XRP price fell sharply below $0.30, recording a low of $0.2138 on cryptocurrency exchange Binance. Following the lawsuit filed by the US Securities and Exchange Commission (SEC), selling pressure increased on XRP.

XRP price fell sharply below $0.30, recording a low of $0.2138 on cryptocurrency exchange Binance. Following the lawsuit filed by the US Securities and Exchange Commission (SEC), selling pressure increased on XRP.

Analysts put forth three main reasons for the sharp decline in the price of XRP: SEC lawsuit, bearish sentiment and probable delisting by cryptocurrency exchanges. Nevertheless, it is not the first well-publicized lawsuit filed by the SEC against a blockchain firm or promoters of a crypto token.

Both Kik and EOS inked a settlement deal with the SEC. As per Adam Cochran of Cinnemhain Ventures, cases related to the aforesaid blockchain firms were based on violation of security laws during token distribution. With regards to XRP, Cochran stressed that the regulatory organization is blaming XRP of breaching securities rules. He stated:

“Unlike Kin and EOS, where the SEC alleged the securities violations were just at the point of sale, the SEC is alleging here that $XRP is *STILL* in violation of securities law present day. That means they believe it is currently a security, hence the exchange reactions.”

A number of attorneys have pointed out that Ripple might find it difficult to claim lack of knowledge due to the supportive documents submitted with the lawsuit. Therefore, for Ripple, the legal case has turned out to be a cumbersome process to manage. However, Ripple’s CEO Brad Garlinghouse has stated that he would give a tough fight in court. Cochran tweeted:

2/8

1. Unlike Kin and EOS, where the SEC alleged the securities violations were just at the point of sale, the SEC is alleging here that $XRP is *STILL* in violation of securities law present day.

That means they believe it is currently a security, hence the exchange reactions.

— Adam Cochran (@AdamScochran) December 23, 2020

Cochran further said that certain sources proposed Coinbased had talks with their advocate regarding XRP’s delisting. There is no need for exchanges to delist XRP as of date. In case, the court declares XRP as a security, nevertheless, lawyers stated that exchanges could stare at numerous issues and could resort to delist XRP to safeguard their interests. Cochran opined:

4/8

3. They’ve personally named the executives as liable, which the SEC does when they go for a kill shot. This is much more common in fraud action than general securities action.

— Adam Cochran (@AdamScochran) December 23, 2020

6/8

EOS got lucky with a settlement, ambiguity and the fact it was no longer found to be a security. Same with Kin.

Projects like Unikoin Gold however were dealt fatal blows.

The shot the SEC lined up here is way worse.

— Adam Cochran (@AdamScochran) December 23, 2020

8/8

And this case will likely drag out for 2+ years before there is clarity.

Crypto projects have a chance to settle and resolve if the SEC thinks they were only previously centralized.

Centralized payment databases have no path to safety.

— Adam Cochran (@AdamScochran) December 23, 2020

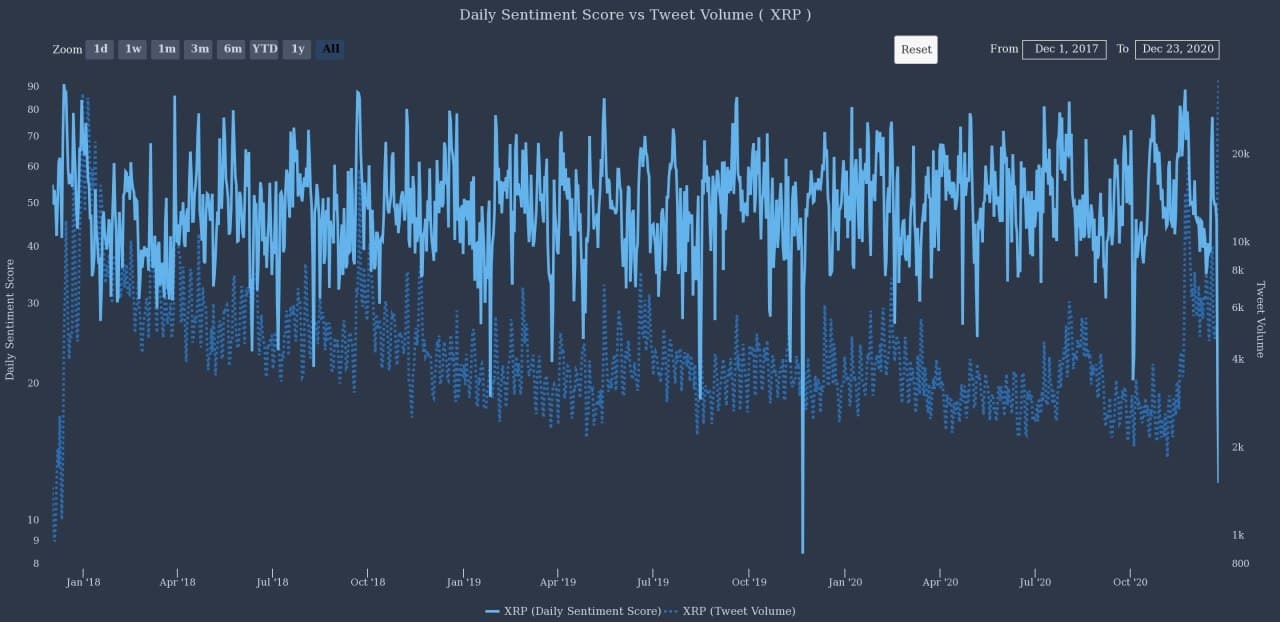

Data provided by Santiment indicates that the view of social media on Ripple has considerable deteriorated. As per Santiment, social media talks about the crypto are still centered about XRP and the case filed by SEC (securities and exchange commission). Santiment analysts stated:

The topics most prominently being discussed today are dominated by $XRP and #Ripple, as the #SEC has charged the company with selling securities. Other subjects include the #TWT airdrop, the #Aavegotchi AMA, and #GRT impressing! https://t.co/pfawwebuGR pic.twitter.com/nRT0OL4uJP

— Santiment (@santimentfeed) December 23, 2020

Data provided by The Tie also indicates that the daily sentiment reading declined to its second-lowest figure for last week, while the volume of tweet surged to historical highs.