Roughly 1 million ETH remains staked in the Ethereum 2.0 deposit agreement. Nevertheless, even though phase 0 has gone live, there is a long-way to move forward until the Ethereum network will scale up.

Roughly 1 million ETH remains staked in the Ethereum 2.0 deposit agreement. Nevertheless, even though phase 0 has gone live, there is a long-way to move forward until the Ethereum network will scale up.

As a result, the core programmers continue to negotiate a plan that could assist in the near-term.

One of the contentious and encouraging is the EIP-1559 proposal. The suggested plan intends to amend the fee structure in the Ethereum network. At this time, the network functions with a “first-price auction model” in which the Ethereum miners confirm transactions and receive a fee fixed by the user.

The EIP-1559 suggests setting up a “base fee” and to char a portion of the ETH, referred to as the “space fee.”

Developer Tim Beiko provided details on recent advancements associated with EIP-1559. He revealed that it was decided in the previous core developers meeting that the issue of transactions in Ethereum is on the basis of scalability of the network and not on its fee structure.

Nevertheless, EIP-1559 would be advantageous to the network as it will simplify computation of transaction fees and therefore aid smart contract, minimize inflation in the ETH, reward miners for securing the network in a honest manner, enhance security and pave way for realizing maximum revenue from various strategies.

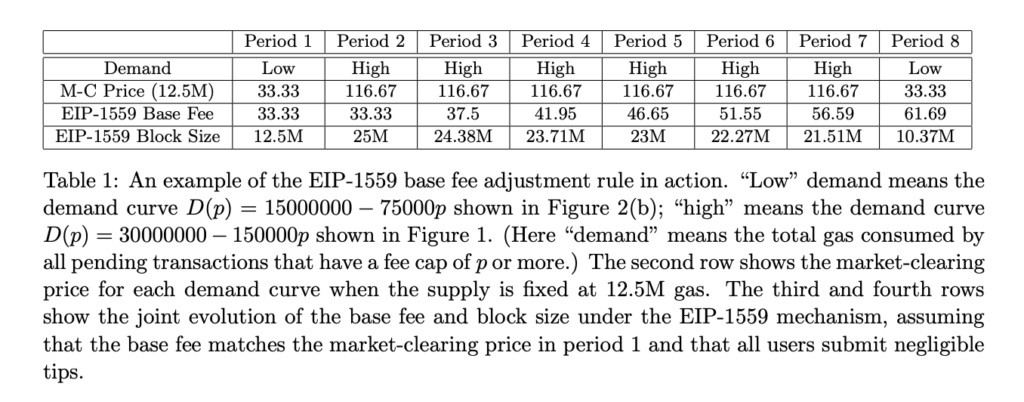

Furthermore, adjustable block space would be an enhancement for network users during periods of heavy congestion by minimizing gas spikes, as indicated in the following table published by Beiko:

The programmers have also pointed out that “ETH burning” could be deployed with “alternative designs”. For illustration, one scenario permits the space fee to be forwarded to another miner as a mode of payment.

Furthermore, it is acknowledged that the “base fee” necessitates additional monitoring to identify a capable method to amend it in unique scenarios, for example during periods of high network usage. With respect to transition phase that it would take to shift from the prevailing tariff system to that of the EIP-1559, the developers informed:

“(…) the current model of keeping legacy transactions and interpreting them as 1559-style ones generally made sense. It could be good to add more economic pressure over time to force people to migrate, too.”

1. No transaction fee mechanism, EIP-1559 or otherwise, is likely to substantially decrease average transaction fees; persistently high transaction fees is a scalability problem, not a mechanism design problem.

2/14— Tim Roughgarden (@algo_class) December 1, 2020

The greatest hindrance that EIP-1559 faces is the likely abuse of base fee by Ethereum miners. Nevertheless, the programmers trust that there are threats comparable with the prevailing model. Furthermore, they trust that financial instruments could be supported to pave way for incentives for “good participation”

Beiko stated:

“Finally, we started discussing how we can move this EIP to mainnet. There was agreement on the call that most research questions are now solved (modulo the transaction pool management and update rule analysis), so we should put together a plan to get this on mainnet.”

Finally, we started discussing how we can move this EIP to mainnet. There was agreement on the call that most research questions are now solved (modulo the transaction pool management and update rule analysis), so we should put together a plan to get this on mainnet.

— Tim Beiko | timbeiko.eth (@TimBeiko) December 3, 2020

The preparedness check list on the GitHub page of the EIP-1559 plan is expected to be updated in the days ahead. The programmers anticipate obtaining response from the group responsible for employing the “Berlin” update. The next meeting is anticipated to happen in another two weeks’ time.