Data published by Glassnode indicates that there is a gradual decentralization of Bitcoin (BTC) ownership, nullifying fears that the liquidity is controlled by few elite groups.

Data published by Glassnode indicates that there is a gradual decentralization of Bitcoin (BTC) ownership, nullifying fears that the liquidity is controlled by few elite groups.

Willy Woo, via statistical analysis, has pointed out that the count of small Bitcoin investors and entities which hold the crypto on behalf of their customers is increasing.

In spite of BTC/USD pair rallying to fresh highs in recent times, an increasing number of small scale investors are entering the fray.

Interestingly, Bitcoin holders, also referred to as “humpbacks” because of their stature as the biggest and long standing ‘whale’ investors in the domain, are not booking profits. Through multiple tweets, Woo summarized the scenario as follows:

“Distribution keeps getting better.”

Distribution keeps getting better.

– small holders growing strongly

– whales growing (institutions)

– humpbacks reducinginstitutions = “coins owned on behalf of a lot of people”

exchanges = coins owned by 130m+ people

miner coins = mainly lost coins pic.twitter.com/CBG1lcfHFA— Willy Woo (@woonomic) February 3, 2021

Back of an envelope estimate of small/medium holders (<100BTC):

– 14.9m BTC available, 3.7m lost

– assume 33%** of exchange coins are theirs: 0.8m BTC

– on-chain wallets: 5.1m BTC5.9/14.9 = 40%

** Fish (and smaller) to Dolphin/Shark ratio is 33% on-chain.

— Willy Woo (@woonomic) February 3, 2021

On the basis of a research report from Token Analyst, an article of Bloomberg published on January 31 alleges that “Bitcoin’s infrastructure is more centralized than ever before.”

The article further states that the scenario was “raising alarms about the security and viability of what is championed as a decentralized network.” In the final leg of December, Forbes highlighted crypto mining sector as victim of “Chinese centralization.”

Bitcoin advocates, in the meantime, underlined the king of crypto as the rival to centralization, which has put fiat currencies under pressure across the globe.

In the latest blog post, Marty Bent commented as follows:

“How did we get to this point? Centralization, complacency, and a detachment from monetary reality.”

A small retracement could occur in case institutions resort to book profit. Well-known traders such as Scott Melker believes that such a situation is perfectly possible as institutions will not hodl permanently.

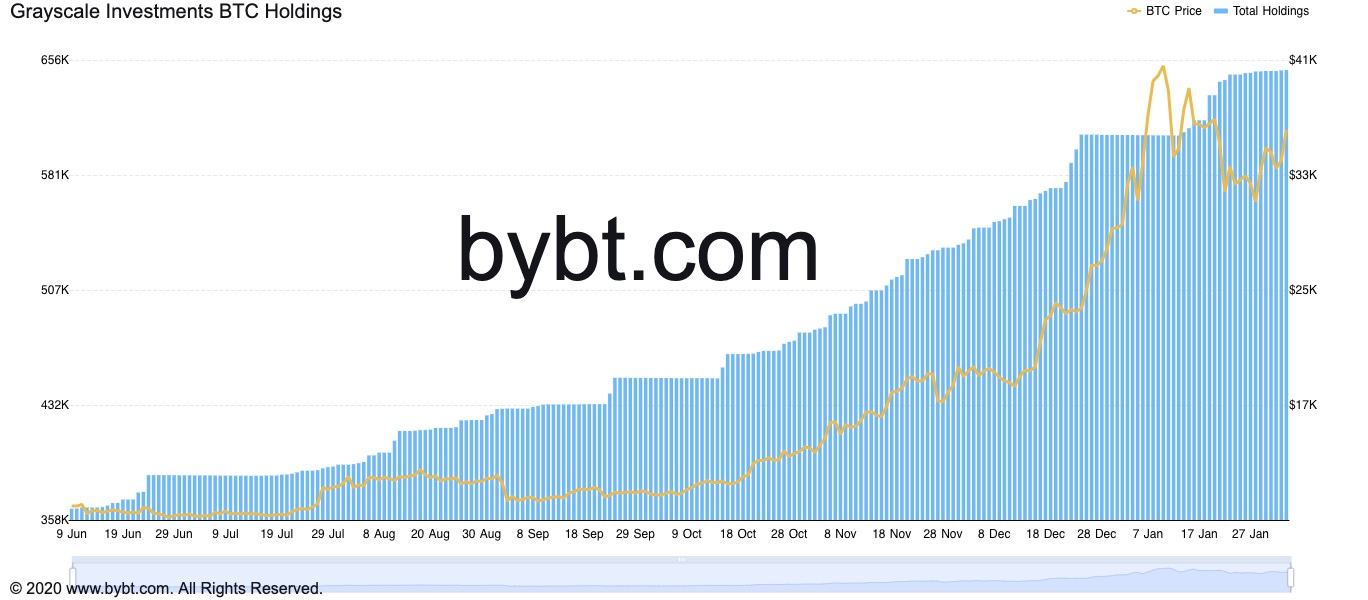

Grayscale and MicroStrategy increased their reserves this week, with latter acquiring 295 Bitcoin on Tuesday, while Grayscale’s Bitcoin based products under administration is now worth $22.50 billion.

Earlier this week, Melker wrote as follows:

“Regardless of all of the reports surfacing about hedge funds exploring Bitcoin, it is our belief most are going to lock in profit at some point, whether they own GBTC or custody their own coins. So, our answer is yes, institutions will sell their bitcoin.”

“But it is reasonable to believe many companies and funds will add Bitcoin to their balance sheet in some denomination as an inflation hedge rather than a short-term profit opportunity, leaving some Bitcoin off the market for good.”