Since May, as more coins were transferred throughout the network during the bull cycle, the on-chain settlement performance has been continuously rising. Dylan LeClair, an on-chain analyst, made the finding based on data from analytics vendor Glassnode. The value is calculated by dividing the mean volume of transactions by the fees.

Final settlement expenses were barely 0.00105 percent of the $451.3 billion in aggregate value delivered. Bitcoin is ranked seventh in the list of networks by daily transaction costs on CryptoFees. Its seven-day average is approximately $678,000, putting it in second place after Ethereum, Uniswap, Binance Smart Chain, SushiSwap, Aave, and Compound.

According to the fee monitoring website, Ethereum is already collecting $53 million in daily fees, which is 98.7 percent higher than the Bitcoin network. Bitcoin and Ethereum should not be compared in terms of value settlement and fees since they are two distinct entities — the former is a store of value and the latter is a decentralized application network and smart contract platform.

When the average transaction volume of Ethereum is split by the costs, the value transferred per dollar in fees is only $139. The Ethereum network’s settlement performance has decreased as the network’s value has increased and a far larger demand has been placed on it, most notably with the emergence of DeFi and NFTs over the last 18 months.

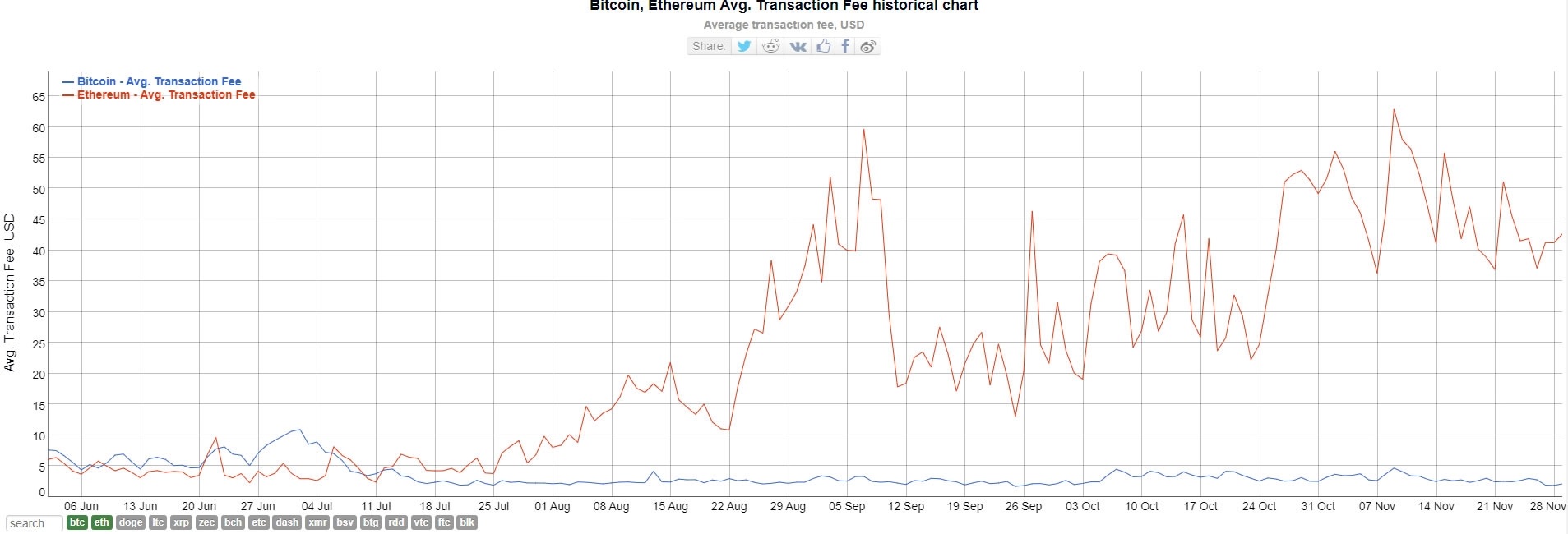

The average transaction cost on the Bitcoin network is now approximately $2.13, as per Bitinforcharts. In comparison, the average charge on the Ethereum network is a stunning $42.58. This year, Bitcoin transaction costs have decreased by more over 50%.

Over the last seven days the #Bitcoin Network transferred an average $95,142 of value for every $1 worth of fees.

The median transaction saw $751 of value transferred for every $1 worth of fees.#Bitcoin is the most efficient monetary settlement network the world has ever seen. pic.twitter.com/DzSwxCDKkd

— Dylan LeClair 🟠 (@DylanLeClair_) November 29, 2021

Since the end of July, the difference in average transaction costs between the two networks has been expanding. Ethereum’s network cost issues may be resolved by using layer two networks, which have exploded in popularity over the last few months, reaching a near-all-time high total value locked of $6.87 billion, according L2beat.