OI is calculated by adding all open trade contracts and deducting all closed trade contracts. It is used to evaluate the market mood and the strength of price movements by providing an indicator of both. With over 90% of the global trading volume, Deribit is the biggest BTC and ETH options exchange in the world.

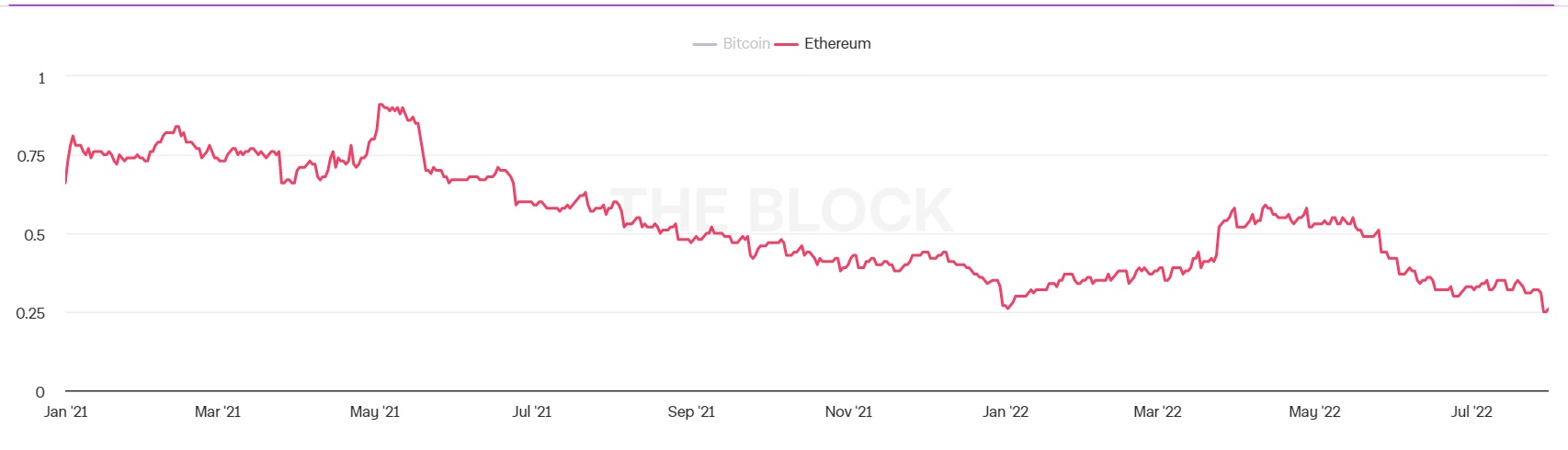

Deribit exchange records show that the majority of ETH options are call options, with a put/call ratio of 0.26. The ETH Put/Call ratio has dipped to a new yearly low as the merge date approaches.

A put option’s terms state that buyers have the right but not the obligation to sell the underlying asset by a certain date and at a specified price. Overall, traders of call options are upbeat, while buyers of put options are generally pessimistic.

A put/call ratio value less than 0.7 and close to 0.5 indicates a growing bullish trend, whereas a put/call ratio value more than 0.7 or beyond 1 signals negative market sentiment.

The upcoming Merge, which is slated for the third week of September, is blamed for the recent rise in ETH OI on the options market and the underlying optimism among traders.

The quarterly contracts for ETH futures, which are set to expire in December 2022, have entered backwardation, which occurs when the futures price falls below the spot price. In contrast, ETH has been steadily gaining ground in the options market. The price of ether in both the current and futures markets rose to -$8 on Monday. Although from a seemingly unfavorable standpoint, Bitcoin increased by 15% after experiencing a price backwardation in June.

Experts have also made suggestions on the potential for an airdrop in the case of a chain split, in addition to the growing excitement around the impending proof-of-stake (PoS) shift. According to a survey by Galois Capital, 53.7 percent of respondents projected a smooth network transition, compared to 33.1 percent who thought the upgrade would lead to a hard fork.