Latest data indicates that “wholecoiners,” which refers to Bitcoin wallets holding a minimum of 1 Bitcoin (BTC), now represent 95% of the crypto’s total capitalization.

Latest data indicates that “wholecoiners,” which refers to Bitcoin wallets holding a minimum of 1 Bitcoin (BTC), now represent 95% of the crypto’s total capitalization.

This implies addresses holding less than 1 Bitcoin, owned by tens of millions of investors, account for rest of the 5% of Bitcoin’s market capitalization.

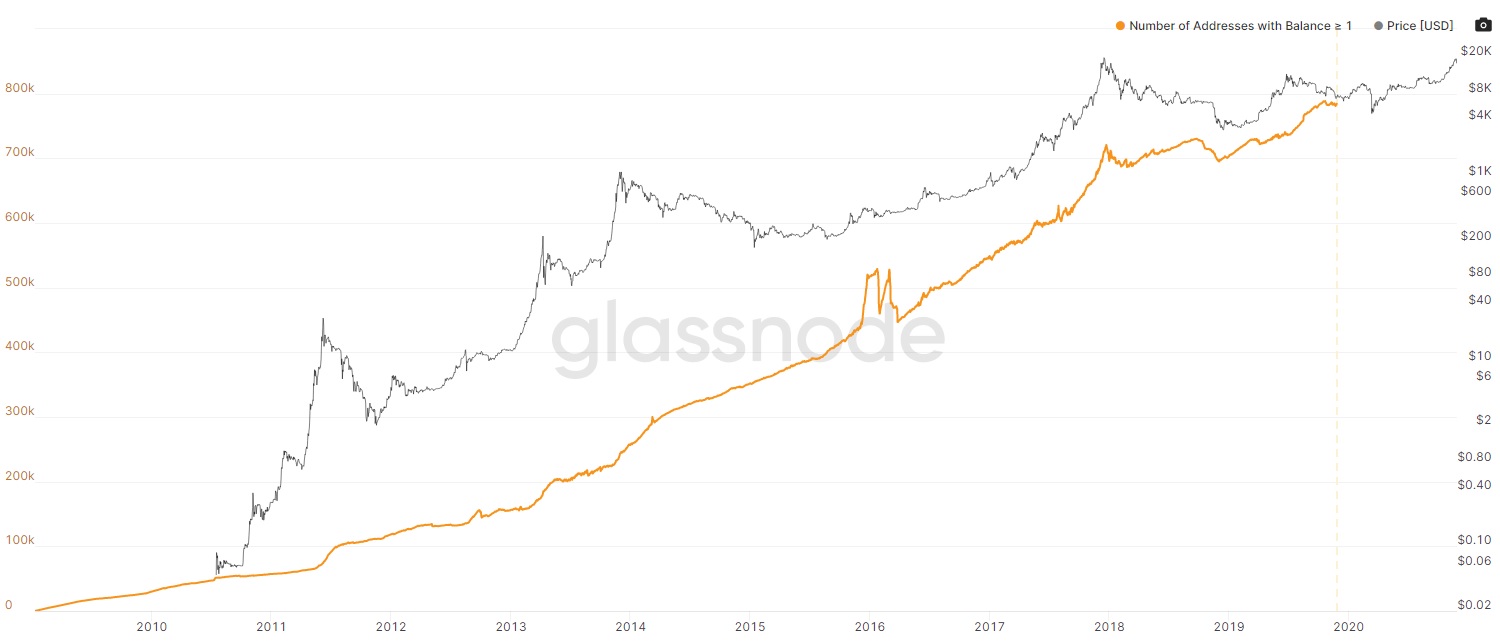

The aggregate number of wholecoiner addresses has been on the rise on y-o-y basis since 2009, in spite of Bitcoin’s sharp price surge. Earlier today, Glassnode CTO Rafael-Shultze-Kraft tweeted a chart disclosing that over 800,000 wallet addresses currently hold a minimum of one Bitcoin.

As per Bit Info Charts, wholecoiner addresses account for about $301 billion worth Bitcoins. On the contrary, the aggregate value of fractional (less than one) Bitcoin addresses is only about $16 billion.

A chart reflecting the holdings of wholecoiners do indicate few reversals, with the biggest decline happening in early 2016 when the number of addresses holding a minimum of one Bitcoin declined to 450,000, a decrease of 13.5% from 520,000.

The number of #Bitcoin “wholecoiner” addresses (holding ≥ 1 BTC) on this day every year ?

Data: https://t.co/VJm4nRFKp8 pic.twitter.com/6VJff2vB3r

— Rafael Schultze-Kraft (@n3ocortex) November 26, 2020

Furthermore, the chart indicates that the growth of wholecoiners remained flat in 2018, with the number of Bitcoin wallet addresses hovering between approximately 720,000 and 690,000 over the 12 month period starting December 2017.

As per Into The Block, some small quantity of Bitcoin is held by 32.95 million Bitcoin addresses, implying that wholecoiners account for only 0.47% of wallet addresses with at least a minute quantity of Bitcoin in it.