A series of on-chain indicators are giving firm “buy” signal for Bitcoin (BTC). Ten indicators compiled by on-chain tracking website CryptoQuant suggest investment in Bitcoin at this point in time.

A series of on-chain indicators are giving firm “buy” signal for Bitcoin (BTC). Ten indicators compiled by on-chain tracking website CryptoQuant suggest investment in Bitcoin at this point in time.

Of the 11 indicators taken for study by CryptoQuant, eight has given out “buy”, while two has given “strong buy” for Bitcoin. Only one of the indicators has given “neutral” signal. None of the indicators have given a “sell” signal.

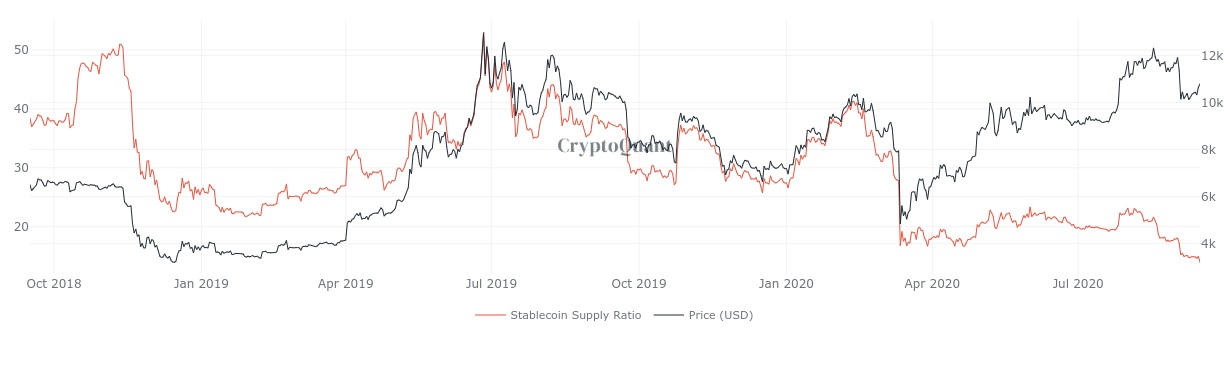

Summing up the scenario, CryptoQuant tweeted “Long-term $BTC on-chain indicators look healthy.” Two solid buy signals have been given by indicators stablecoin supply ratio (SSR) and exchange stablecoin reserves.

In spite of lack of clarity in price activity, both indicators continue to indicate that underlying trader sentiment is bullish. SSR relates to buying capacity of stablecoin holders relative to the price of Bitcoin.

Even while trading at $11,400 at the end of last month, buying support was robust and circumstances stay perfect at prevailing price levels.

Long-term $BTC on-chain indicators look healthyhttps://t.co/VnrIVP3lDF pic.twitter.com/cfE73acVXh

— CryptoQuant (@cryptoquant_com) September 16, 2020

The indicators cement the overall bullish view of Bitoin provided by technical analysis in September. With respect to network fundamentals, hash rate and difficulty are near their record highs, underling long-term optimism of miners.

Earlier this week, data analyst Willy Woo highlighted other elements of price action that hint of further uptrend. Plan B, who developed the stock-to-flow Bitcoin price model, in the meantime, has forecast BTC/USD to start its next rally from $10,000 to $100,000.

Only those who are worried about non-technical aspects have expressed words of caution. Robert Kiyosaki, author of “Rich Dad Poor Dad,” cautioned that the development of Covid-19 vaccine would be solely adequate for sparking Bitcoin sell off, say the least in the short-term.