Data provided by Arcane Research indicates that Bakkt Bitcoin exchange has created new record in terms of trading volumes between September 20 and October 20. The rise in volume follows a perceptible increase in institutional need for Bitcoin (BTC) from public enterprises in recent times.

Data provided by Arcane Research indicates that Bakkt Bitcoin exchange has created new record in terms of trading volumes between September 20 and October 20. The rise in volume follows a perceptible increase in institutional need for Bitcoin (BTC) from public enterprises in recent times.

Bakkt, the digital currency payment platform and derivatives exchange, is customized for investing in cryptocurrencies by the US based institutional investors. It is managed by Intercontinental Exchange, the holding company of the New York Stock Exchange.

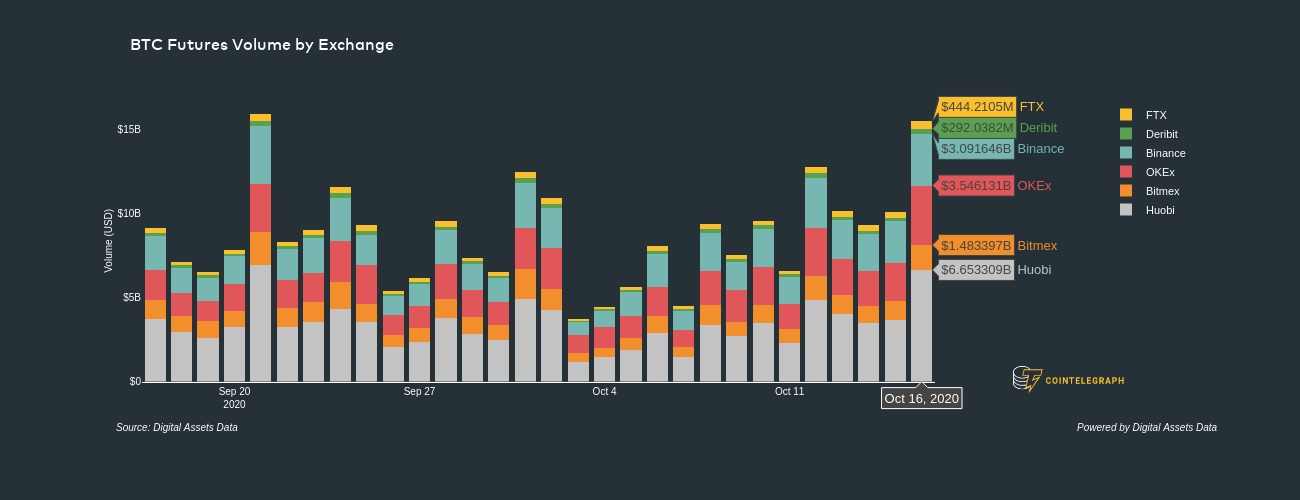

When there is a rise in the trading volume in Bakkt’s Bitcoin futures market, which facilitates physical settlement of Bitcoin contracts, it usually illustrates an increase in institutional demand for cryptocurrencies. As shown below, Digital Assets Data mirrors a considerable jump in futures volumes in several exchanges in October.

?Another ATH #BTC delivery on @Bakkt this month?

Over 400 BTC futures contracts were held to expiry in October, an increase of 14% from September.

With another record-breaking month on Bakkt, the demand for bitcoin is increasing among institutional investors. pic.twitter.com/Ejz5aWhc93

— Arcane Research (@ArcaneResearch) October 16, 2020

As per Arcane Research analysts, 400 Bitcoin contracts will be expiring in October at Bakkt exchange. On m-o-m basis, the data indicates a 14% surge from September.

Bakkt’s volume and open interest are crucial in measuring institutional activity as it is one of the three broadly utilized platforms by institutions along with LMAX Digital and CME.

Arcane Research pointed out that the considerable rise in futures contract deliveries on Bakkt signals an increase in institutional demand. The researchers pointed out:

“Another ATH BTC delivery on Bakkt this month. Over 400 BTC futures contracts were held to expiry in October, an increase of 14% from September. With another record-breaking month on Bakkt, the demand for bitcoin is increasing among institutional investors.”

