In the last two weeks, the price of Bitcoin seems to have lost momentum and cryptocurrency market experts are of the view that it bears will have an upper hand in the near term feature.

In the last two weeks, the price of Bitcoin seems to have lost momentum and cryptocurrency market experts are of the view that it bears will have an upper hand in the near term feature.

A study of the derivative markets information will provide us a better picture of what is going on in the cryptocurrency market, specifically on the institutional side, and how the step taken by big players may have an effect on the spot market.

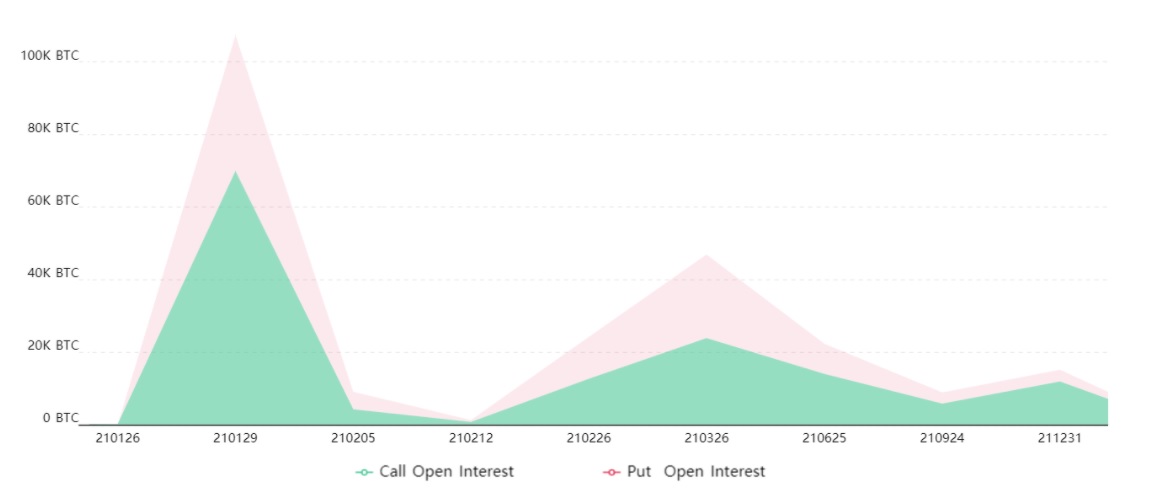

After hitting a high of $10.6 billion, Bitcoin’s (BTC) open interest retraced to $8.4 billion. With 47% of option contracts to be settled on January 29, the monthly expiry date stands distinct.

Even though a $4 billion expiry could be considerable, it should be noted that these options are segregated between calls, which reflect a neutral to bullish view, and put options, which mirror a bearish view. Additionally, purchasing a Bitcoin contract for $52,000 on January 29 might have been a good idea a few weeks back, but not so currently.

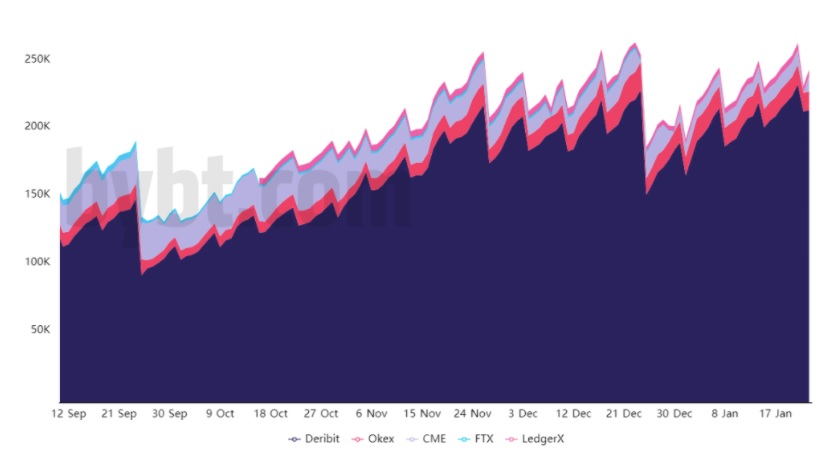

As the information provided above indicates, Deribit cryptocurrency exchange which has a market share of 83% is way ahead of others. However, to have an idea about the importance of this expiry, there is a need to adjust data and match both put and call contracts around the prevailing $32,000 level.

Almost all exchanges offer contracts that expire on a monthly basis, while some also list short-term contracts having weekly expiry. December 25, 2020 saw a record level of option contracts, worth $2.40 billion, getting expired and accounting for 31% of all open interest.

