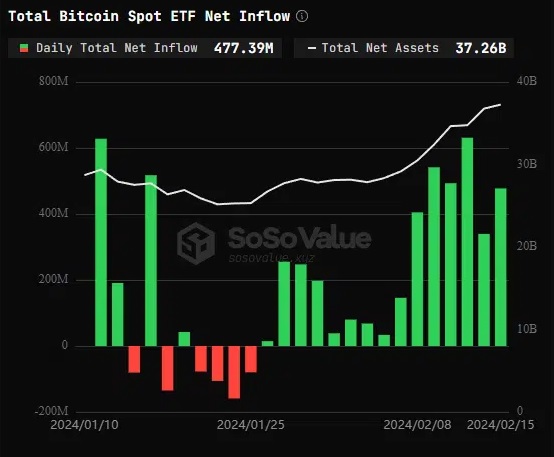

Since its emergence over a month ago, the spot Bitcoin ETF market has experienced a consistent increase in cumulative net flows. The month of February, in particular, witnessed a notable uptick in Bitcoin ETF inflows, culminating in a total net inflow of $477 million on February 15th, as reported by SOS Value. This consistent influx of investments over the past 15 trading days underscores investors’ growing confidence in Bitcoin as a robust investment instrument.

Since its emergence over a month ago, the spot Bitcoin ETF market has experienced a consistent increase in cumulative net flows. The month of February, in particular, witnessed a notable uptick in Bitcoin ETF inflows, culminating in a total net inflow of $477 million on February 15th, as reported by SOS Value. This consistent influx of investments over the past 15 trading days underscores investors’ growing confidence in Bitcoin as a robust investment instrument.

BlackRock’s IBIT Leads the Way

BlackRock’s Bitcoin spot ETF, IBIT, has played a significant role in this trend, with a daily net inflow of $330 million propelling the fund to a cumulative historical net inflow of $5.17 billion. In contrast, Grayscale’s ETF (GBTC) experienced a $174 million net outflow on the same day, marking a deviation from the overall positive trend.

Record-Breaking Inflows and Market Optimism

February 13 saw the most substantial single-day net inflow, reaching $631.2 million, reflecting the excitement surrounding Bitcoin ETFs. Fidelity’s FBTC, with the third-highest daily trading volume and a net inflow of $3.65 billion, aligns with this optimistic trend, showcasing investor confidence in the market.

Grayscale’s Challenge Amid Market Growth

Despite the overall upward trajectory, Grayscale faces challenges, evident in a notable net outflow. Since transitioning from a Trust to a Spot ETF, Grayscale’s GBTC has seen a loss of $6.856 billion. This may be attributed to higher fees compared to competitors, signaling investor apprehension. Nevertheless, the broader market for spot Bitcoin ETFs remains robust, with a collective holding of 692,939 bitcoins, reflecting strong confidence in Bitcoin as an asset class.

Accessibility and Diversification Appeal

Spot Bitcoin ETFs have significantly simplified Bitcoin interaction for regular investors, enabling transactions through ordinary brokerage accounts. Bitcoin’s accessibility and minimal correlation with other risk assets make it an attractive addition to diversified investment portfolios. Leading the charge are BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin ETF, accumulating significant assets and indicating the pent-up demand for Bitcoin exposure among investors.

Positive Outlook and Factors Driving Adoption

Except for the Grayscale Bitcoin Trust, the Bitcoin ETF market has attracted over $10 billion in assets, signaling a positive outlook. Anticipation of a Bitcoin halving later in the year, expected to further limit supply amid increased ETF demand, supports this optimistic trend. In a CNBC interview, Michael Saylor, Executive Chairman of MicroStrategy, highlighted Bitcoin’s uncorrelated nature with traditional risk assets as a crucial factor driving its adoption. He pointed to the upcoming Bitcoin halving as a potential catalyst for heightened demand.

Gold ETF Challenges and Ongoing Debate

While Bitcoin ETFs thrive, gold ETFs face challenges, with the World Gold Council announcing a 2% reduction in total assets under management. Analysts debate the comparison between gold ETFs and Bitcoin, with some cautioning against interpreting it as a definitive shift away from gold towards Bitcoin.