Bitcoin (BTC) declined sharply by roughly 6% in a span of four hours as the latest weekly candle started forming on March 15. Three aspects paved way for the weakening of underlying momentum of Bitcoin.

Bitcoin (BTC) declined sharply by roughly 6% in a span of four hours as the latest weekly candle started forming on March 15. Three aspects paved way for the weakening of underlying momentum of Bitcoin.

They are new weekly candle formation, increase in financing rates and capital inflows into stablecoin that was perceived as the main reason for the latest price rally.

During the formation of a new weekly candle, Bitcoin usually records huge volatility as the trend on the first day of the week could decide the performance of Bitcoin for the remaining part of the week.

In the past few hours, a trader with nickname “Rekt Capital” has observed that Bitcoin has recorded an overextended retracement. As an outcome, the trader believes that Bitcoin could be on course to record “volatile reset.” Additionally, the trader stated:

#BTC has pulled back towards the red area and even overextending below it – for now

The day is still young so price could still resolve itself relative to this red boxed area and turn it into support

Technically, $BTC is in the process of a volatile retest#Bitcoin https://t.co/GrsYEC0sNW pic.twitter.com/wX6xGGTmcq

— Rekt Capital (@rektcapital) March 15, 2021

In case Bitcoin does not succeed in rebounding from the $55,000 zone, a sharp price correction to $46,700 is bound to happen, as per a cautionary statement issued by the trader. The level of $46,700 is regarded as the next major support. Notably, the futures market financing rate of Bitcoin was fluctuating around 0.1% across major cryptocurrency exchanges as the price of Bitcoin started declining.

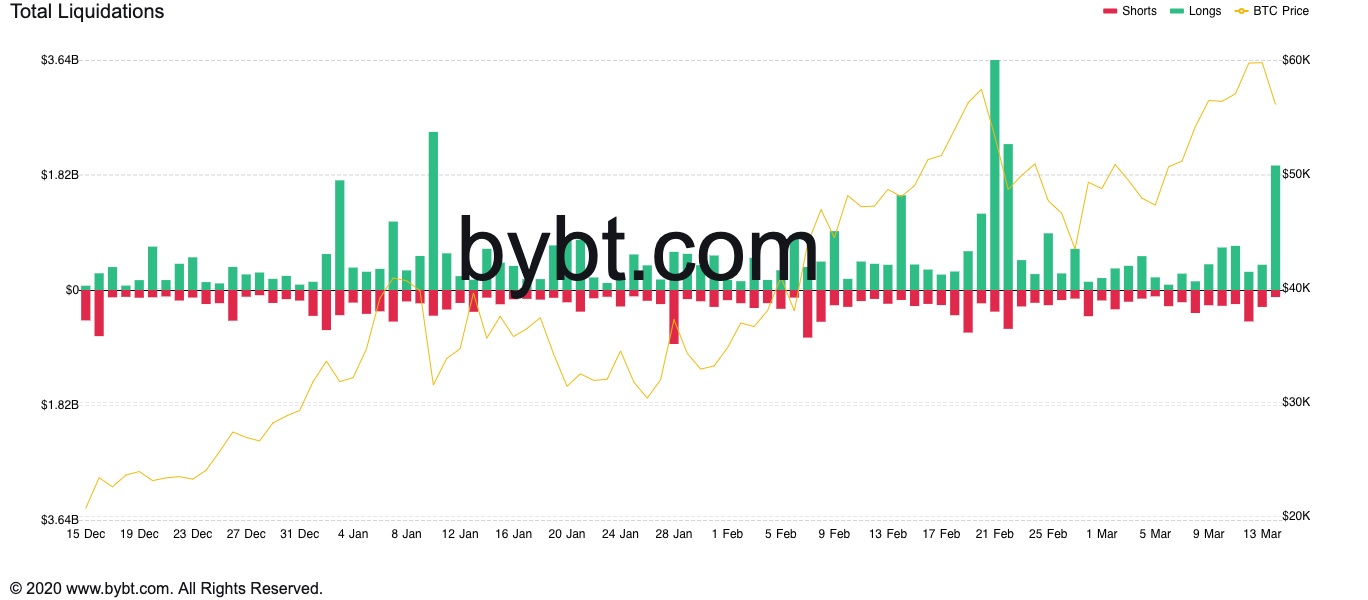

This shows that a staggering majority of market participants wanted to acquire Bitcoin, transforming it to a jam-packed trading environment. As per data provided by Bybt.com, 194,541 traders were pushed out in the last 24 hours, with dilutions totaling about $1.83 billion, the largest since February 21. Similarly, the futures market recorded a torrent of liquidations with the market being perceived as overheated.

The continuous selling pushed Bitcoin below $57,000, which is regarded as key support level. Analyst Michael Van de Poppe said:

#Bitcoin barely holding on to this critical level here.

Needed for upwards continuation, otherwise, price drops back into the range. pic.twitter.com/dHrWlybMzg

— Michaël van de Poppe (@CryptoMichNL) March 15, 2021

Before the decline began, on-chain data analytics platform CryptoQuant highlighted huge Bitcoin deposits being made into Gemini cryptocurrency exchange, which commands same popularity as Coinbase in the US. Gemini exchange is also referred to as “whale exchange.”

Ki Young Ju, the CEO of CryptoQuant, stated:

This 18k $BTC deposit is legit as it was a transaction between user deposit wallets and Gemini hot wallet.

All Exchanges Inflow Mean is skyrocketed due to this deposit. Don’t overleverage if you’re in a long position.

Chart 👉 https://t.co/oIVOkm5U3a https://t.co/AnK19GINGi pic.twitter.com/fTGS3ucI3e

— Ki Young Ju 주기영 (@ki_young_ju) March 15, 2021

Along with the whales induced selling pressure, another signs of bearishness is that the latest Bitcoin price rise was sparked by inflow of funds to stablecoins via cryptocurrency exchanges. Ki pointed out that the rally was fueled by funds set aside in stablecoins instead of funds inflow from US based institutions. He detailed:

Coinbase Premium Index was always significantly high when $BTC price breaking 20k, 30k, 40k, and 50k. It was significantly negative when the price breaking 60k.

This 60k bull-run is not US institution-driven, it all came from stablecoins.

Chart 👉 https://t.co/RpcUEnGxB6 https://t.co/BafK1ggcoA pic.twitter.com/Xoz8cMj3sA

— Ki Young Ju 주기영 (@ki_young_ju) March 14, 2021

At the time of writing this article, Bitcoin was trading at $56,505, down 5.4% in the last 24 hours.