Near Protocol (NEAR), a blockchain platform facilitating smart contracts, has the ability to step up through the utilization of parallel processing. The method, referred to as sharding, is similar to what Eth2 intends to attain and Near’s PoS (Proof-of-Stake) consensus protocol also permits staking of coins by token holders.

Near Protocol (NEAR), a blockchain platform facilitating smart contracts, has the ability to step up through the utilization of parallel processing. The method, referred to as sharding, is similar to what Eth2 intends to attain and Near’s PoS (Proof-of-Stake) consensus protocol also permits staking of coins by token holders.

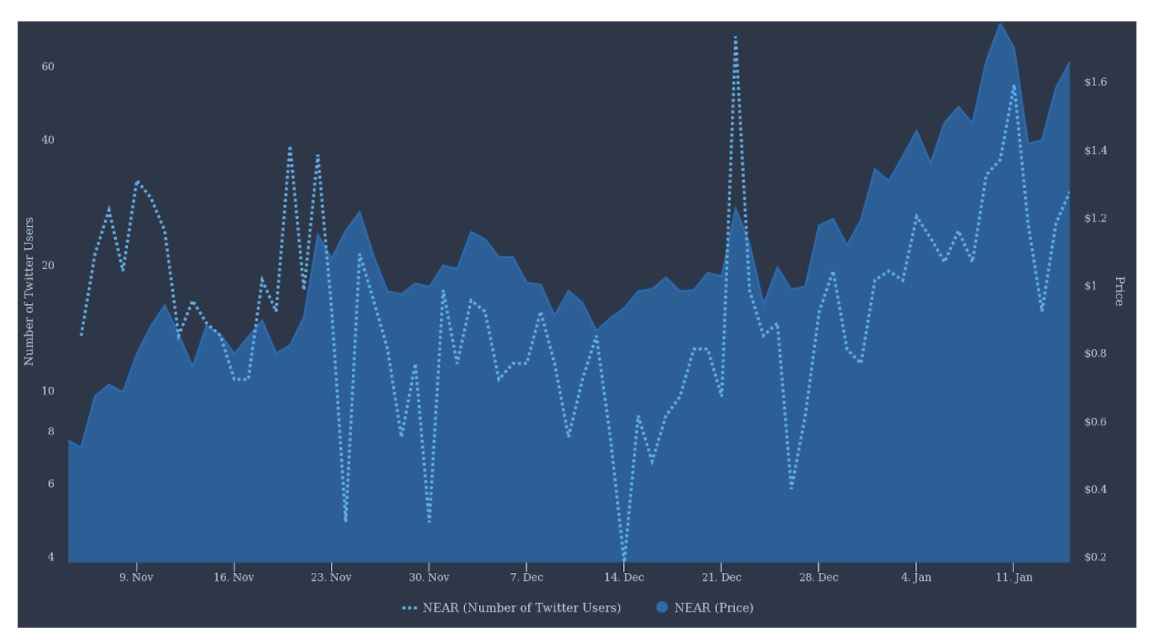

In the last month, NEAR has surged by 107% and this has brought up queries on whether the venture is moving forward in the extremely disruptive smart contract sector.

NEAR, in comparison to its contenders, is a fresh venture as the mainnet was only rolled out in April 2020. In contrast to Ethereum (ETH), NEAR’s consensus protocol performs the role of fee stabilization and expedites the creation of decentralized apps.

Notably, NEAR conducted its ICO four months after the launch of its mainnet. A likely reason could be that the core team amassed $35 million in private financing rounds organized in July 2019 and May 2020.

Some of the major investors in the project include Pantera Capital, Andreessen Horowitz’s a16z Crypto Investments Ripple’s incubator Xpring and Electric Capital.

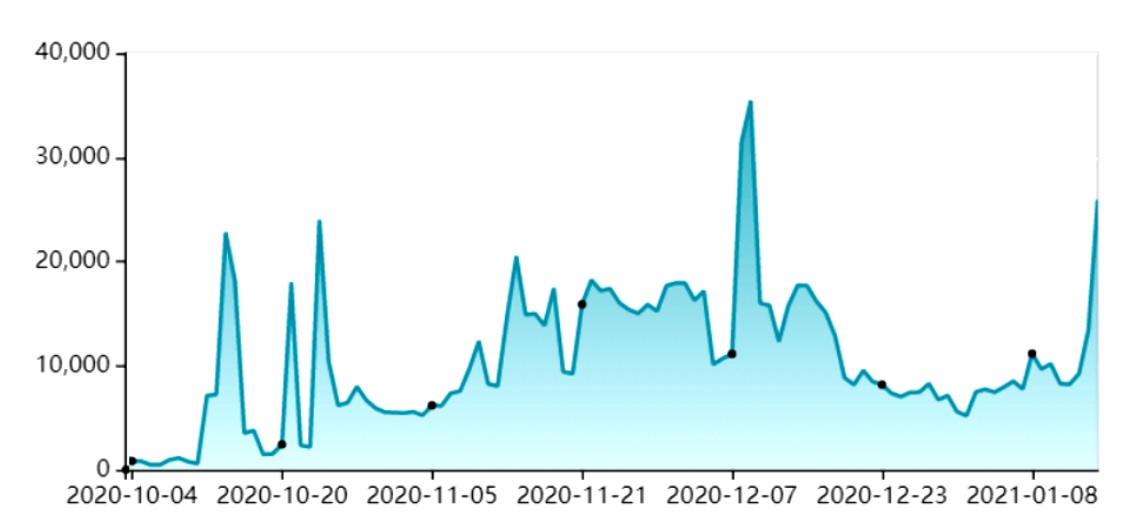

In the last three months, network activity of Near covenant has risen considerably and info published by the Near Blog indicates that there are several benign application available already.

Berry Club is a notable app that allows players to sketch with pixels and get rewarded in collectible tokens. Another app named Paras also permits users to communicate with a marketplace facilitating buying and selling of NFT (non-fungible token) digital art card.

Back in November, 1inch.exchange-backed venture Mooniswap disclosed their intention to develop Automated Market Making (AAM) aspects on NEAR. The aggregator used by the decentralized exchange has been structured to draw the best possible liquidity and pricing from all major DEXs in a single platform.

Sergej Kunz, CEO and co-founder of 1inch, stated: “By building on NEAR, we’ll be able to experiment with sharding and be prepared for the arrival of Ethereum 2.0.”

On January 19, Crypto.com also aims to disburse another lot of $250,000 worth NEAR tokens at 50% discount from the market price. Clients will have to stake their CRO tokens and also fulfill the established trading volume necessities on the exchange.

One cause of worry is there are unresolved issues about how the community’s treasury was managed. A considerable number of NEAR tokens are being administered by a small section of people who are not needed to follow transparent guidelines and laws.

Data provided by TheTie, an unconventional platform facilitating social analytics, indicates that the latest price surge was supported by a rise in social network interactions. However, trades and transfers on the NEAR Protocol mainnet started only three months before.

Interestingly, NEAR covenant seems to be in an initial development phase. Successfully completing the Mooniswap integration will probably be a crucial landmark for the venture and that could trigger further appreciation of NEAR token.