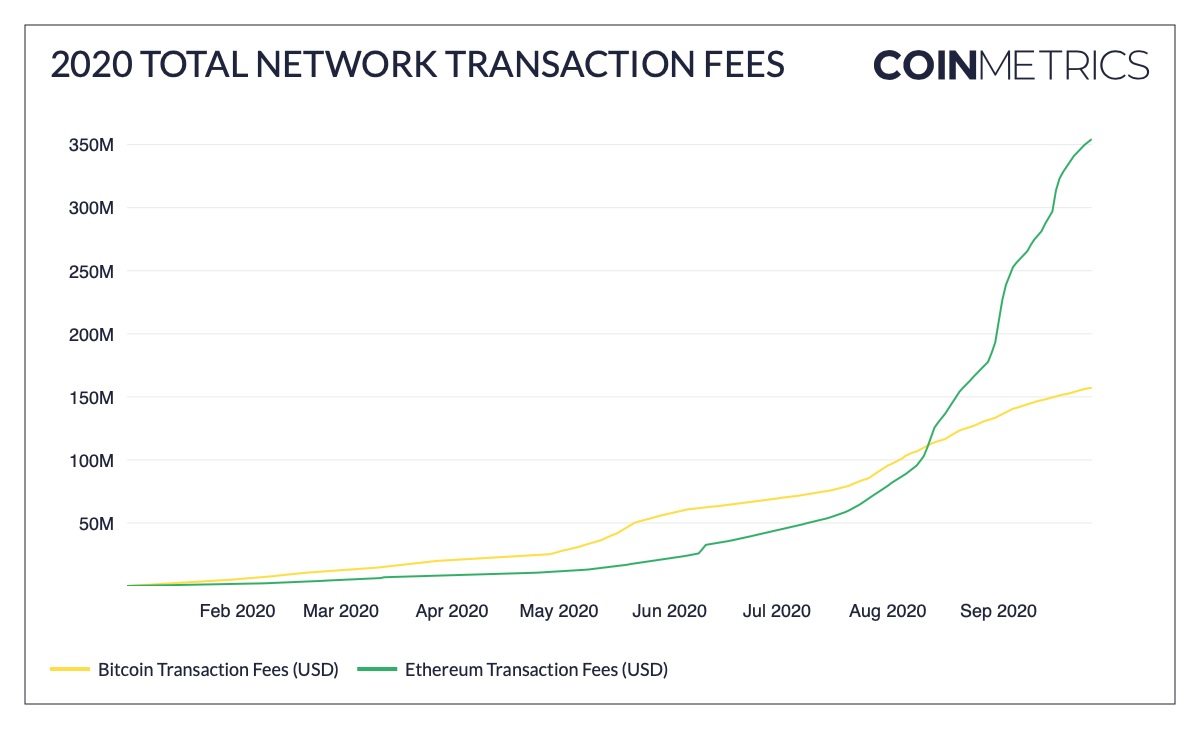

Aggregate transaction charges received by Ethereum (ETH) miners so far this year is almost double that of Bitcoin (BTC). Precisely, Ethereum miners have earned $276 million, compared with the $146 million earned by Bitcoin miners.

Aggregate transaction charges received by Ethereum (ETH) miners so far this year is almost double that of Bitcoin (BTC). Precisely, Ethereum miners have earned $276 million, compared with the $146 million earned by Bitcoin miners.

A chart published by Coinmetrics underlines how Ethereum fees surged in the second half of this year, matching the roll out of Compound token incentive. On August 12, aggregate fee paid for transactions on Ethereum blockchain matched with that of Bitcoin and continued to rise steeply.

It is a notable change considering trends in transaction charges over the last few years, when Bitcoin clearly reigned over other networks by a huge difference.

Last year, Bitcoin had a five-to-one edge over others in the aforesaid comparison. It can be remembered that Ethereum posted higher daily fee than Bitcoin for the first time in June.

As transactions continued to increase, the average gas fee started surging. During August and September, Ethereum started recording new highs in transaction fees discouraging users to a large extent.

The issue arose mainly due to an unanticipated exponential growth of decentralized finance and yield farming. However, stablecoin transactions and a handful of Ponzi schemes also contributed to a considerable rise in Ethereum transaction fee.

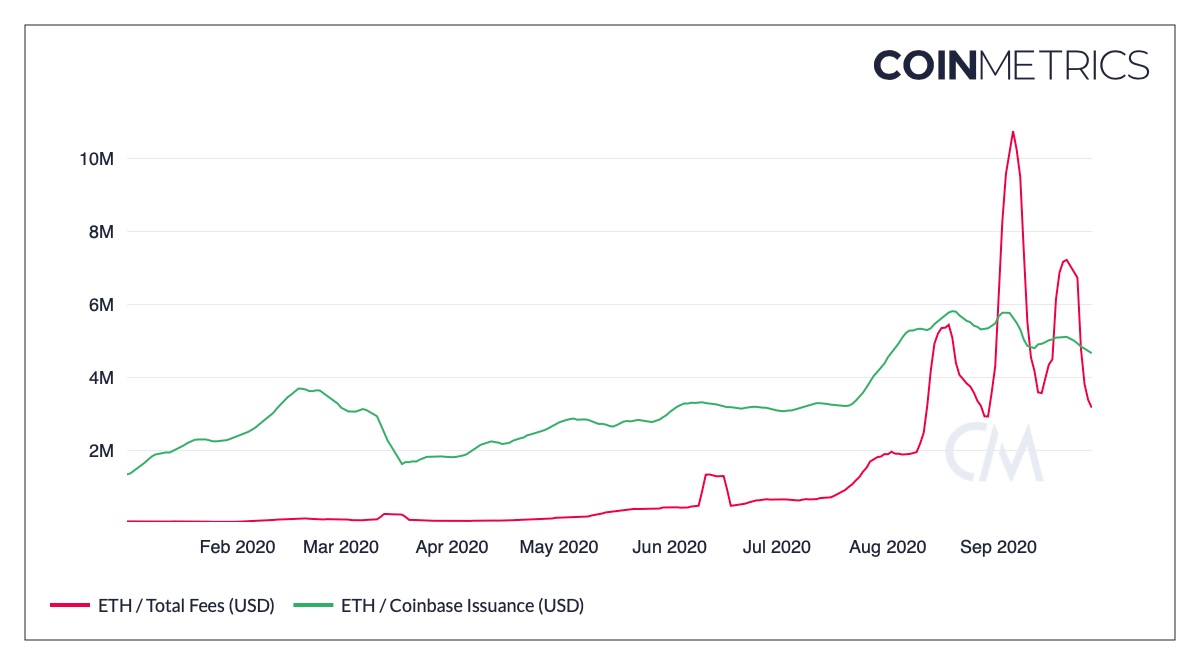

Notably, Ethereum fee based revenue eclipsed block rewards on some high-activity days in the last few months. As a whole, fees have risen consistently by over 10% of total issuance since May, a pattern witnessed only a few times in the past.

This could be specifically useful for ETH holders amid the EIP-1559 plan, which calls for introduction of a fee burn system. A scrutiny of the plan indicates that bidding wars could still happen during periods of high activity and benefit miners, it can be argued that high transaction volume could bring down the overall issuance rate to a considerable level.

In case of Bitcoin, increasing transaction charges to cover ongoing issuance is the need of the hour, considering its future, as block rewards will ultimately end. Nevertheless, the crypto domain in the last two years has started moving away from Bitcoin focused uses cases to stablecoins and now to DeFi.

Even though Bitcoin usage continues to be high, losing dominance over other altcoins will be fatal for the numero uno crypto.