At the beginning of this week, Bitcoin (BTC) enthusiasts and crypto investors were delighted to know that MicroStrategy, a Nasdaq-listed business intelligence enterprise, having a market cap of $1.20 billion, had officially endorsed Bitcoin as its main reserve asset by buying 21,454 BTC (worth $250 million).

At the beginning of this week, Bitcoin (BTC) enthusiasts and crypto investors were delighted to know that MicroStrategy, a Nasdaq-listed business intelligence enterprise, having a market cap of $1.20 billion, had officially endorsed Bitcoin as its main reserve asset by buying 21,454 BTC (worth $250 million).

That paved way for a large number of cryptocurrency analysts and professionals to issue ultra-bullish statements on Twitter, making several people firmly believe that Bitcoin is on the verge of a massive break out.

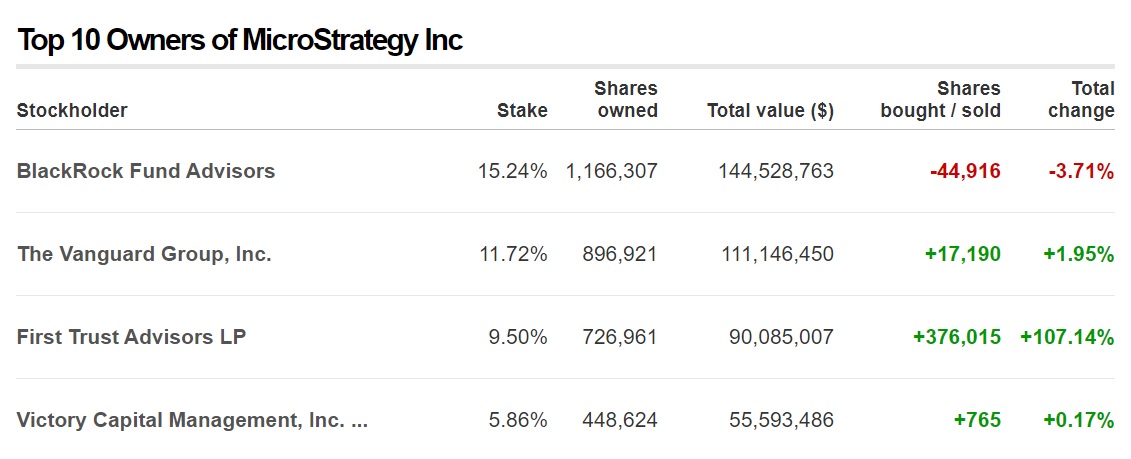

While the report is upbeat and a strong indication that institutional adoption of cryptos is happening, there is yet another notable info. The $89 billion fund BlackRock is the largest shareholder of MicroStrategy.

As per data provided by CNN Business, BlackRock Fund Advisors owns a 15.24% stake in MicroStrategy. This implies MicroStrategy’s latest buying provides BlackRock with roundabout exposure to Bitcoin, transforming the company into a “publicly-traded Bitcoin play.”

MicroStrategy, through a media release, stated that it is adopting Bitcoin as a “primary treasury reserve asset.” and CEO Michael J. Saylor affirmed that that Bitcoin could likely be supreme to cash.

Saylor said:

“Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

The Bitcoin purchase looks more intriguing considering the earlier comments made by Saylor and BlackRock about the numero uno crypto. Back in February 2018, BlackRock’s international chief investment strategist Richard Turnill stated:

“We see cryptocurrencies potentially becoming more widely used in the future as the markets mature. Yet for now, we believe they should only be considered by those who can stomach potentially complete losses.”

During the same period, Turnill listed out certain criteria that could provide necessary impetus to Bitcoin in the long-term. He stressed that a worldwide regulatory infrastructure on cryptos could likely assist the growth of cryptos.

Soon thereafter, the Financial Action Task Force (FATF) under G7 created united crypto regulatory guidelines. Several top countries throughout Asia, the US and Europe have also endorsed precise guidelines regarding cryptos.

MicroStrategy, a $1.2 billion company, just turned itself into a publicly-traded bitcoin play. Smart https://t.co/tCXiAVc8w7

— Barry Silbert (@barrysilbert) August 11, 2020

Saylor, who is upbeat about the long-term growth prospects of Bitcoin, was extremely cynical about the crypto in 2013 when he stated:

“Bitcoin’s days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling.”

Enterprises that have earlier denied Bitcoin are showing a shift in stance by beginning to accept it as an asset of value. Notably, JPMorgan has started serving Bitcoin exchanges Coinbase and Gemini in May.

Changpeng Zhao, the CEO of Binance, said:

Smart publicly listed company buys $250,000,000 worth of #bitcoin, as a safe heaven asset.

Stimulus money flowing from Wall Street into #bitcoin.

Are you in front or behind them? https://t.co/1FYLZERjkS

— CZ Binance (@cz_binance) August 11, 2020

The change in stance underlines the rising adoption of Bitcoin across the globe.