Bitcoin’s (BTC) sharp rise seems to have sparked portfolio churning, with funds moving out of altcoin markets. The DeFi Composite Index, initially rolled out by Binance Futures in the last leg of August, is witnessing its second month of decline, trading at about $400, reflecting a decline of about 60% from all-time high of $1,200.

Bitcoin’s (BTC) sharp rise seems to have sparked portfolio churning, with funds moving out of altcoin markets. The DeFi Composite Index, initially rolled out by Binance Futures in the last leg of August, is witnessing its second month of decline, trading at about $400, reflecting a decline of about 60% from all-time high of $1,200.

As a matter of fact, numerous DeFi tokens have lost 70% to 90% of their value since early September. Last month, index plummeted sharply to $507, after hitting a record high of $1,189 on the first day of listing in August.

In the 45 days ended November 1, only eight DeFi tokens, UNI and AAVE had a neutral correlation with Bitcoin. Eight DeFi tokens had a totally negative correlation with Bitcoin. Additionally:

“7 of 13 DeFi tokens had negative correlations with Ethereum (ETH), despite Ethereum powering much of the DeFi ecosystem. DeFi’s negative correlation with BTC and ETH is no surprise as the DeFi bubble came to a crashing end in September.”

Earlier this week, UniSwap, the decentralized exchange (DEX), has recorded a volume of $1.80 billion, representing the largest share in DEX industry, which recorded aggregate (total of all DEX exchanges) monthly volume of about $2.80 billion.

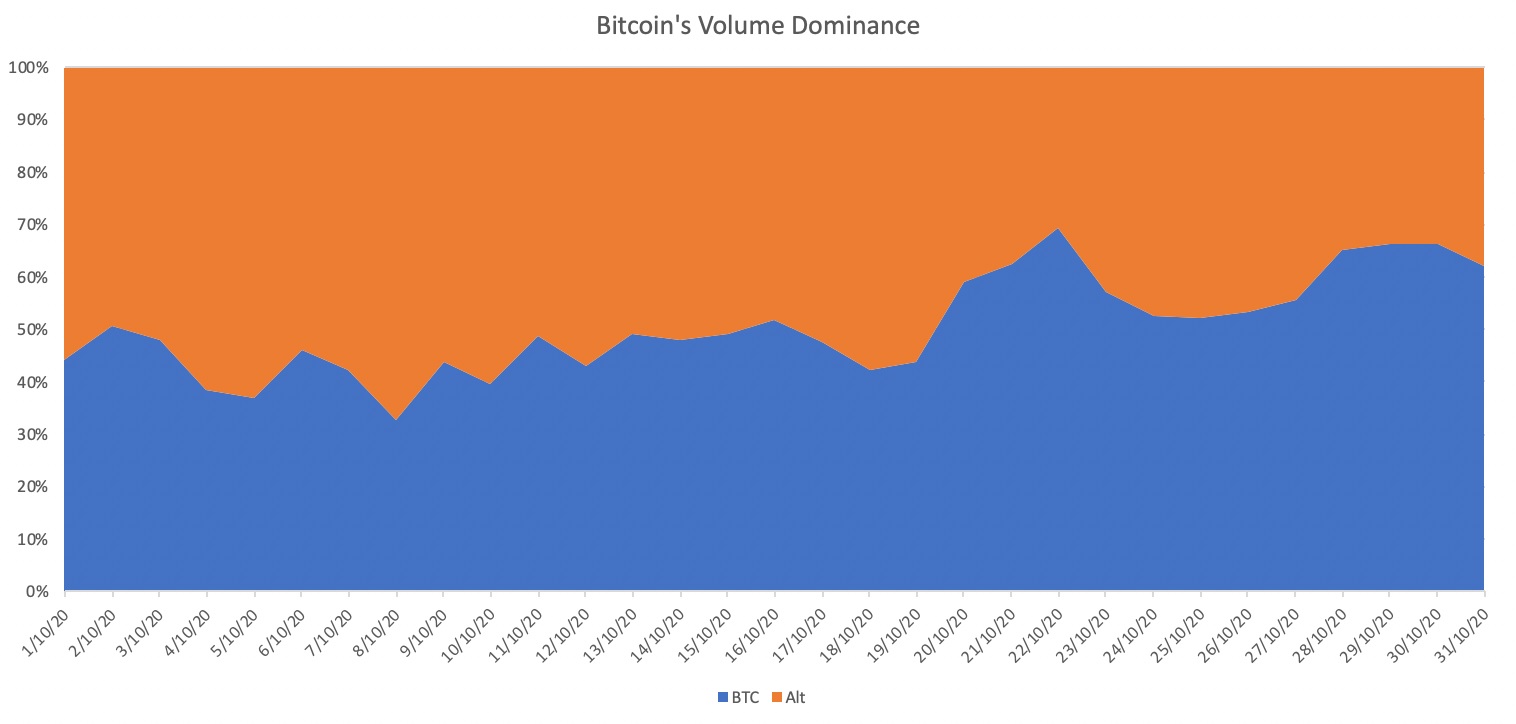

In the meantime, Bitcoin’s market dominance has risen sharply in the past few weeks, coinciding with the 10% appreciation in price since the beginning of September.

Binance has highlighted the sharp rise in Bitcoin trading volume dominance, pointing that it has been “suppressed in prior months” due to the media’s preoccupation with “alt-season.”

Last month, nevertheless, the mood of the market took a U-turn in favor of Bitcoin, with traders moving to BTC as the altcoins started undergoing price correction. Binance, irrespective of the current decline, has taken a stance that core fundamentals of the DeFi market are robust.

In spite of these short-term retracements recorded by altcoins, the TVL (total value locked) in DeFi covenants has remained over $11 billion for a month.