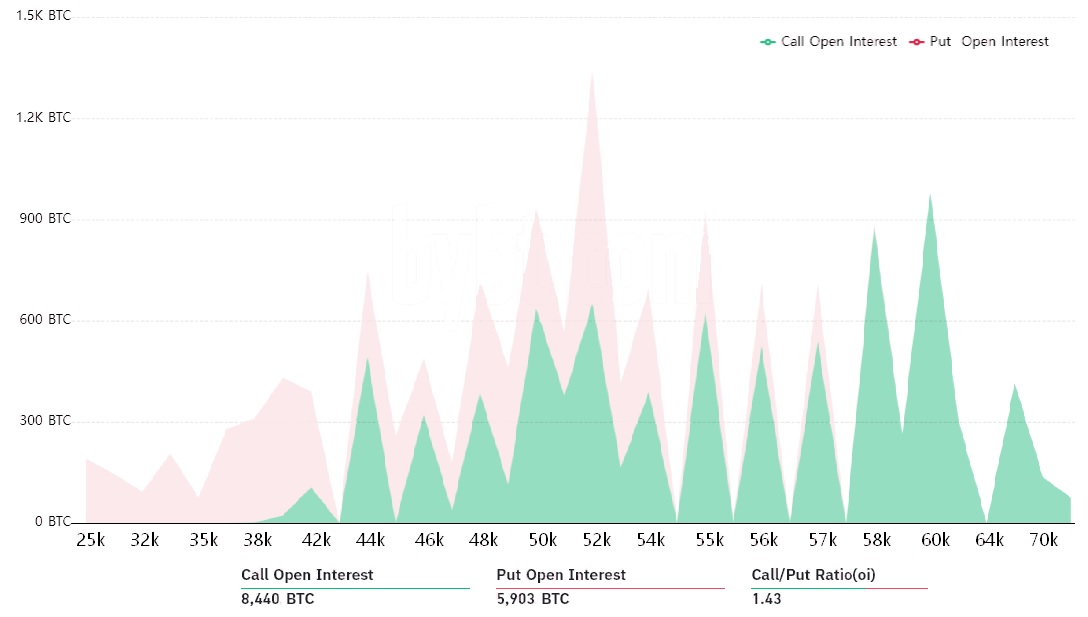

This benefit helps to explain why call (purchase) options are so popular. As compared to bearish put options, open interest is 43% higher. For Friday’s expiry, as the above statistics indicate, bears staked $335 million and were caught off guard with 92% of the put (sell) options are expected to be valueless.

To put it another way, just $36 million in neutral-to-bearish put options will be active on Friday at 8:00 a.m. UTC if Bitcoin stays over $56,000 on Oct. 15. The following are the four most likely outcomes when the current contract expires on October 15th. The potential profit is represented by the asymmetry benefiting one side over the other. Also known as buy and sell contracts, depending on the expiration price, a different number of call and put contracts become active.

In the range of $52,000-$54,000, there are 3,140 calls and 2,110 puts.The overall outcome is a $55 million advantage in favor of call (bull) contracts.

Between $54,000 and $56,000, there are 3,700 calls and 1,240 puts. The net effect is a $130 million advantage in favor of call (bull) derivatives.

In the $56,000 and $58,000, there are 4,850 calls and 680 puts. The net outcome is a $235 million advantage in favor of call (bull) options.

Above $58,000, there are 6,230 calls and 190 puts. Bulls profited $350 million as a consequence of their utter domination.

This rough assessment takes into account just call options utilized in bullish wagers and put options used in neutral-to-bearish transactions. Investors, on the other hand, may have employed a more sophisticated approach that usually includes various expiration dates. Bulls have complete control of this Friday’s expiration in all scenarios, and there are many reasons for them to maintain the price over $56,000.

Bears, on the contrary, require a 7% downward move beneath $54,000 to prevent losing of $235 million or more. Traders must keep in mind, however, that throughout bull runs, the amount of effort required by a bear operator to push the market is enormous and generally unsuccessful.

Analytics show that call (buy) options have a significant edge, driving even more optimistic wagers for the next week.