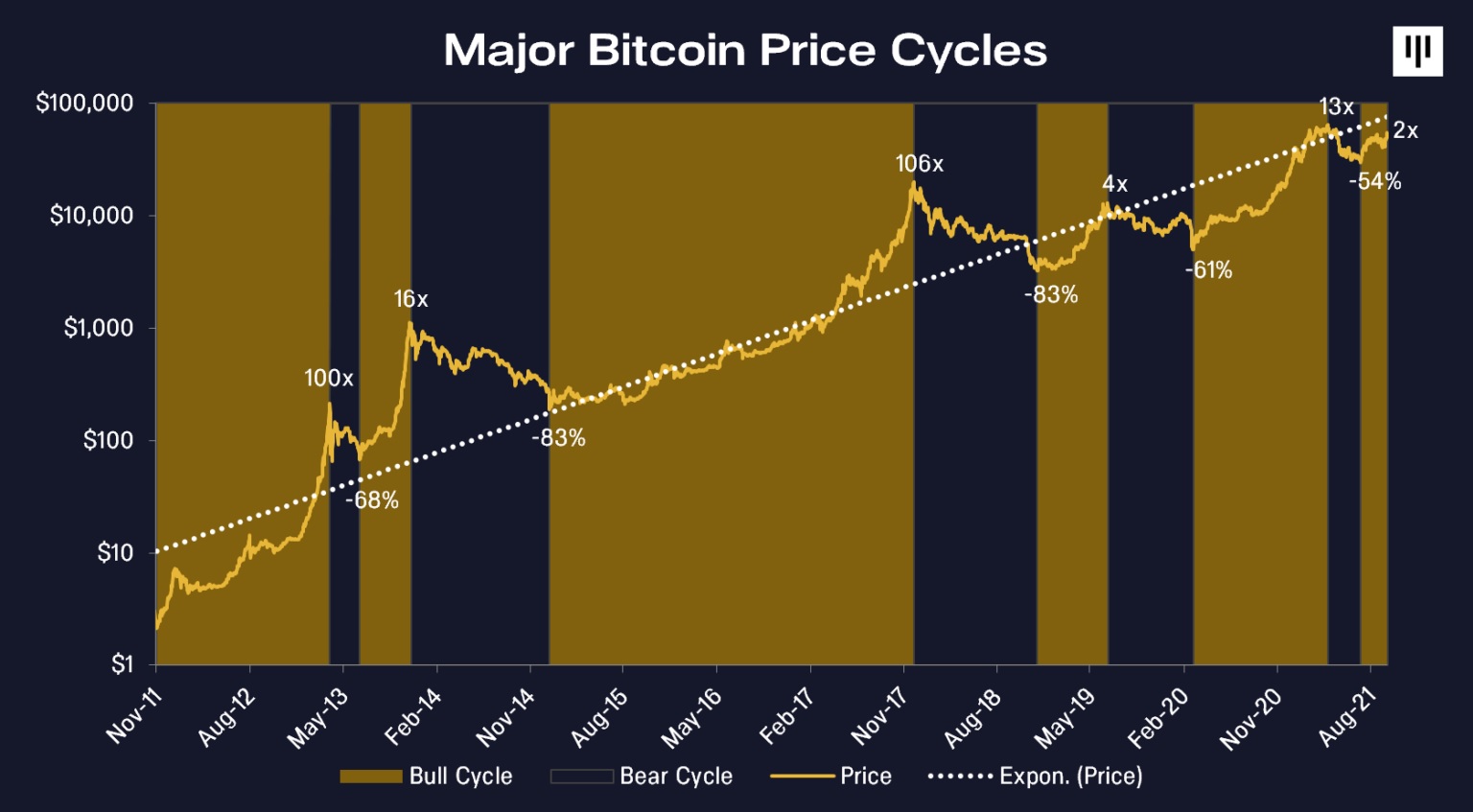

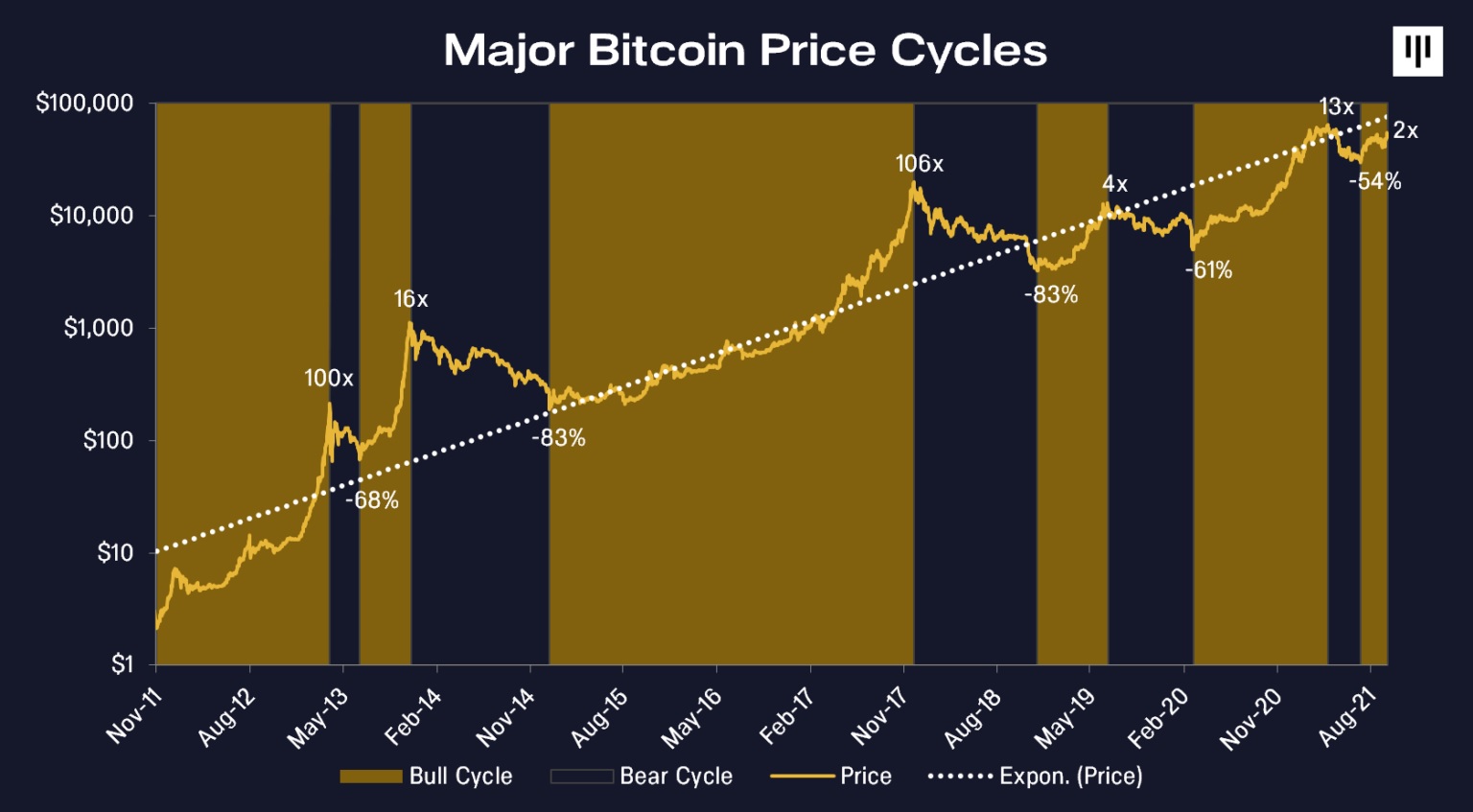

Even after a robust bull run, the Bitcoin (BTC) market tends to collapse by more thanr 80%. As per Pantera Capital, a hedge firm headquartered in California, this is the case. There have been fewer significant BTC price decreases recently, according to the study.

Even after a robust bull run, the Bitcoin (BTC) market tends to collapse by more thanr 80%. As per Pantera Capital, a hedge firm headquartered in California, this is the case. There have been fewer significant BTC price decreases recently, according to the study.

When Bitcoin peaked at about $1,111 in 2013-15 and $20,089 in 2017-18, it fell by nearly 83%. Likewise, the bull run in cryptocurrency prices from 2019 to 2020 and from 2020 to 2021 resulted in significant price drops. In spite of this, their subsequent retracements were -61% and -54%.

After the negative cycles of 2013-15 and 2017-18, Pantera Capital CEO Dan Morehead saw a steady decline in selling sentiment, saying that future bad markets would be “shallower.” “I have argued that the magnitude of price fluctuations would decrease as the market grows wider, more valued, and more institutional,” he said.

They emerged when Bitcoin’s bullishness was re-ignited to re-test its recent record high around the $65,000 mark. A rise in the Bitcoin/USD exchange rate to over $60,000 was seen following a rejection of a Bitcoin exchange-traded fund (ETF) by the Securities and Exchange Commission (SEC) in 2013.

