In the past three days, Bitcoin (BTC) transaction charges have almost tripled to $10.20, from $3.52 (on average). As per Glassnode, which runs cryptocurrency market aggregation service, of the revenue earned by Bitcoin miners, 22.25% is derived from transaction fees, while the rest 77.75% is generated through block rewards.

In the past three days, Bitcoin (BTC) transaction charges have almost tripled to $10.20, from $3.52 (on average). As per Glassnode, which runs cryptocurrency market aggregation service, of the revenue earned by Bitcoin miners, 22.25% is derived from transaction fees, while the rest 77.75% is generated through block rewards.

The percentage of revenue earned in the form of fees has hit the highest level since the peak attained in January 2018, when the percentage of fees accounted for 45% of miners revenue.

The recent surge follows an increase in average daily Bitcoin fees in recent times. Barring the time span between November 2017 and January 2018, the average daily Bitcoin fees were in double digits (in US dollars).

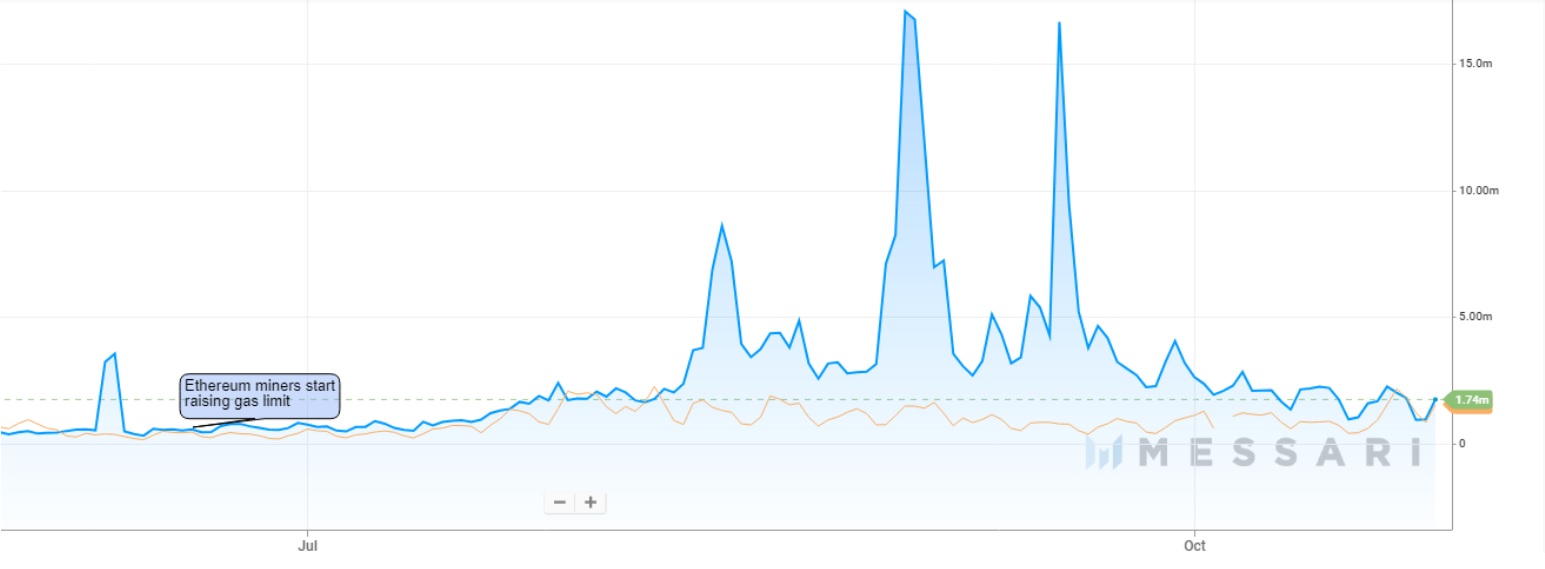

In spite of the tripling of mining revenue in the last month, Bitcoin and Ethereum miners continue to rake in huge fees. Ether (ETH) fees in recent times eclipsed that of Bitcoin in the longest series ever, due to the use of stablecoin and the exponential growth of decentralized finance (DeFi) sector established on the Ethereum network.

Barring two exclusions at the end of July and the beginning of August, revenue generated in the form of fees from the Ethereum networks was higher than that of Bitcoin until October 22, after the scenario began in June 6.

The percentage of #Bitcoin miner revenue from fees increased to 22.25% in the past hour (24h MA).

It is the highest observed value since January 2018.

Live chart: https://t.co/hcl2opVV0B pic.twitter.com/0gTFWcbVed

— glassnode (@glassnode) October 27, 2020

Even though Bitcoin regained its dominance with respect to fees last week, it did not last long. Ethereum’s fees overshadowed that of Bitcoin on October 25. At the time of writing this article, Ethereum fees aggregated $1.74 million in the last 24 hours, compared to $1.54 million of Bitcoin’s, as per Messari.

Of late, with a larger interest of slashing miner fees, there has been a rise in discussion about Vitalik Buterin’s Ethereum Improvement Proposal (EIP)-1559. In spite of surveys reflecting backing from community for the plan, miners are aggressively opposing the plan due to the anticipated negative impact on their revenues.