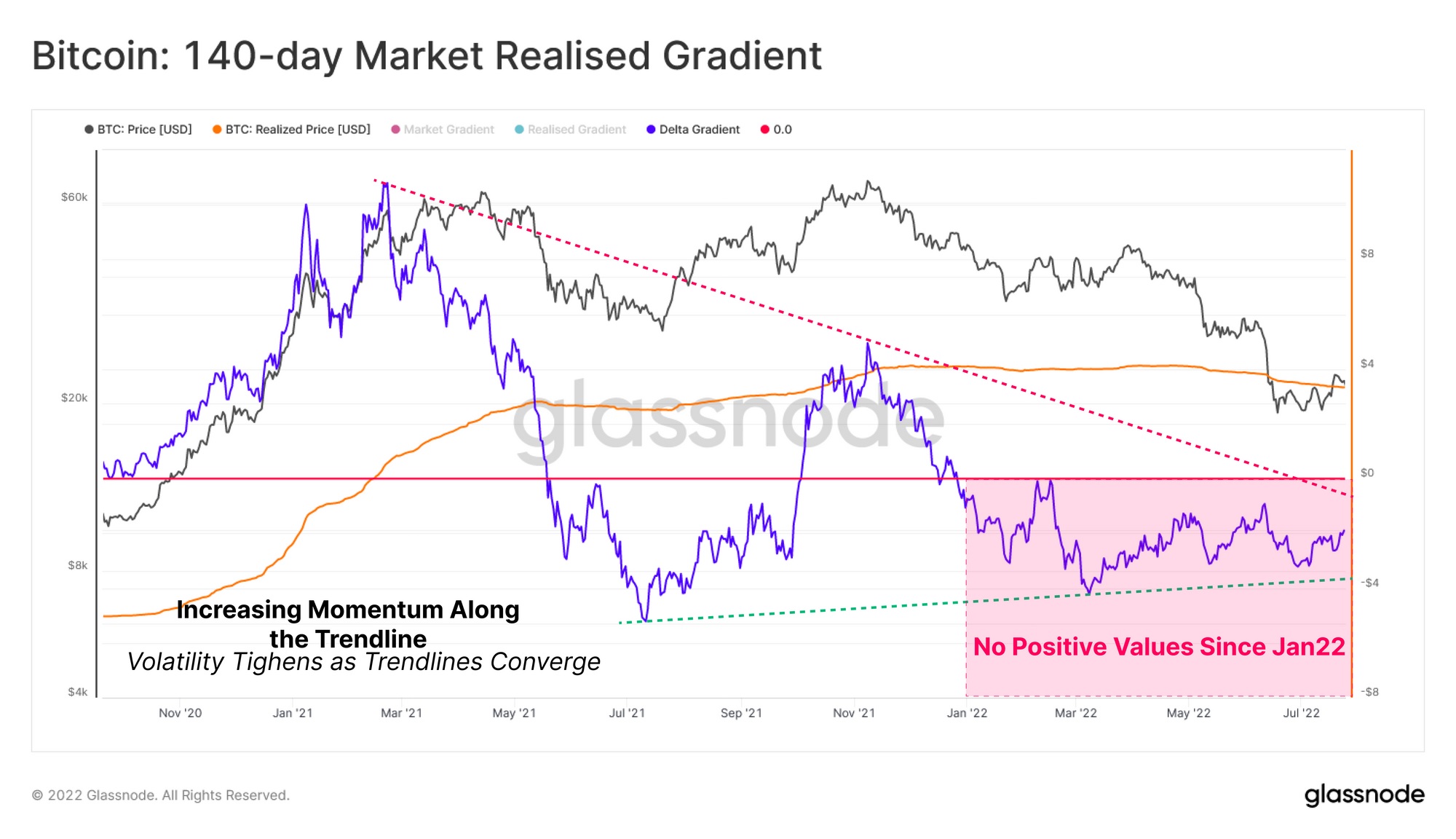

Since March of 2021, the maximum values of the 140-day MRGO have displayed a consistent decreasing trend, and it has not produced a positive value for the year 2022. According to the statistics shown earlier, this indicates that a macro bear market trend has most certainly been occurring during the course of the prior 15 months.

At this stage, bears have an advantage due to the existing condition, which entails negative value that has persisted for a considerable amount of time. This circumstance is symptomatic of the consistently poor market valuation in 2022. At this juncture, bears are in a stronger position than bulls.

The underlying pattern maintains indicating to the potential of a longer-term recovery being in motion, despite the likelihood that further length and rebound time may be necessary. This is despite the fact that the pattern keeps pointing to the possibility of a longer-term recovery being in action.

MGRO examines the rate of change in the gap between the market price and the real price in order to establish a connection between the current momentum of the market and the amount of money that is flowing into the market. This connection is established by linking the current momentum of the market to the amount of money that is flowing into the market. The current total amount of Bitcoin is used to compute the realized price of Bitcoin, which is derived by dividing the realized market capitalization of Bitcoin by the current total quantity of Bitcoin. The worth of all Bitcoins based on the price at which they were bought is known as the realized market capitalization. This value is different from the value of Bitcoins based on the price at which they are presently trading.

A number that is bullish on the MGRO displays bullish momentum, whereas a value that is negative on the MGRO reflects bearish momentum. A bullish indication of momentum is also represented by a positive MGRO number. A single Bitcoin could be purchased for a total of $21,167 at the time that this article was published. The leading cryptocurrency, as determined by market capitalization, has seen an increase of 0.29 percent during the course of the last twenty-four hours.