Intercontinental Exchange (ICE) owned Bakkt, a regulated cryptocurrency trading and custody service provider, has recorded record daily trading volumes in the category of physically-settled Bitcoin (BTC) futures.

Intercontinental Exchange (ICE) owned Bakkt, a regulated cryptocurrency trading and custody service provider, has recorded record daily trading volumes in the category of physically-settled Bitcoin (BTC) futures.

Specifically, Bakkt revealed that over $200 million worth Bitcoin futures contracts were traded on a single day, up 36% from its earlier high.

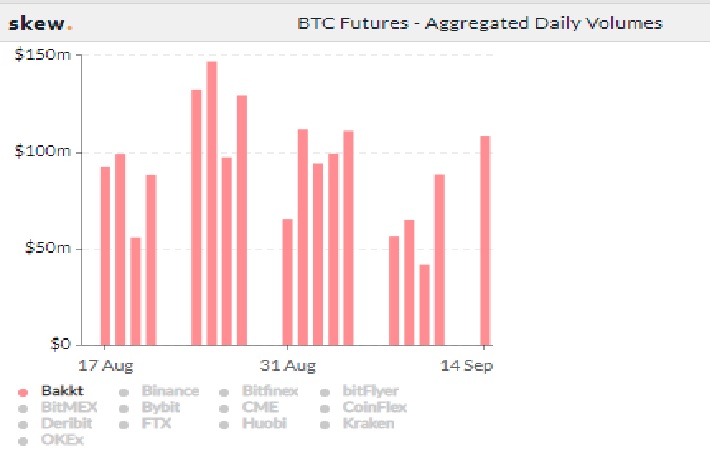

As per cryptocurrency market data aggregator Skew, the record high trading volume is about twice the average daily trading volumes recorded so far this month.

In spite of being pitted as the probable accelerator for an institution driven rally, Bakkt’s Bitcoin futures missed to make the anticipated move, with prolonged periods of inaction during January 2020.

Nevertheless, the sustained rise in volume recently seen on its trading platform indicates that institutions have now started to get a hold of it.

One important distinction between Bakkt’s contracts and others is that they are fundamentally ‘physically settled’ transactions, rather than cash. Nevertheless, analysts have underlined that several futures contracts traded on Bakkt will get rolled over, with only a fraction of traders opting for possession of Bitcoin at the time of contract expiry.

Another record day in the books for our physically delivered futures:

15,955 Bakkt Bitcoin Futures were traded today, representing over $200M of volume and a 36% increase from our previous all-time high ?

— Bakkt (@Bakkt) September 15, 2020

In spite of hitting record highs, Bakkt’s volumes fade relatively to the transaction volumes on prominent cryptocurrency exchanges. In the past 24 hours, Binance platform’s BTC-USDT perpetual contract (a futures contract without any expiry or settlement date) recorded $2.65 billion in transactional volumes, while the rest of 74 crypto based pairs (futures), put together, recorded trading volume of $5.96 billion.

Likewise, the 103 futures pairs offered by Huobi generated trading volume of $5.48 billion in the past 24 hours. The figure includes $1.28 billion trading volume generated by the BTC-USD perpetual contract.

Even OKEx trading platform saw $516 million worth trading volume generated by BTC-USD perpetual contracts, with the 466 futures pairs offered by the exchange generating $2.72 billion worth transactions.

Nevertheless, Bakkt surpassed Derebit, with the latter’s BTC-USD contract recording daily trading volume of $168 million.