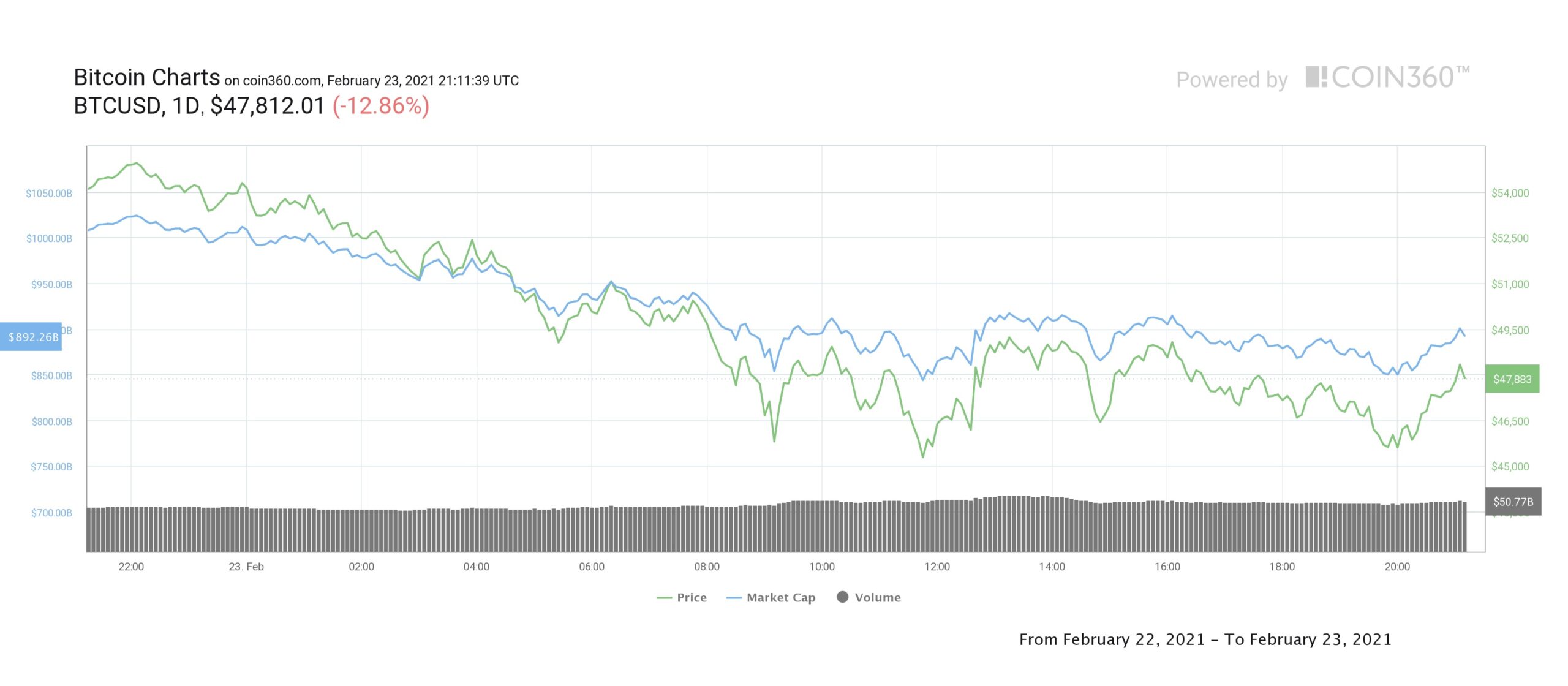

Bitcoin (BTC) got smashed by another round of sell off in the crypto market on February 23. After declining to below $45,000 Bitcoin has regained only a portion of the lost ground.

Bitcoin (BTC) got smashed by another round of sell off in the crypto market on February 23. After declining to below $45,000 Bitcoin has regained only a portion of the lost ground.

At the time of writing this article, Bitcoin was trading at $50,768, reflecting a gain of about 0.75% in the last 24 hours. Notably, Bitcoin needs to stay above the psychological level of $50,000 for continuation of the recent uptrend.

Currently, most altcoins and DeFi based crypto tokens are trading at heavy losses, with decline of more than 90% of their valuation in the last 48 hours. Meanwhile, Bitcoin has shed nearly $10,000 in value over the last two days.

However, analysts believe that experienced professional traders are eyeing to buy the decline and have thus raised their respective long positions which are usually leveraged.

While the recent market crash has slightly marred a few other advancements in the cryptocurrency landscape such as stories of Bitfinex and Tether settling their lawsuit slapped by the New York Attorney General’s Office and decided to pay $18.5 million in fines to the state of New York. The two parties accepted to regularly submit reports related to their reserves.

Attraction towards the initial Bitcoin based exchange-traded fund in North America has grown steadily since the Purpose Bitcoin ETF has risen into a $564 million fund in a matter of five trading days demonstrates that investors want to find and profit from this growing technology.

The filing also shows that 2,251 BTC has been assigned to the fund on February 23rd. Despite the mayhem the market has witnessed over the past few weeks, many crypto traders and professional investors regard the recent downturn as an appropriate remedial event that enable overbought cryptos to retest crucial support levels.

As cited by crypto enthusiast, who uses Twitter handle “Bitcoin Archive,” price declines of these kinds are natural and regular occurrence during the sharp rally in 2017. At that time the market recorded “9 dips between 20–40%”. In spite of these frequent sharp price corrections, the market still rallied by “20 times from its earlier all-time peak.

To sum up, Bitcoin Archive explained the link it has with the current scenario and the trend of Bitcoin:

*CORRECTIONS ARE NORMAL*

The last BullMarket had:

– 9 dips between 20-40%

– GAINS: $1k to $20k in 2017

– That’s 20x the previous ATHWe are now sitting on 2.35x the previous cycle ATH OF 20k

*WE ARE JUST GETTING STARTED*#HODL #BTC #Bitcoin pic.twitter.com/ucxT4VWMEv

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) February 23, 2021

Even traditional marked were not spared yesterday, but managed to reverse into green soon after the US Fed Chair Jerome Powell reconfirmed that the central bank will keep the prevailing loose monetary policies unaltered, implying that the benchmark rates will be maintained near zero and continuation of asset purchases at $120 billion per month.

At the end of the trading day, Nasdaq was down 0.50%. However, the S&P 500 and Dow Jones Industrial Average had gained 0.13% and 0.50%, respectively. Bitcoin’s decline of $13,000 in the last 48 hours has also dragged the altcoin market downwards. Almost all the top notch decentralized finance (DeFi) tokens were hit hard.

Interestingly, Crypto.com Coin (CRO) recorded a 33% retracement. However, Venus (XVS) DeFi covenant, hosted on Binance Chain, recorded price decline of 24% to trade at $58.63.

A handful of ventures were able to defy the downtrend and ended with gains on February 23. The uptrend was aided by announcements related to blockchain interoperability-related ventures that boosted crypto tokens centered on layer-two and cross-chain dealings.

Solana (SOL) gained 11.23% to hit $14.94 following the roll out of its automated market maker covenant Raydium. The price of Fantom (FTM) token also gained 24% after the core team revealed partnership with Yearn.finance and the introduction of a cross-chain bridge focused on Ethereum network. The total cryptocurrency market cap currently stands at $1.44 trillion, with Bitcoin’s dominance rate hovering around 62%.