Data provided by Bybt.com indicates that January 29 expiry involves settlement of 107,000 Bitcoins (BTC). Furthermore, 45% of the total open interest in options market will get settled on the day of expiry. Interestingly, considering the fact that only five days remain for expiry, only a portion of those contracts will be trading on expiry as most of those strikes are far from reality.

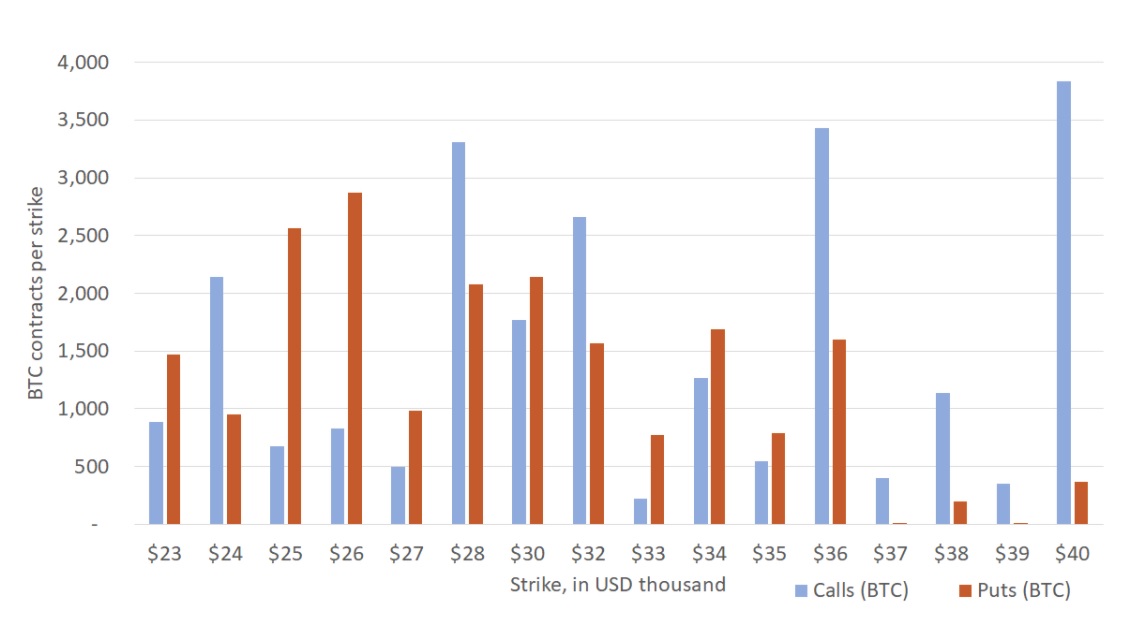

As Bitcoin hit its all-time peak of $42,000, some traders resorted to buying of call options contracts on extremely higher side. As the price of Bitcoin underwent a correction, those short-term call options have lost all their value. As of date, more than 68% of call options expiring on January 29, having a strike price of $40,000 and above, should not be included in the computation.

The same rule is applicable for put options with strike price of $25,000 and below. Put together, these two options account for 76% of open interest.

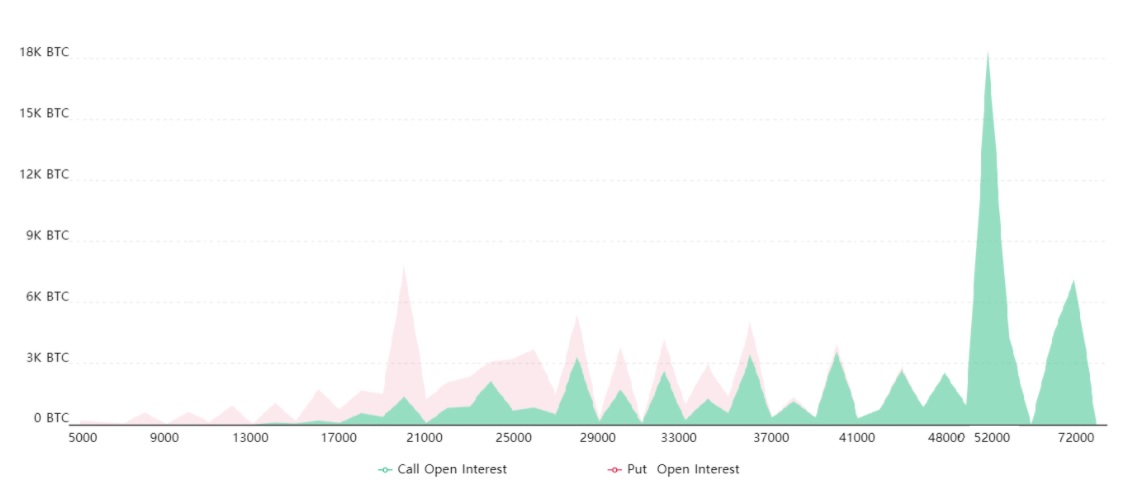

So, only around $745 million worth call options with strike price lower than $40,000 will have some value on January 29. Likewise, only $300 million worth put option contracts with strike price of over $25,000 will have some value. Overall, the adjusted open interest on January 29 stood at $1.05 billion, with a put-to-call ratio of 0.40.

