Yesterday, Ether, the native cryptocurrency of Ethereum blockchain, made its third try to attain new highs against Bitcoin so far this year. The rally seems to be losing steam as the cryptocurrency market has become range bound in the past few days.

Yesterday, Ether, the native cryptocurrency of Ethereum blockchain, made its third try to attain new highs against Bitcoin so far this year. The rally seems to be losing steam as the cryptocurrency market has become range bound in the past few days.

Despite the slight bearish signals, there is still hope for crypto enthusiasts as one crucial indicator continues to indicate a bullish breakout in the weeks ahead.

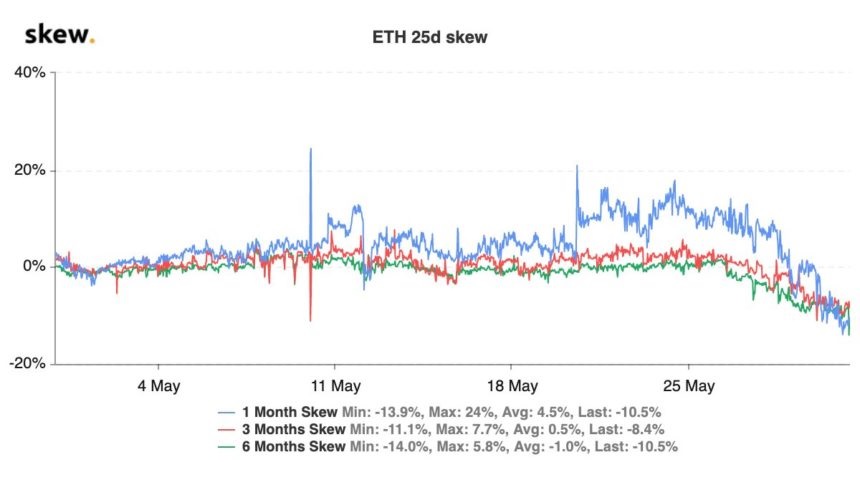

This likelihood is substantiated by Ether’s options skews switching to negative, implying that traders hope the crypto to begin an uptrend soon. Ethereum is reversing from latest highs as the cryptocurrency market is trying for the third-time to cross above the recent highs.

Ethereum, at the time of writing this article, was trading at $235. This is a noteworthy reversal from the low of $205 recorded last week when the cryptocurrency was undergoing an extended consolidation stage at roughly $200.

The volatility of Ether, of late, has been quite independent of Bitcoin and other altcoins’ volatility.

As the crypto is trying to take a lead in the market, the days that follow could be crucial in confirming the trend. The recent rally did not permit ETH to gain considerable ground against Bitcoin.

On Thursday last week, the BTC/ETH pair hit a low of 0.022. After hitting that level, it rebounded sharply on value buying. In the three days that followed the dip, ETH hit a high of 0.026 BTC.

That was the third attempt to break above that level so far this year a pattern that crypto enthusiast Skew mentioned in a recent tweet while highlighting Eth’s price as a percentage of Bitcoin.

ETH / BTC: third breakout attempt this year pic.twitter.com/CgqRKRjzkW

— skew (@skewdotcom) May 31, 2020

For the time being, Ether seems to have entered into another consolidation phase at $230 levels. However, it is not expected to continue for a long time. Skew also detailed that the crypto’s options skew, a measure of volatility spread between options contracts with different expiry dates, has nosedived in the past few days.

This signals that the crypto is on course to record high volatility in the days ahead. As the options skew is negative, there is a likely possibility of an uptrend. “Negative skew indicates risk of volatility now seen to be on the upside,” Skew detailed in another tweet. If Ether trends higher in the short-term, it is likely that the rally will propel the entire crypto market upwards.

Ethereum’s growing decentralized finance (DeFi) network took a heavy toll after the market crash in March. In case of LongHash, MakerDAO turned unstable due to unproven erosion of trust in the covenant.

Parafi Capital, an Ethereum investor, made the following blog post: “We believe this lack of stability and liquidity is translating into uncertainty around using DAI as a decentralized stablecoin in many DeFi protocols. Anecdotally, we have heard a handful of DeFi teams express frustration over DAI’s lack of liquidity/stability.”

In addition, hackers gained control over a new DeFi covenant with over $25 million worth cryptocurrencies due to a bug in smart contract. Following the chaos, a commentator even went to the extent of saying that “the entire DeFi ecosystem almost died.” However, it never went that far. This example is applicable to Ethereum bull scenario.

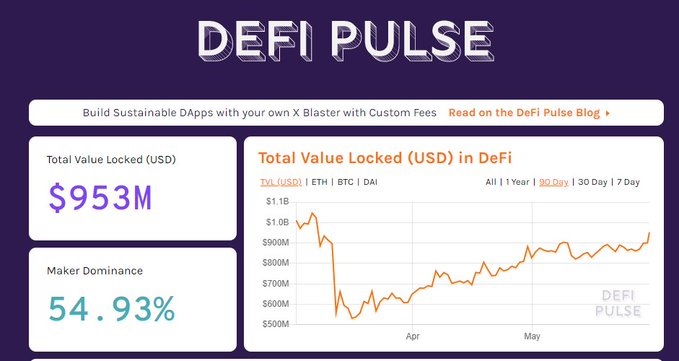

In March, the value locked in DeFi apps plummeted to $500 million from the earlier level of over a billion. That was anticipated as the value of top altcoins declined by over 50%. However, as per data compiled by DeFi Pulse, decentralized finance has rebounded along with that of cryptos.

There is currently $953 million worth assorted cryptocurrencies held in various DeFi apps, as per the site. This reflects a 100% increase from March lows.

Notably, all of the DeFi assets are not based on Ethereum, but a majority of them are. Maker, Compound and Synthetic, which are based on Ether, retain roughly $750 million worth assets. Ether could benefit as DeFi gains popularity, according to crypto analysts.

Rune Christensen,founder of MakerDAO, opined that Ethereum via DeFi will lure entire value available in the crypto domain. He pointed out that 4 million Dai was created with WBTC in a single trade.

This basically demonstrates the underlying demand for non-ETH tokens and it is the start of a wider trend of DeFi functioning as an economic void that will ultimately lure almost entire value to the Ethereum blockchain.

Similarly, Ryan Selkis, CEO of crypto research company Messari, detailed that the launch of DeFi and the market share it could command, ETH has a “higher ceiling” to travel in comparison to the 2017-18 uptrend when it touched ETH to $1,400.