Data provided by CoinGecko indicated that Bitcoin hit $45,000 on Bitstamp. At the time of writing this article, Bitcoin was trading at $46,555, reflecting a loss of 12.20% in the past 24 hours.

The decline nullified a reversal that stopped Monday’s 20% price correction from all-time peak of about $58,000. Bitcoin rebounded from $47,400 to hit $54,000 before a new decline took control.

At the time of writing this article, Bitcoin is struggling to come back above $47,000, which has been acting as a minor support for a short while. The trend is now unclear against the backdrop of huge volatility.

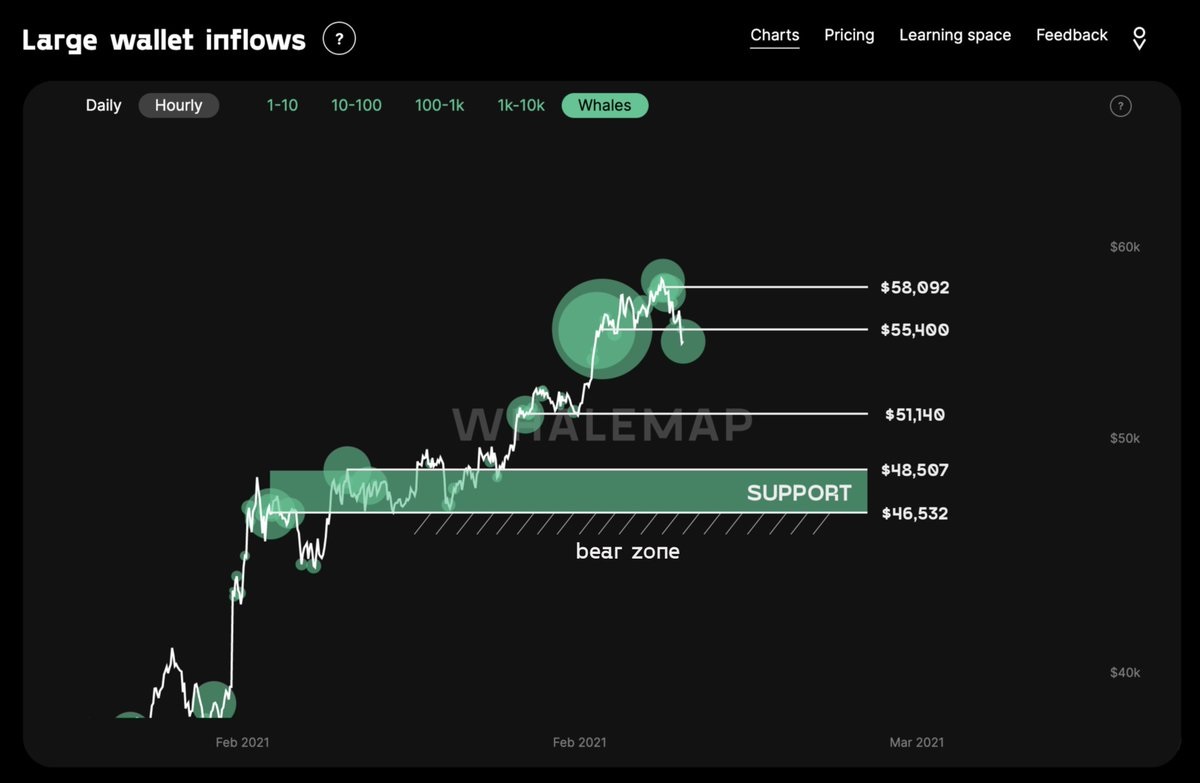

A study of buy and sell positions provided little confidence about the likelihood of recapturing the lost ground as credible support lacks below $46,500.

Analysts, nevertheless, are not concerned even about deeper decline as they consider it as a healthy correction. In comparison to earlier price declines, the current price correction is a miniscule.

Michaël van de Poppe, analyst at Cointelegraph Markets, pointed to his Twitter followers that the crypto community has seen the worst in 2018 & 2019.

Through an YouTube update, he predicts that Bitcoin will reveal its classic characteristic of deep decline of about 80% from peak, in case bears take charge.

Approaching bounce region for #Bitcoin.

I think we’re close now.

Resistance zone at $48,500 and $51,000. pic.twitter.com/ctsLwLpVFD

— Michaël van de Poppe (@CryptoMichNL) February 23, 2021

Theories detailing the decline vary from profit booking by large investors (‘whales’) to regular market cycles.