Ether (ETH), the native crypto of Ethereum blockchain, has recorded a new all-time peak of $1,924.56 earlier today as undercurrent of crypto markets continue to remain bullish. At the time of writing this article, Ether was trading at $1,899.29, up 3.6% in the last 24 hours.

Ether (ETH), the native crypto of Ethereum blockchain, has recorded a new all-time peak of $1,924.56 earlier today as undercurrent of crypto markets continue to remain bullish. At the time of writing this article, Ether was trading at $1,899.29, up 3.6% in the last 24 hours.

After remaining range bound for a major portion of February, the top altcoin became active this week. In his latest update, Cointelegraph Markets analyst Michaël van de Poppe predicts a likely breakout that will lead the cryptocurrency to $2,200, provided bulls manage to comfortably hold above $2,000.

As the cryptocurrency has remained below the level for quite a long-time, there is need to consolidate above $2,000 so that there is no sharp retracement in price.

He summed up by stating “However, once again, quite a tricky breakout, so you basically have to watch that zone… at $1,820.”

Lack of support would push the crypto to $1,400 and that might happen if Bitcoin (BTC) undergoes a price correction from its all-time high of about $52,000, Van de Poppe cautioned.

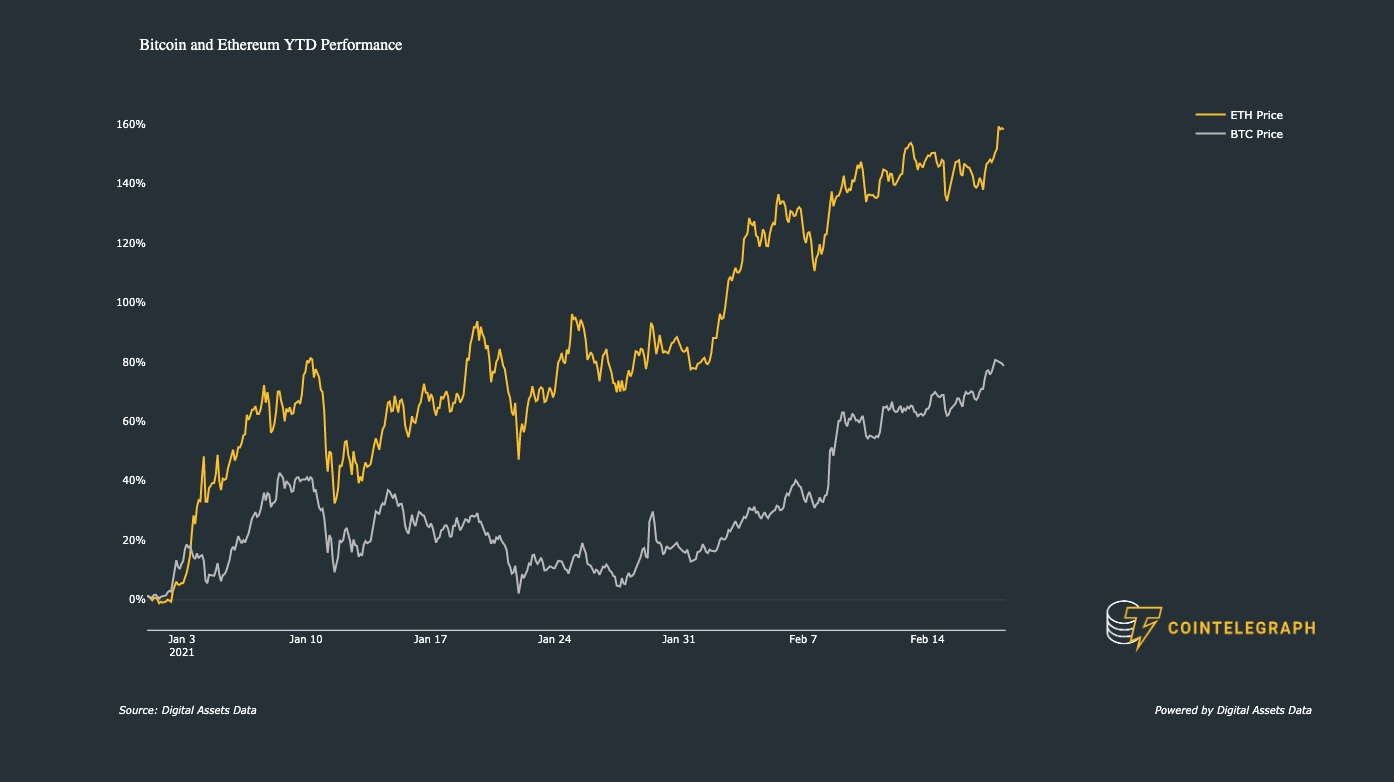

Interestingly, Ether has eclipsed Bitcoin (BTC) in terms of gains this year, with year-to-date appreciation of 164% compared with 85% for Bitcoin/US Dollar pair. In the meantime, info related to crucial discussions has fueled Ether’s strong uptrend.

According to Ki Young Ju, CEO of on-chain analytics service CryptoQuant, movement out of Coinbase indicates three huge chunks of about 200,000 ETH has left the exchange to private wallets last year.

There were three consecutive massive $ETH outflows from Coinbase cold wallets last year.

Speculative guess but those might be OTC deals for institutional investors like $BTC Coinbase outflows.

You might want to set an alert for this. (> 30k)

Chart 👉 https://t.co/57cdxcMex6 pic.twitter.com/0M5DokL1bk

— Ki Young Ju 주기영 (@ki_young_ju) February 18, 2021

As per Ki, the aforesaid event could have happened through large volume deals done Over-the-Counter (OTC), comparable to similar events in Bitcoin.

After uploading a chart, he wrote the following comments:

“There were three consecutive massive $ETH outflows from Coinbase cold wallets last year. Speculative guess but those might be OTC deals for institutional investors like $BTC Coinbase outflows.”

Ki stated that in case this is a trigger for uptrend, it would be worthy to set up alert to monitor similar crypto outflows.

He also mentioned through a separate tweet that the rally seen this time is totally different from the one seen in 2018.

$ETH all-time high in 2021 is different from 2018.

Fewer deposits, more withdrawals across all exchanges.

Selling pressure significantly weaker than in 2018.Save Chart 👉 https://t.co/CKsNQVp89j pic.twitter.com/S7Gyd6WfIY

— Ki Young Ju 주기영 (@ki_young_ju) February 18, 2021