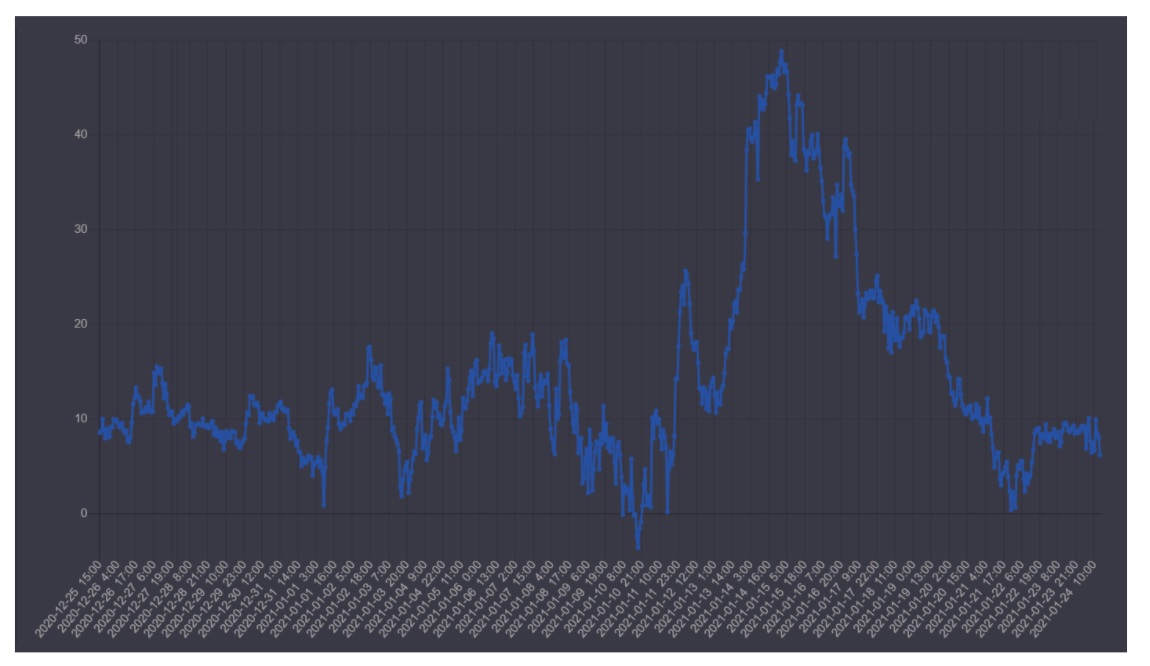

An analysis of open interest will enable interpretation of data related to trades that have been completed. However, skew indicator tracks options on a real-time basis. This measure is appropriate as Bitcoin was trading below $23,500 only thirty-days before. Therefore, bearishness is not indicated by the open interest around that level.

While analyzing option contracts, the 20%-30% delta skew in the main significant measure. This indicator matches call and put options alongside. A 10% delta skew mirrors call options that are bought and sold for a small premium for the deep bearish/neutral put options contracts. On the contrary, a negative skew transforms to a big amount of downward protection and signals bearish view of traders.

As the data provided herewith indicates, the previous bearish view happened on January 10 when Bitcoin plummeted by 15%. This step was followed by a 30%-20% delta skew as bullish view hit 49, a level unnoticed over the last 12 months. Whenever the indicator breaches 20, it mirrors worries of likely price rise from market makers and professionals and is regarded as bullish. On the contrary, the prevailing 0 to 10 range that remained since January 20 is regarded as neutral.

Though expiry of $4 billion options contracts could be worrisome, almost 74% of options contracts are already regarded as valueless. With respect to January 29 expiry, bulls stay primarily in control as much greater adjusted open interest indicates. In spite of bulls having a total advantage, the bearish sentiment reflecting put options contracts range between $33,000 and $35,000.

As a whole, the advantage of 1,200 Bitcoin options contract is more than nullified by the 1,950 Bitcoin contracts, with imbalance tilted towards the call option contracts in the range of $28,000 to $32,000.

Finally, as per the current scenario, overall bulls seem to be in control of expiry scheduled Friday, even though rewards between $28,000 and $35,000 are well-balanced. As a whole, there is little to gain from price fluctuations ahead of January 29 expiry.