Selling pressure seems to have finally taken a toll on Bitcoin (BTC) just two days after it wiped out several 100 million dollars’ worth short positions in crypto market and raced to $34,700. The sharp retracement wiped out billions of dollars’ worth market capitalization.

Selling pressure seems to have finally taken a toll on Bitcoin (BTC) just two days after it wiped out several 100 million dollars’ worth short positions in crypto market and raced to $34,700. The sharp retracement wiped out billions of dollars’ worth market capitalization.

Data published by Cointelegraph Markets, Coin 360 and TradingView indicated that BTC/USD plummeted over 12% in an hour on the first trading day of the week.

The retracement strengthened after sluggish moves last night as altcoin rally to grab a portion of Bitcoin’s market dominance.

At the time of writing this article, against the back drop of huge volatility, Bitcoin was trading at $31,093.69, down 9.1% in the last 24 hours. Earlier today, Bitcoin hit a low of $27,700.

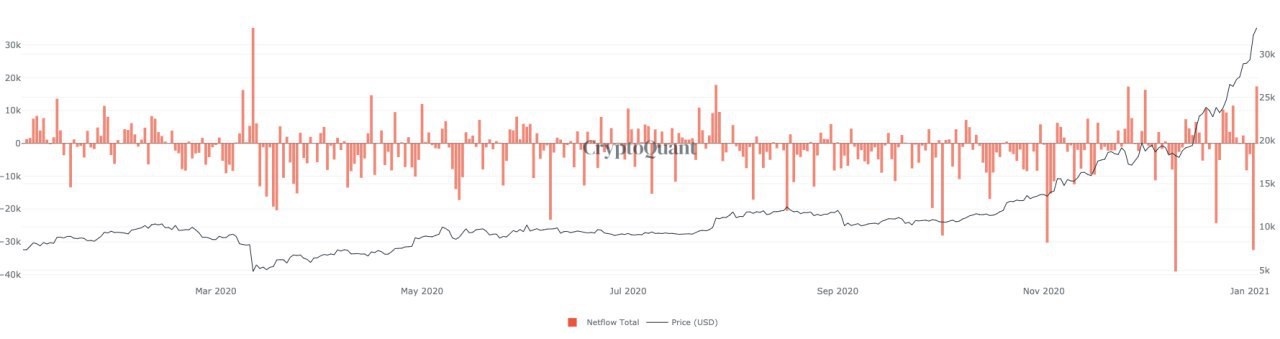

Data indicates sharp rise in exchange activity, with inflows increasing at a dramatic rate, following large payouts last week.

Luke Martin host of Venture Coinist podcast, briefly explained the sharp decline:

“Just woke up to the biggest $BTC dip we’ve had since breaking 20k.”

Just woke up to the biggest $BTC dip we’ve had since breaking 20k.

Down 20% from the peak….my brain is not used to 28k being a 20% drop though. pic.twitter.com/6fcOOcBu46

— Luke Martin (@VentureCoinist) January 4, 2021

Notably, Michaël van de Poppe, an analyst at Cointelegraph, in a YouTube video, has given his views on next major support levels.

Michaël van de Poppe said “If we want to see some support zones on Bitcoin and expecting where we’re going to move from, the first area is around $29,600, second area is around $27,600.”