Bitcoin (BTC) recorded a fresh all-time peak of $48,985 yesterday, before undergoing a slight price correction to $46,000 level. At the time of writing this article, Bitcoin was trading at $47,673, reflecting a loss of 0.5% from prior close.

Bitcoin (BTC) recorded a fresh all-time peak of $48,985 yesterday, before undergoing a slight price correction to $46,000 level. At the time of writing this article, Bitcoin was trading at $47,673, reflecting a loss of 0.5% from prior close.

A fast study of the Bitcoin price chart (H4 time frame) indicates that the numero uno crypto is currently consolidating, with underlying bullish bias through the formation of a series of higher lows and higher highs.

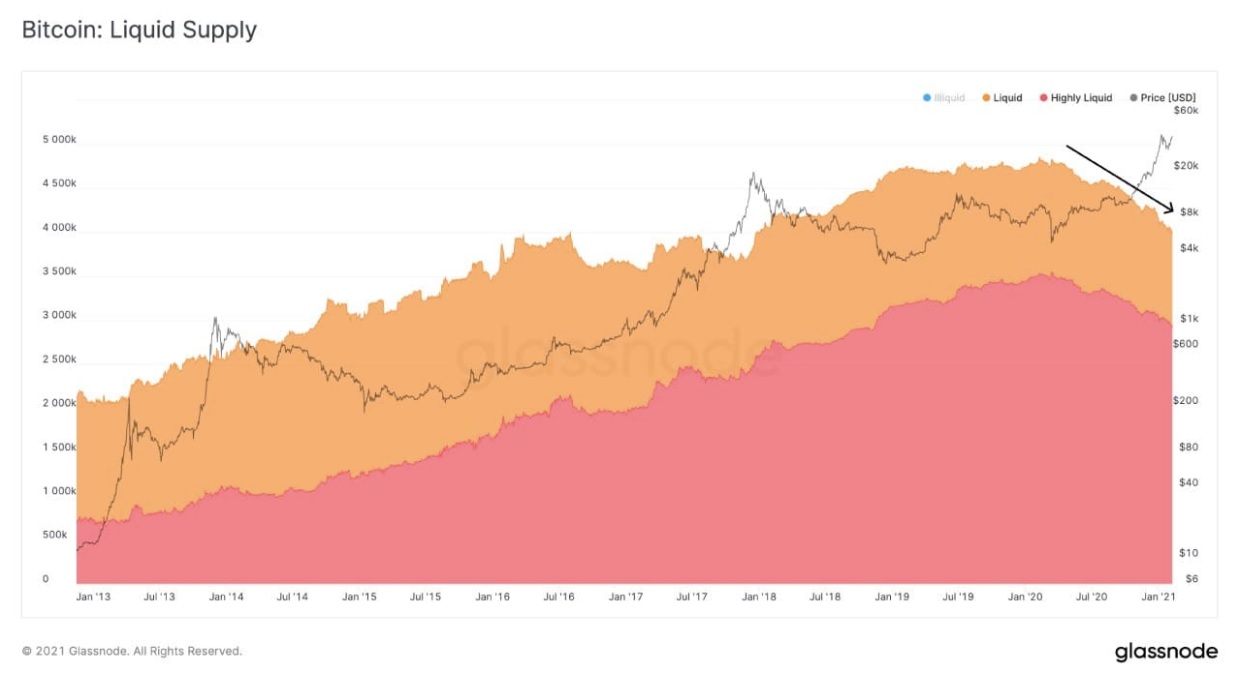

If BTC can sustain its prevailing price trajectory, it could easily reach up to $50,000 before the start of next week. A Decentrader analyst report reveals that while Bitcoin’s floating supply has been on a decline, interest in Bitcoin has been growing as the amount of Bitcoin that has not made it to on-chain for a prolonged frame of time has also increased.

The chart provided herewith clearly shows that floating supply of Bitcoin is currently about four million coins and the count are slowly declining since June 2020 as whales and institutional investors boost their investments in this budding asset class. Additional record of growth of large investors can be seen by studying at the sharp rise in wallets possessing over 1000 Bitcoin.

While the count of wallets holding large amount of Bitcoins has been on the increase, the number of wallets holding small quantities of Bitcoin has remained almost unchanged, signaling that “larger players are scooping up bitcoin off smaller players.” Further positive news for the crypto industry has come in the form of PayPal intending to start offering crypto related services to the UK residents.

Notably, for the foremost time, users, barring those living in the US, will be able to invest in crypto via the PayPal and Venmo platforms by the end of second-quarter. In an attempt to match the facilities provided by Cash App and PayPal, Apple Pay has rolled out a fresh collaboration with BitPay that will permit users of Apple Wallet to utilize their BitPay card to commence purchases.