When ProShare’s Bitcoin Strategy ETF was approved, institutional investors hoped it would make it simpler for them to participate in the BTC market as a whole. By doubling to recover levels above $60,000, Bitcoin was able to wipe off almost all of its losses from April to July’s market cycle. As Bitcoin develops becomes a popular financial asset after the approval of its first ETF, it’s becoming more normal to hear it valued at $100,000.

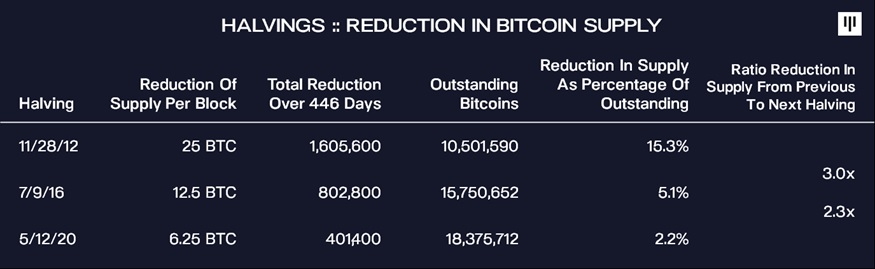

When it comes to Bitcoin’s future price, Morehead used the common stock-to-flow model to avoid a similarly optimistic forecast. This led to a BTC price increase of 9,212% as he said the first halving decreased the new Bitcoin issuance rate by 15% of the aggregate outstanding supply (approximately 10.5 million BTC).

To put it another way: the second halving reduced the available quantity of new Bitcoins to 15.75 million BTC, or one-third of what was previously available. Since this resulted in a 3,080% increase in the price, it had less of an effect on Bitcoin’s price.

It was on May 11th, 2020 that the supply was halved again, with Bitcoin rising by more than 720% since then. There will be no more 100x-in-a-year rallies, According to Morehead, who added: “The cycles presented logarithmically make today’s level seem cheap to me.”