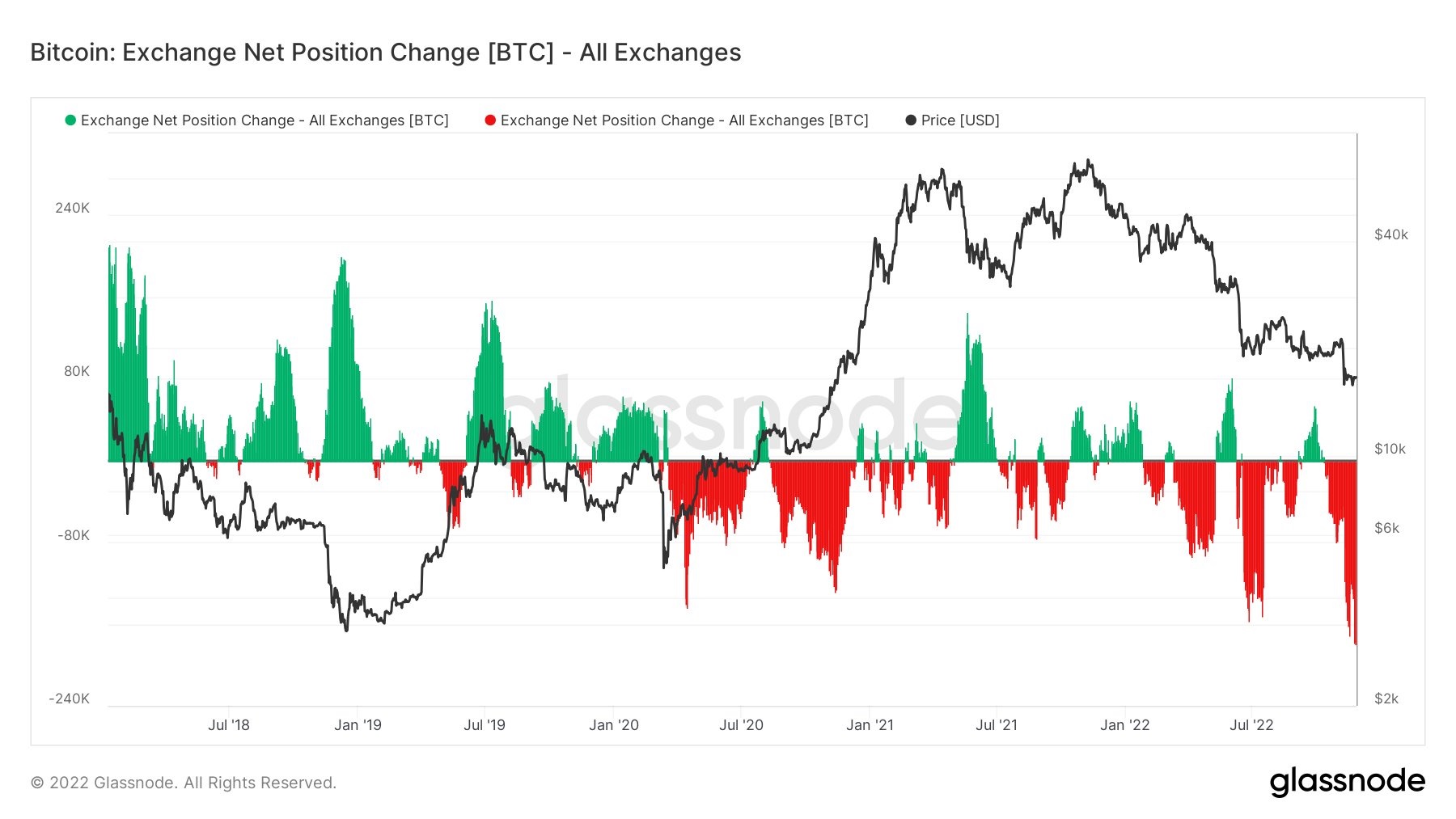

Prominent data analytics company Glassnode reports that cryptocurrency exchanges are seeing a major outflow of Bitcoin as BTC owners choose to self-store their currencies. As per Glassnode’s Bitcoin exchange net position variation statistic, which analyzes the 30-day supply stored in crypto exchange wallets, 179,250 BTC valued at nearly $2.8 billion left centralized cryptocurrency exchanges in October.

Prominent data analytics company Glassnode reports that cryptocurrency exchanges are seeing a major outflow of Bitcoin as BTC owners choose to self-store their currencies. As per Glassnode’s Bitcoin exchange net position variation statistic, which analyzes the 30-day supply stored in crypto exchange wallets, 179,250 BTC valued at nearly $2.8 billion left centralized cryptocurrency exchanges in October.

