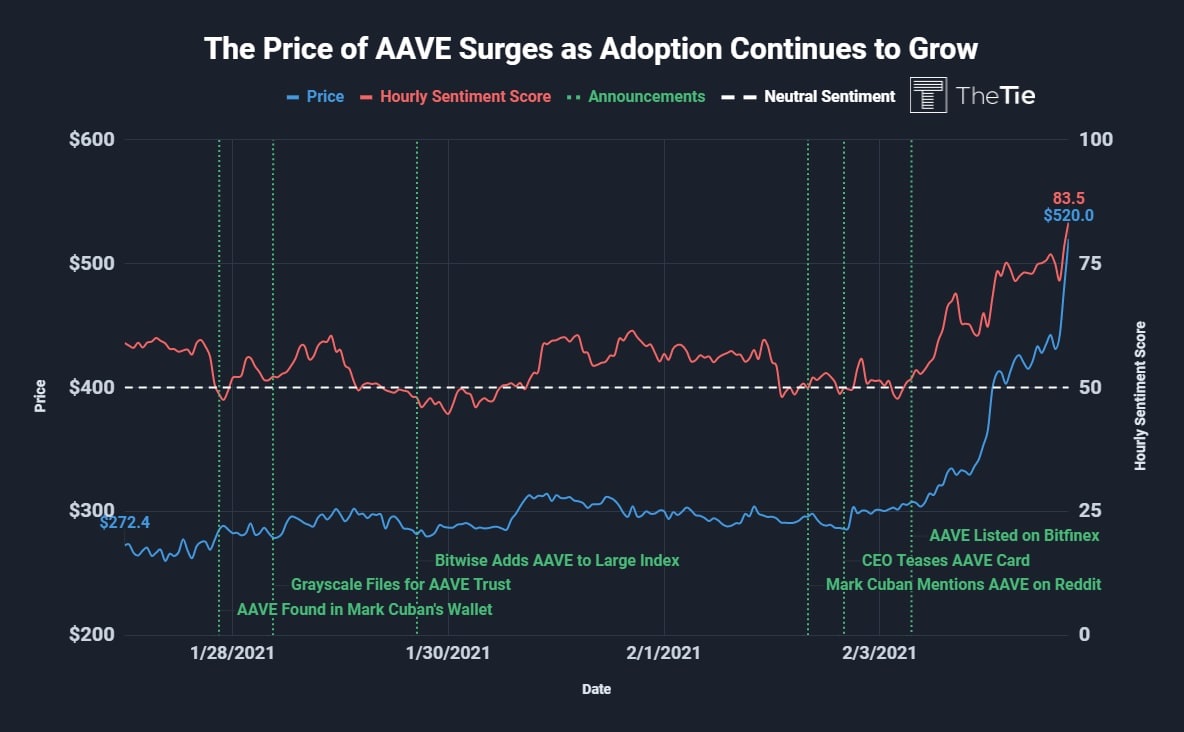

The price of Aave (AAVE) token has ralled by 76% since the start of February and earlier today the DeFi token recorded a fresh all-time peak of $520.

The price of Aave (AAVE) token has ralled by 76% since the start of February and earlier today the DeFi token recorded a fresh all-time peak of $520.

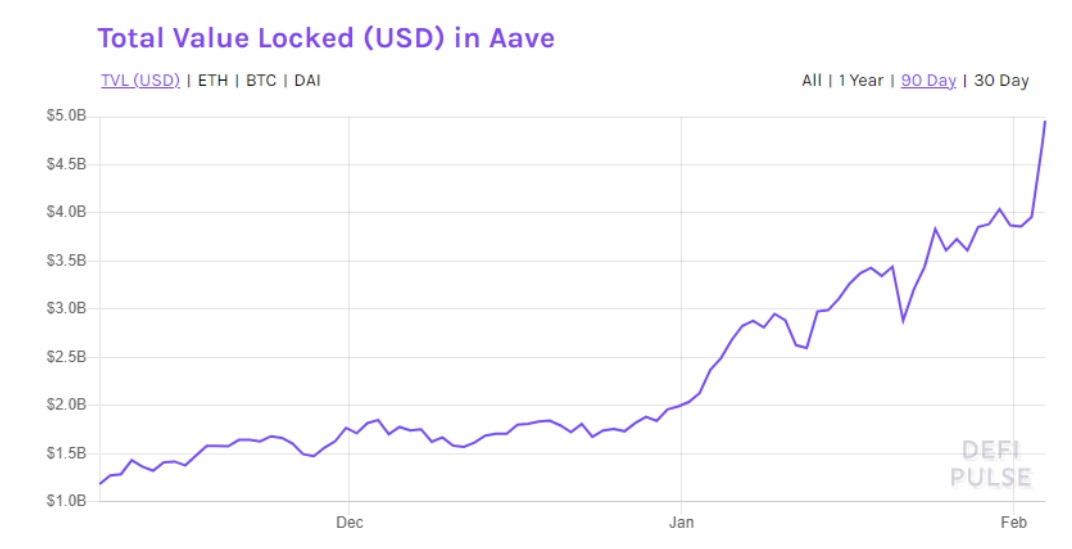

Presently, Aave is the second-ranked DeFi platform in terms of total value locked (TVL) and the covenant will see an increase in users and excel its competitors.

Data provided by TradingView indicates that AAVE token rallied from $284 on February 1 to the current level of $510 as its daily trading volume hit $2.40 billion.

The recent rally began on January 28 when the core team unveiled Aave V2 migration tool which facilitates users to effortlessly shift their account details, including borrowed positions and staked tokens, to the amended covenant.

From then onwards, key measures for the DeFi platform have consistently risen, including the total value locked (TVL) on the covenant, which established a fresh all-time peak of $4.957 billion on February 3.

This transformed AACE into second ranked covenant by TVL and presently only Maker (MKR) has a greater TVL.

The price of AAVE token skyrocketed on the first day of February after the core team issued the following tweet:

Today is the last day to vote on the AIP to add $BAL on Aave V2 ✨ @BalancerLabs $AAVE and $stkAAVE holders head on over to vote here: https://t.co/qIxMqofbHq

— Aave (@AaveAave) February 1, 2021

On February 2, the suggestion was endorsed by the community and Balancer (BAL) was included as collateral. Soon thereafter, the price of AAVE token surged from $284 to $300. As in the case of Bitcoin (BTC), large investors have played a crucial role in pushing AAVE token’s price to $520.

As per Treyce Dahlem, an academic at TheTIE, the latest 90% jump in the price of cryptocurrency token AAVE in the last week was assisted mainly by large market participants and institutions who are increasingly showing enthusiasm towards DeFi.

Dahlem stated:

“Billionaire Mark Cuban recently spoke about the “unlimited upside” of DeFi and according to a snapshot of his on-chain portfolio, he is an AAVE whale holding more than $150,000 worth of the token. Grayscale recently filed more than a dozen altcoin trusts with Delaware’s corporate registry, one of those altcoins being AAVE. Additionally, Bitwise added AAVE to their Bitwise 10 Large Cap Crypto Index. These announcements have caused investor sentiment to reach a new YTD high of 83.5 (very high).”

The huge range of services offered by decentralized finance enables the sector to grow in an exponential manner. The possibility of generating returns via lending and staking tokens is attractive to several investors.

A huge chunk of traders are also drawn by the hassle-free way of borrowing against their cryptocurrency holdings and partake in advancement of the protocol via governance suggestions.

AAVE v2 come out with an admirable DeFi solution and moves ahead by integrating other covenants in the DeFi domain and this has paved way for the latest rally of AAVE token.