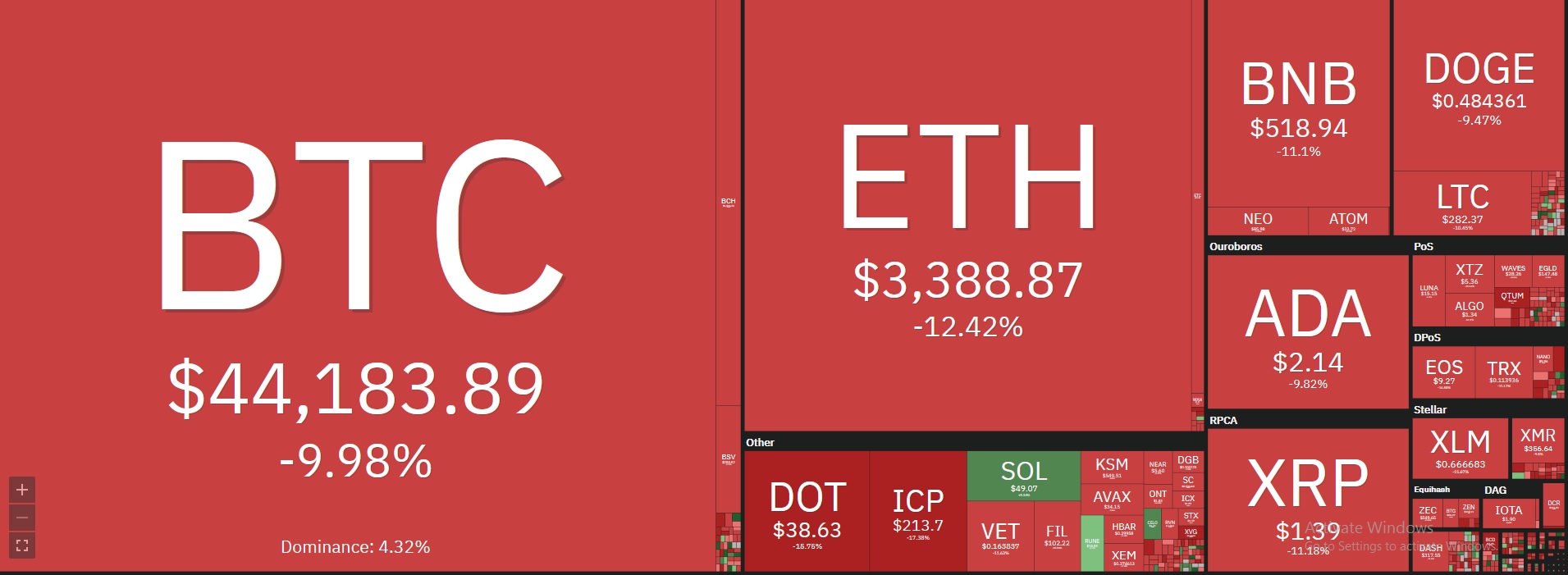

Bitcoin (BTC) price dropped below $45,000 on Monday, the second occurrence in four days, supporting bears view of a deeper near-term decline in the days ahead. The numero uno cryptocurrency dropped to a low of $42,024, reflecting a loss of about 13% in the last 24 hours.

Bitcoin (BTC) price dropped below $45,000 on Monday, the second occurrence in four days, supporting bears view of a deeper near-term decline in the days ahead. The numero uno cryptocurrency dropped to a low of $42,024, reflecting a loss of about 13% in the last 24 hours.

At the time of writing this article, Bitcoin was trading at $43,076, mirroring a loss of 25.7% in the past one week. Along with the price, the market cap has dropped to $806.98 billion.

The Bitcoin’s sharp decline trigged a broader market sell-off, with Ethereum (ETH) declining 13.1%, Polkadot (DOT) dropping 15% and Binance Coin (BNB) inching downwards by 11.8%. In the past few days, market view of cryptos has turned bearish after Tesla stepped back from accepting Bitcoin as payment for its electric vehicles.

Also, news reports indicating a likely scrutiny of Binance cryptocurrency exchange by the US Justice Department has also given rise to worries about a likely regulatory problem.

In the meantime, Caitlin Long, CEO of Avanti digital bank has opined that the disclosure of reserves made by Tether has sparked the sell-off. In her tweet, Long wrote Tether’s “probability of default [and] loss severity in default just went up” due to its exposure to credit.

Specifically, 75% of the company’s cash and cash equivalents are held in the form of commercial debt. In spite of the volatility in the market, institutions continue to rake up Bitcoin with confidence, providing another support to the argument that the bull market is not yet over.

Bitcoin Treasuries, which monitors corporate and institutional investments in Bitcoin, has stated Saturday that institutions have bought 215,000 Bitcoin in the last 30 days.

1/ SOME THOUGHTS on #stablecoins & the #crypto selloff, which are probably connected.

HUGE news last week & it matters far more than @elonmusk or @binance news. A long thread 👇: pic.twitter.com/itRfCfY1d3

— Caitlin Long 🔑 (@CaitlinLong_) May 15, 2021

That’s translates to an investment of about $10 billion. Considerable gains have been realized by corporations having Bitcoin on their balance sheets. As per the document provided by Bitcoin Treasuries on May 12, the worth of MicroStrategy’s Bitcon reserves have increased by 2.30 times. Likewise, the worth of Square’s Bitcoin holdings has risen by 9x. Against the backdrop of crypto market price correction, the notional profit has gone down a bit.

Institutions have accumulated 215,000 #bitcoin in the past 30 days.

— Bitcoin Magazine (@BitcoinMagazine) May 15, 2021

For the past year, institutions have been pouring money into Bitcoin. One of the principal factors for BTC’s rise from $10,000 in the summer of 2020 to a peak of about $64,000 in April is because of these so-called smart money investors.