Bitcoin (BTC) has rebounded after plunging all the way below $32,000 last week and is presently trying to make a swift recovery. BTC is currently trading 1.75% higher at $34,297, reflecting a market capitalization of $644 billion.

Bitcoin (BTC) has rebounded after plunging all the way below $32,000 last week and is presently trying to make a swift recovery. BTC is currently trading 1.75% higher at $34,297, reflecting a market capitalization of $644 billion.

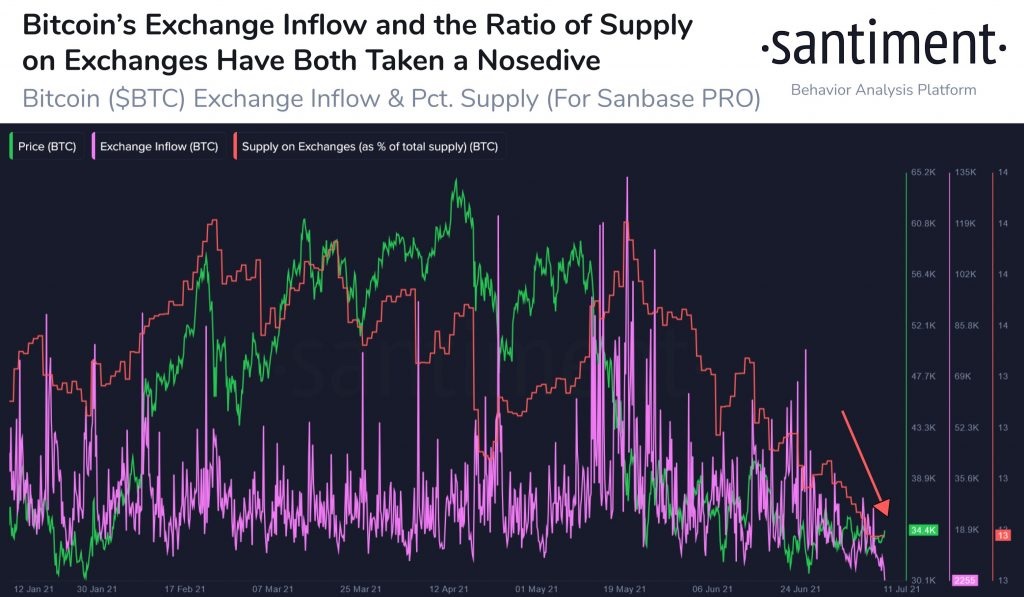

Despite the fact that Bitcoin continues to encounter stiff selling pressure at $35,000, some on-chain indicators have recently improved significantly. BTC inflows to exchange based wallets have decreased, indicating a reduction in sell-side pressure. Santiment, an on-chain monitoring firm, has reported as follows:

“The quantity #Bitcoin inflow to recognized exchange wallets, and also the overall quantity of $BTC on exchanges, have both dropped sharply during the past 50 days, possibly indicating lessening sell-side pressure.”

This decrease in Bitcoin exchange inflow suggests that there are lesser coins currently offered for sale on the exchanges. Simultaneously, data from Glassnode indicates that the BTC hash rate is recovering rapidly.

The Bitcoin hash rate has rebounded over 33% after reaching a low of below 75 exahashes on June 28.The drop in June coincided with China’s authorities launching a full-scale crackdown on domestic crypto miners. As a consequence, a huge number of miners have closed down their facilities and switched off their mining equipment.

Bitcoin hashrate is rebounding.

The network is regenerating as it should. pic.twitter.com/5Q4HIVbMSV

— Lex Moskovski (@mskvsk) July 11, 2021

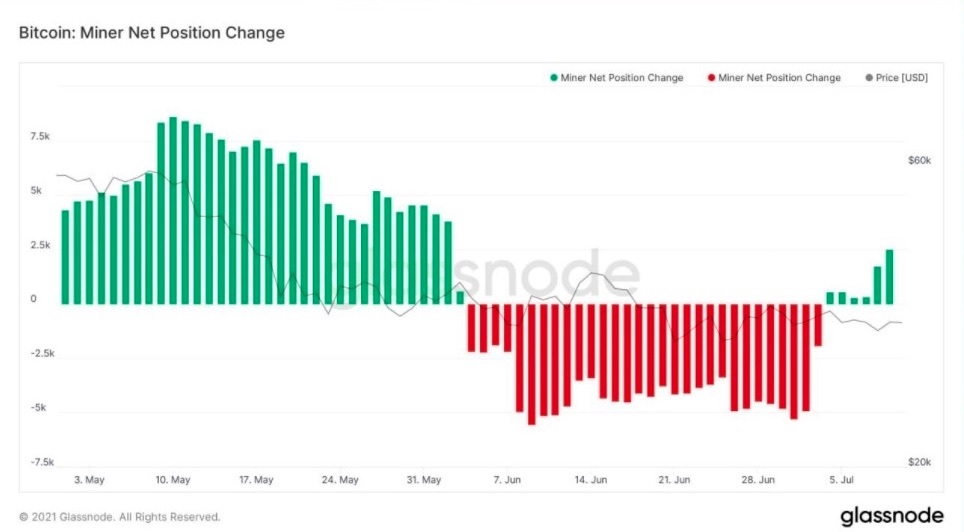

The majority of the miners have begun to relocate their activities to other western nations, particularly the European Union and North America. As an outcome, the Bitcoin hashrate dropped sharply. The good news is that the Bitcoin hashrate has begun to rebound once more. Miners have resumed acquiring Bitcoins in tandem with the revival of the cryptocurrency’s hashrate.

As a consequence, crypto miners’ wallet holdings have begun to rise once more. The Bitcoin net miner situation has improved steadily again in July, according to Glassnode statistics.

Current trend indicates that miners have resumed their stockpiles and are hesitant to liquidate at this price. All through month of June, the mining situation suffered setbacks and stood in the red. These on-chain measures are improving, indicating that hopeful investors are returning to the game. The bullish trend in on-chain data suggests that Bitcoin can restart its upward trajectory at any point.

The issue is if BTC can successfully break through the $35,000 barrier. Last week, Craig Johnson, chief market technician at Piper Sandler, told CNBC that Bitcoin may go through a protracted period of stability before resuming its upward trend.

He continued,

“Bitcoin has already corrected by around 45%. When you look back at the previous two crypto cycles, they lasted around 1,000 days each. You’ll need to ready to hunker down and wait for things to stabilize for a while longer until launching the very next big leap.”