There is also a news that Grayscale Investments may introduce new products that will give exposure to decentralized finance as a freshly filed corporate enrollment in the State of Delaware indicates that the asset manager is looking at Yearn Finance as a likely upcoming offering.

Conventional markets saw some selling pressure Friday, following the February 11 media release that federal regulators have begun scrutinizing Reddit and Robinhood for hints of market rigging linked to the latest volatility in stocks such as AMC and GameStop.

After opening in red, all three top indices rebounded to end the day in positive territory, with the S&P 500 and Nasdaq recording gains of 0.47% and 0.5%, respectively. The Dow also ended with a small gain of 0.09%.

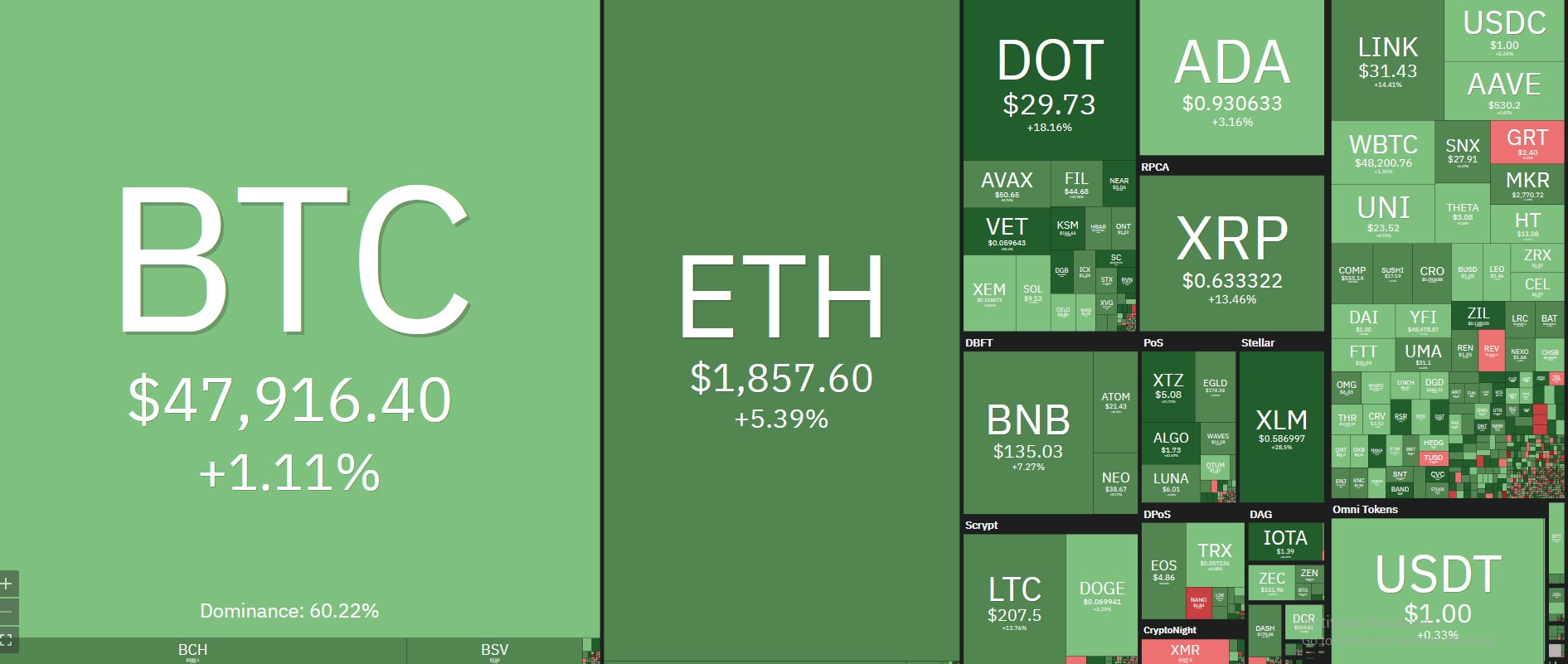

The broader crypto market continued to march ahead as several ventures recorded over 10% gains and fresh all-time highs. Ether (ETH) also recorded fresh all-time high of $1,863, while Polkadot (DOT) remained as one of the best performing altcoins, rallying 21% in a day to reach $29.52.

Other prominent gainers are proof-of-stake covenant Algorand (ALGO), which rose by 38% to record 2021 high of $1.84, and Tezos (XTZ), which recorded price rally of over 23% to post record high of $5.41. The aggregate crypto market cap currently stands at $1.48 trillion and Bitcoin’s dominance rate remains at 60.4%.