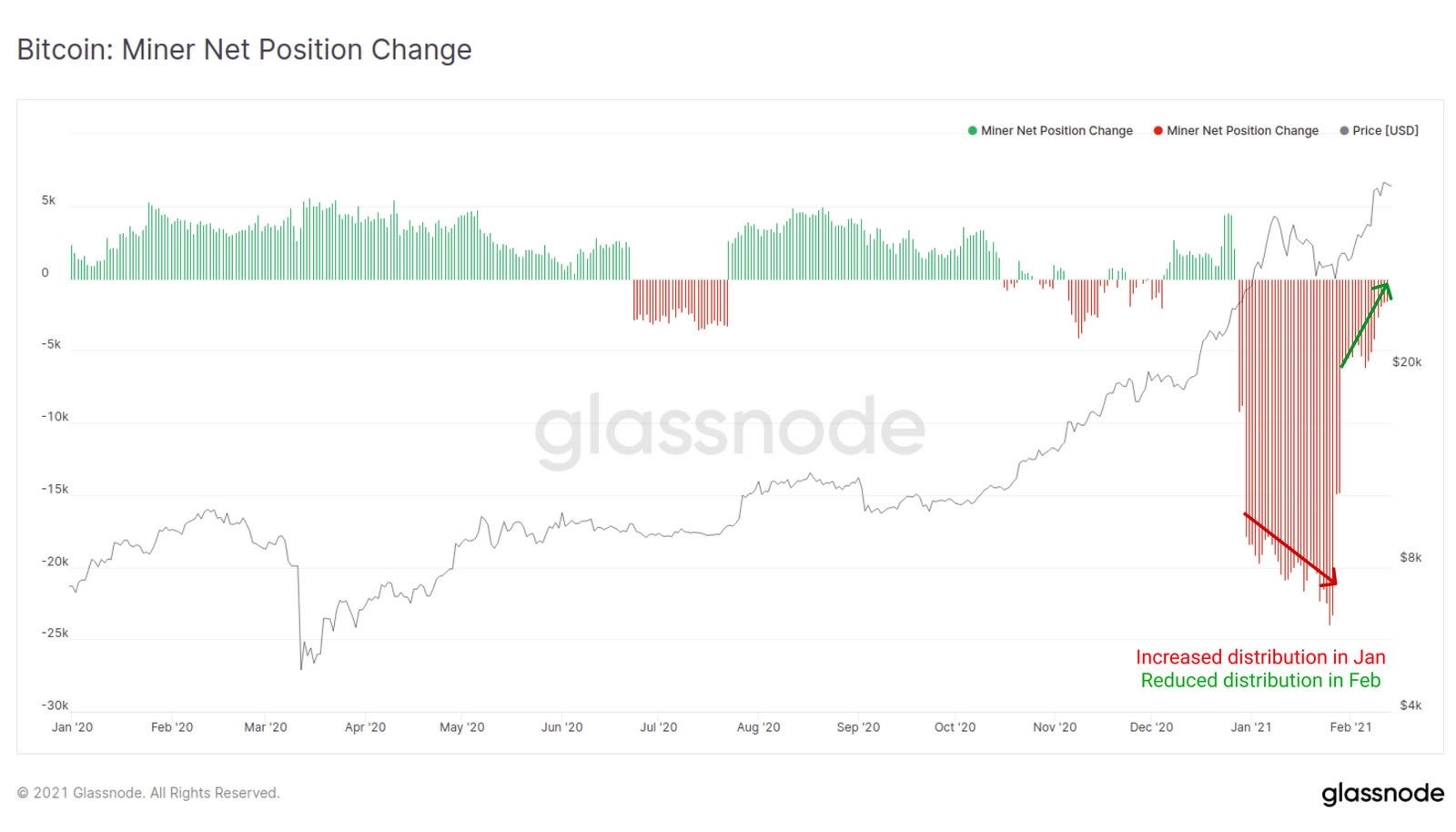

Glassnode, which provides on-chain data, has published a report that points to accumulation by Bitcoin miners while seasoned investors are booking profits. In spite of huge selling by miners in January, Glassnode’s report indicates that Bitcoin outflows from miners have decreased significantly so far this month.

Glassnode, which provides on-chain data, has published a report that points to accumulation by Bitcoin miners while seasoned investors are booking profits. In spite of huge selling by miners in January, Glassnode’s report indicates that Bitcoin outflows from miners have decreased significantly so far this month.

The report emphasizes that long-time investors and miners are the key sellers of Bitcoin during big rallies. As per Glassnode, a drop in miner outflows implies underlying bullishness as miners would got back their operations costs or increasing holdings as in view of Tesla’s $1.5 billion investment in Bitcoin:

“This suggests that miners have either completed adequate sales to cover costs, or could also mean they see Tesla’s vote of confidence as fair reason to keep a strong grip on their treasuries.”

As miners continue to stay unmoved with their Bitcoin holdings, Glassnode interprets that the major portion of cryptos being liquidated in the market is by long-term investors. The document further points out to past week’s (February 8) ‘Elon Candle’, denoting the largest ever daily candle in Bitcoin’s history being formed a day after Tesla revealed its investment in Bitcoin, resulting in a gain of of $7,162 or 18.5% in 24 hours.

By studying the Average Spent Output Lifespan (ASOL) of Bitcoin, an indicator reflecting the average age (days) of “all spent transaction outputs,” it was concluded by Glassnode that long-time investors used Tesla’s news related to Bitcoin to book profits.

“The Elon Candle has lifted the average age of coins spent from 30-days to 58-days, as shown in the ASOL.”

The firm pointed out that Coin Days Destroyed (CDD), an indicator reflecting the economic activity by providing more weightage to coins that remain unspent for a considerable period of time, also indicates that older coins are being disbursed. Glassnode interprets that long-time investors are booking profits since October, when Bitcoin breached $12,000 level.

The news of Tesla’s investment in Bitcoin has also led to record high social signals for the numero uno crypto. Specifically, Twitter activity related to Bitcoin rising to fresh highs. In spite of profit booking, Bitcoin continues to stay near all-time highs, with Bitcoin testing its latest peak of about $49,600 on February 16.