The price of DeFi token Aave (AAVE) has been running for several weeks, with the price hitting an all-time peak of $288.90 area today. Being one of the most popular decentralized finance Covenant, the overall rally in the DeFi industry has fuelled the uptrend of AAVE crypto token.

The price of DeFi token Aave (AAVE) has been running for several weeks, with the price hitting an all-time peak of $288.90 area today. Being one of the most popular decentralized finance Covenant, the overall rally in the DeFi industry has fuelled the uptrend of AAVE crypto token.

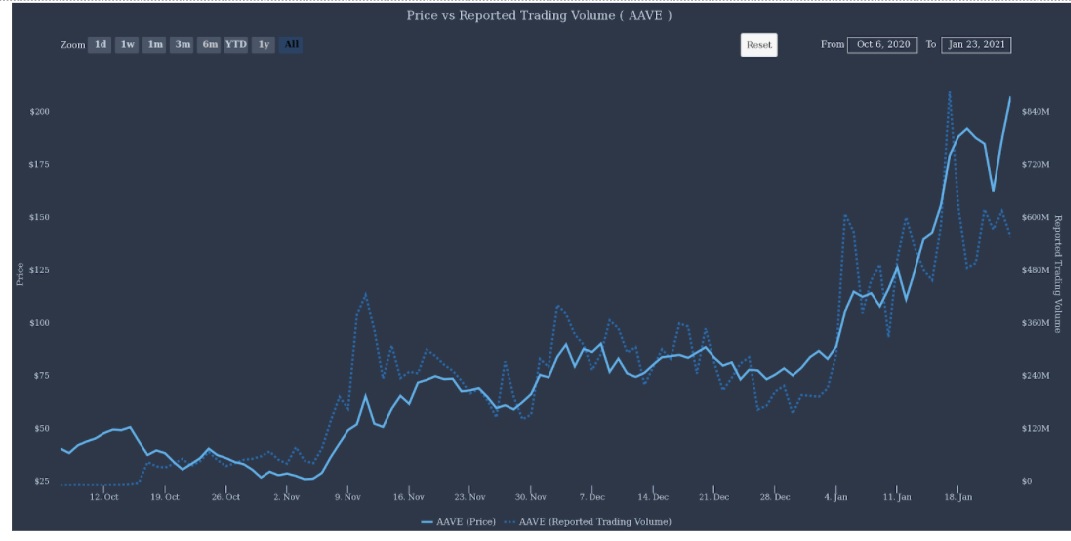

At the beginning of this year, the AAVE crypto token was being traded at $83 on cryptocurrency exchanges and the latest uptrend seems to have considerably increased the covenants total value locked (TVL), boosting transaction volumes on both spot and derivative exchanges.

The unhindered up-gradation of AAVE’s learning platform and ability to provide flash loans where are also reasons for the sharp increase in the price of AAVE token.

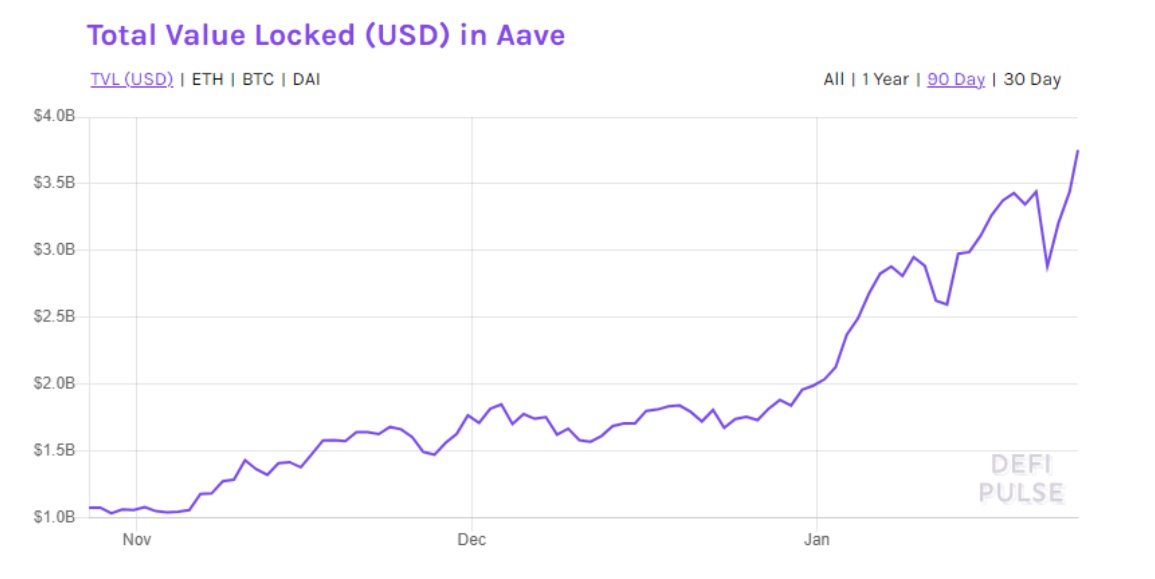

Data provided by DeFi Pulse indicates that AAVE’stotal value locked (TVL) increased from 2.03 billion on the first day of this year. As the price of Bitcoin (BTC) and Ether(ETH) rose sharply the total value locked (TVL) of AAVE token also increased steeply.

At the time of writing this article, the total value locked (TVL) of AAVE token had hit a fresh all-time peak of $3.75 billion, transforming it into the second-largest behind DeFi platform in terms of total value locked (TVL) Maker (MKR).

The Systematic inclusion of Prash tokens to the borrowing and lending Covenant increases the possibility of a further rise in the value of AAVE token’s TVL and enable AAVE token to maintain its position as the leading DeFi ventures in the cryptocurrency domain. The trading volume of AAVE token also increased at the beginning of this year, rising from $200 million on January 3rd to $928 million on January 16th.

The 24-hour trading volume of AAVE token attained a new record of $1.06 billion as the price of AAVE surged higher. The rise in volume was partly led by investors purchasing additional tokens for staking. Currently, 26.8% of the overall supply of AAVE tokens has been taken on the platform offering an APY of 6.1%. The availability of flash loans another reason for the sharp rise in the price of AAVE’s token.

Flash loans permit cryptocurrencies to be used as collaterals and utilize the funds for purchasing cryptos or anything else. The loans enable investors to make the best use of the token value without a need to sell them and become liable for taxation. From the time of rolling out flash loans a year before, over $1.7 billion have been released so far and there is an expectation that the figure will rise as Crypto rally advances.

As shown in the image below, the most dominant token demanded for cash loans is the DAI stablecoins, closely followed by USDC and ETH. Data provided by Messari indicates that AAVE disbursed loans worth $25 million in the first half of last year, $500 million in the third quarter, and almost $1 billion in the fourth quarter, including a sum of $450 million in December.

As the flash loan strategy gets popular, more users are anticipated to get attracted by AAVE as the facility can be utilized for arbitrage opportunities that arise between collateral swaps, DEXs, self-liquidations and numerous applications within the DeFi industry.