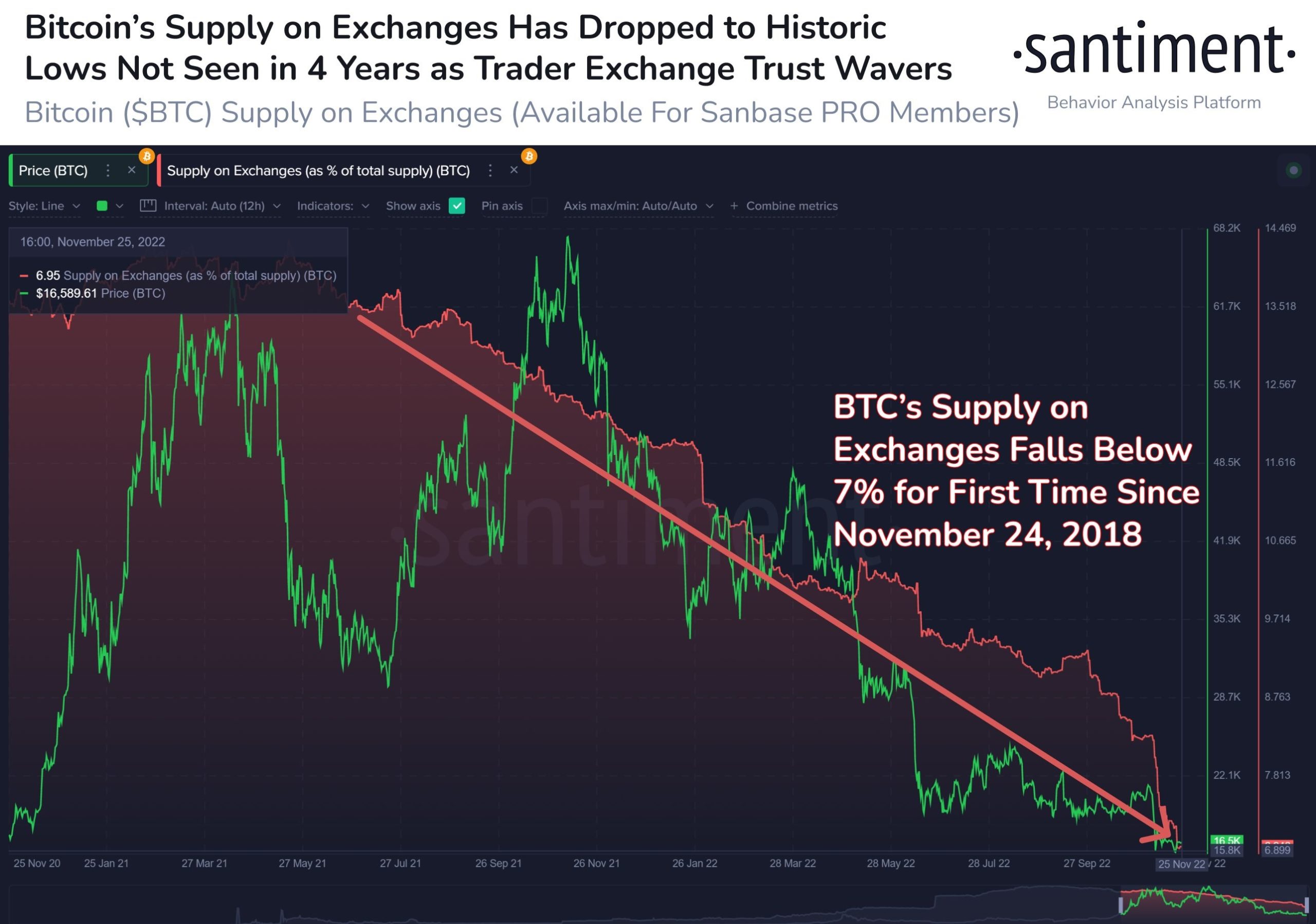

According to the graph provided by Glassnode, the prevailing pace of BTC fleeing cryptocurrency exchanges venues is the biggest it has been in more than four years. The analytics company Santiment also closely monitors the Bitcoin availability on cryptocurrency exchanges. For the initial time since November 24, 2018, BTC availability on cryptocurrency exchanges has gone under 7%, as per Santiment.

“As per Santimentfeed statistics, just 6.95 percent of Bitcoin is on cryptocurrency exchanges. Since Black Thursday, there has been a steady change of BTC migrating towards self custody (Mar 2020). But the FTX collapse has expedited this tendency.”

