Through a tweet, cryptocurrency info provider Skew pointed out that Bitcoin (BTC) will undergo tremendous volatility as 102,200 Bitcoin option contracts are set to expire on Friday.

Through a tweet, cryptocurrency info provider Skew pointed out that Bitcoin (BTC) will undergo tremendous volatility as 102,200 Bitcoin option contracts are set to expire on Friday.

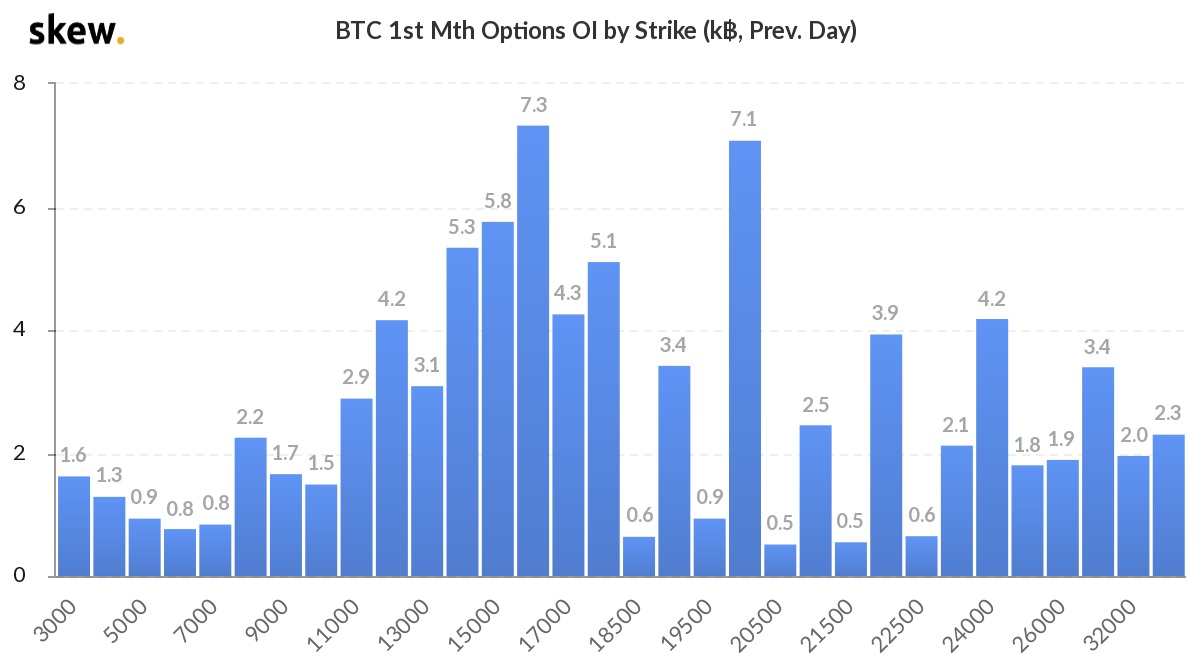

Notably, holders of option contracts enable purchasing or selling Bitcoin at a particular price, also referred to as strike price. The expiry, dated Friday, has considerable clusters at about $15,000 strike price and $20,000 strike price, as per data provided by Skew.

In general traders anticipate expiry of Bitcoin options contracts to be characterized by huge volatility as the holders churn their contracts just days before expiry.

Traders running on profit may also choose to obtain their payout and liquidate their holdings. Such kind of scenarios is mainly responsible for huge volatility in the value of Bitcoin.

Usually, the effect of options contract on the price of Bitcoin has become obvious about one or two days before the date of expiry.

Trading in cryptocurrencies has increased in 2020 as rising number of traders and institutional investors are looking at the option of boosting exposure in Bitcoin. Few days before, Deribit, which facilitates trading in cryptocurrency derivatives, started offering Bitcoin futures.

To begin with, the firm started offering contracts that expire on September 24, 2021 and has a $100,000 strike price. In short, Bitcoin traders who believe that the crypto will hit the aforesaid rate can enter into a speculative trade through the futures market.

💯 More than 100k BTC Options expiring on Dec 25th! pic.twitter.com/lnbACbJUjZ

— skew (@skewdotcom) December 21, 2020

Bitcoin is presently going through a bull market driven mainly by institutional investors and high volume OTC (over-the-counter) trades. Along with predicted futures volatility, institutional buying is also anticipated to provide wonderful support to Bitcoin and increase in illiquid wallets, which refers to addresses that have moved out less than 25% of Bitcoins they have ever garnered.

Through a detailed study, Chainalysis has found that illiquid wallets possess roughly 77% of the 14.80 million Bitcoins that have been mined and has not been lost. About $2.30 billion worth Bitcoin futures are scheduled to expire on 25th December, paving way for heightened volatility in the crypto market.