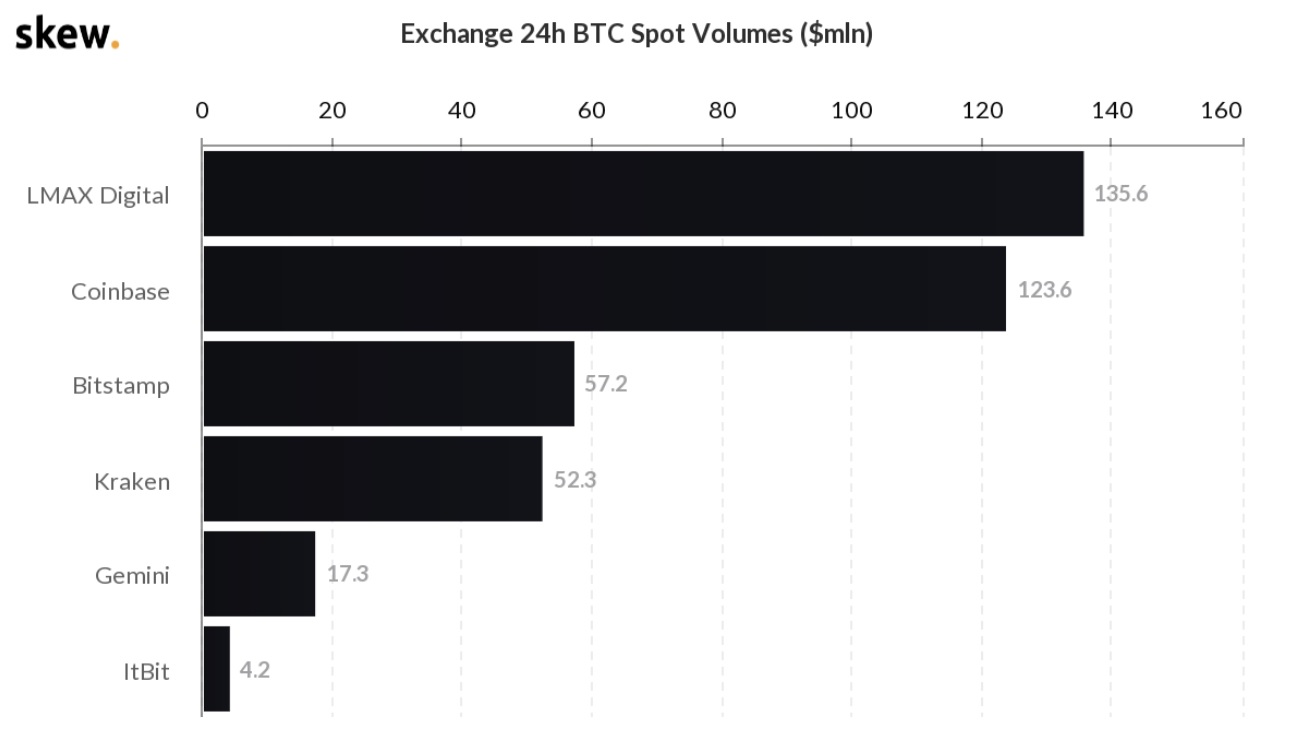

In addition to huge trading volumes recorded by Bakkt, LMAX Digital and CME are also recording a surge in demand on an ongoing basis. Data provided by Skew indicates that LMAX Digital stays as the top spot exchange in the crypto domain in terms of volume.

As per Skew, LMAX Digital executed $135.60 million worth BTC in the past 24 hours. This surpassed the daily transaction volume of Coinbase, Kraken, and other top retail-centered exchanges.

As LMAX Digital mainly aids institutional trades, the exchange eclipsing Coinbase in terms of trading volume portrays the prevailing institutional landscape of Bitcoin.

There is robust demand arising from institutions, in the aftermath of investments from companies of high repute such as MicroStrategy and Square.

Just like Bakkt, the CME Bitcoin futures market has also recorded a rise in open interest. From the beginning of October 2, following the September contract expiry, open interest of Bitcoin futures increased from $345 million to $561 million.

Industry professionals and large volume players in the crypto market anticipate a continuation of the trend of increasing institutional demand for Bitcoin.

Bitcoin investor and billionaire Tyler Winklevoss, co-founder of Gemini, stated that Bitcoin is slowly transforming into a treasury asset of corporates. When MicroStrategy stated that it bought $425 million worth Bitcoin, the company stressed that it regards Bitcoin as the company’s main treasury asset. Winklevoss opined:

“Bitcoin is on its way to becoming a corporate treasury asset. Michael Saylor and Jack are leading the charge. Soon many other companies will follow, and eventually central banks. This is just the beginning.”