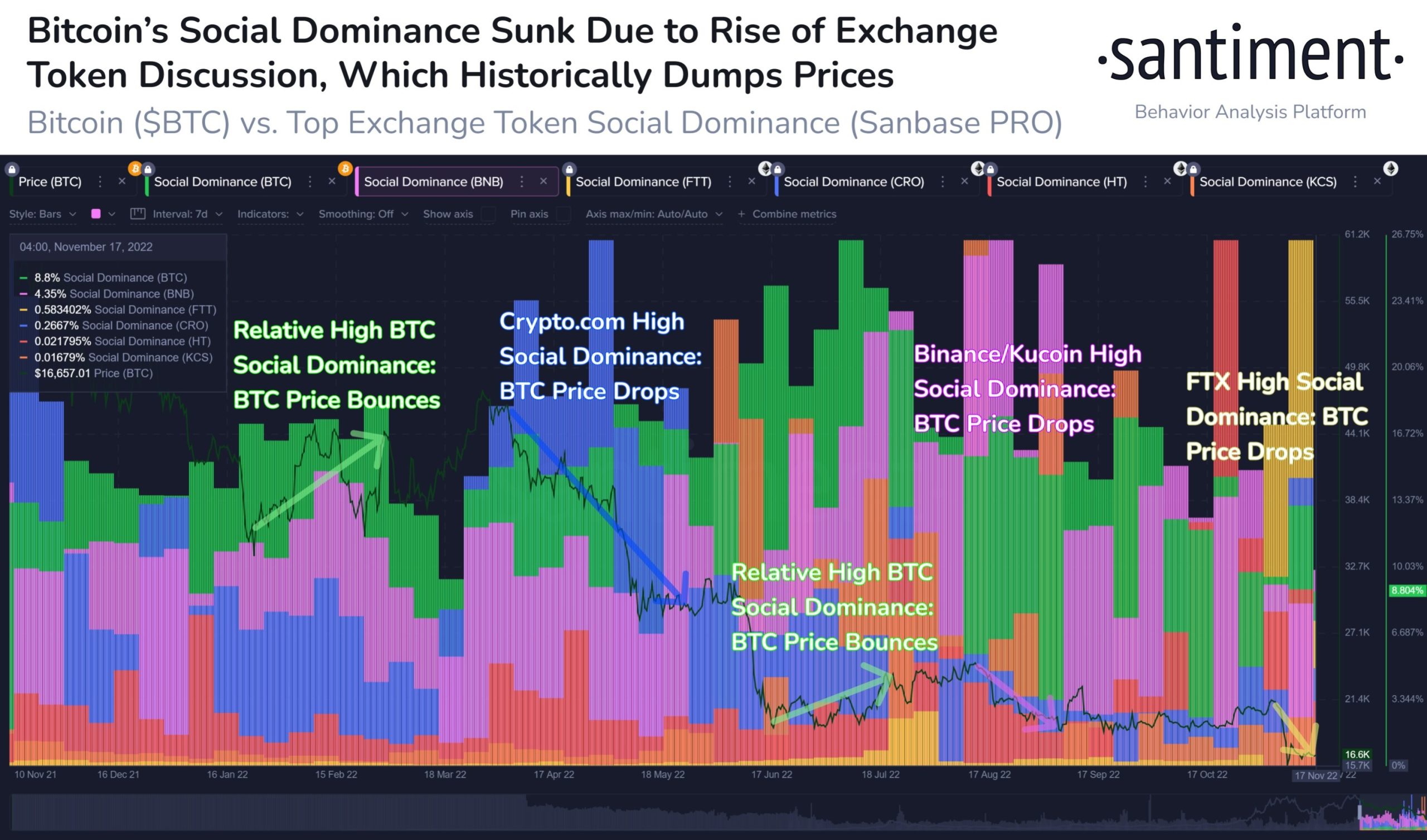

Santiment stated earlier in November that cryptocurrencies have a pattern of rebounding when market players move their attention away from cryptocurrency exchanges.

“In essence, cryptocurrencies flourish when cryptocurrency exchanges are not the primary focus. The most devastating exchange crash in history will generate long-lasting shudders. As evidenced, the secret to a reversal is probably to be a shift in attention away from crypto exchange tokens and towards Bitcoin.”

Sam Bankman-FTX Fried’s filed for insolvency on November 11 after allegations that the cryptocurrency exchange mismanaged client payments. Several investors withdrew their crypto assets from centralized cryptocurrency platforms in response to the shocking revelation.