Experts argue that the Bitcoin’s (BTC) price in the past ten years may have been exaggerated after taking the fiat inflation into consideration.

Experts argue that the Bitcoin’s (BTC) price in the past ten years may have been exaggerated after taking the fiat inflation into consideration.

As the value of Bitcoin is generally quoted in fiat, the US dollar in particular, experts argue that it is not resistance to depreciation.

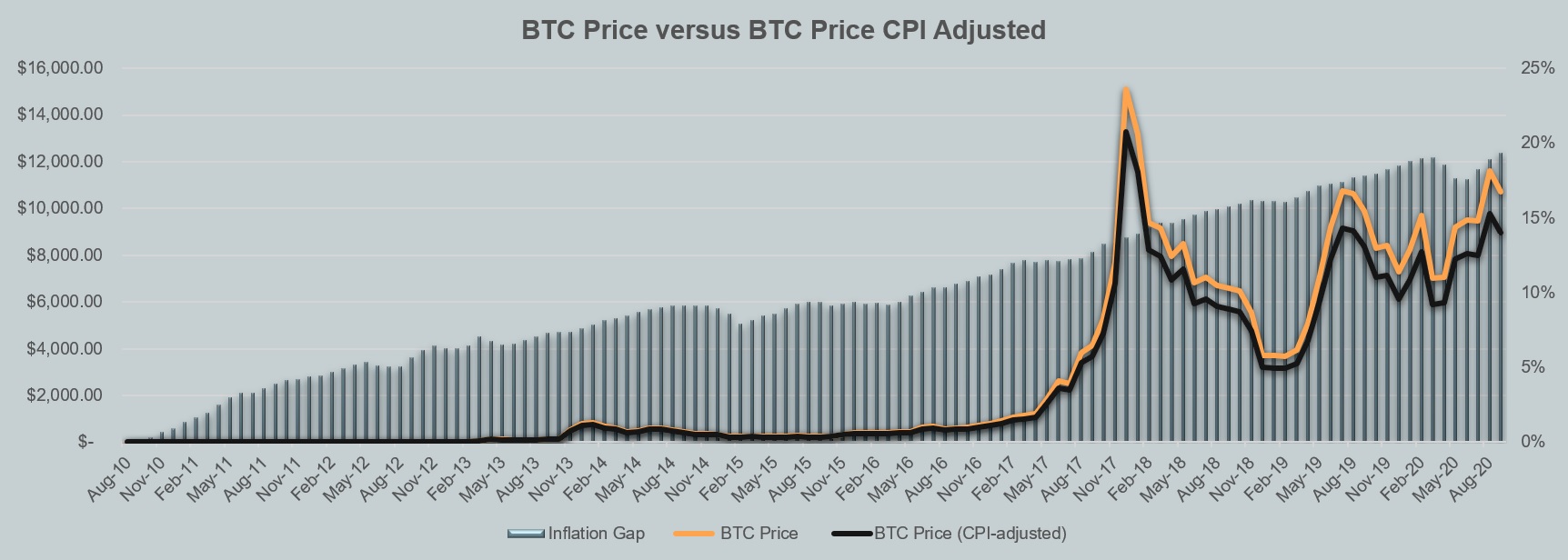

The US inflation stood far below the average in the years that following the 2008-09 financial crisis, fluctuating at an annual rate of around 2%. Nevertheless, it sums up to 20% over a decade.

Therefore, using the 2010 greenback as the base and applying the depreciation on Bitcoin’s current price of $10,466, we arrive at a value of $8,770.

Though the figures may disappoint Bitcoin enthusiasts, still, it does not imply that investment in Bitcoin was a bad decision or that it does not possess qualities to be called as a store of value.

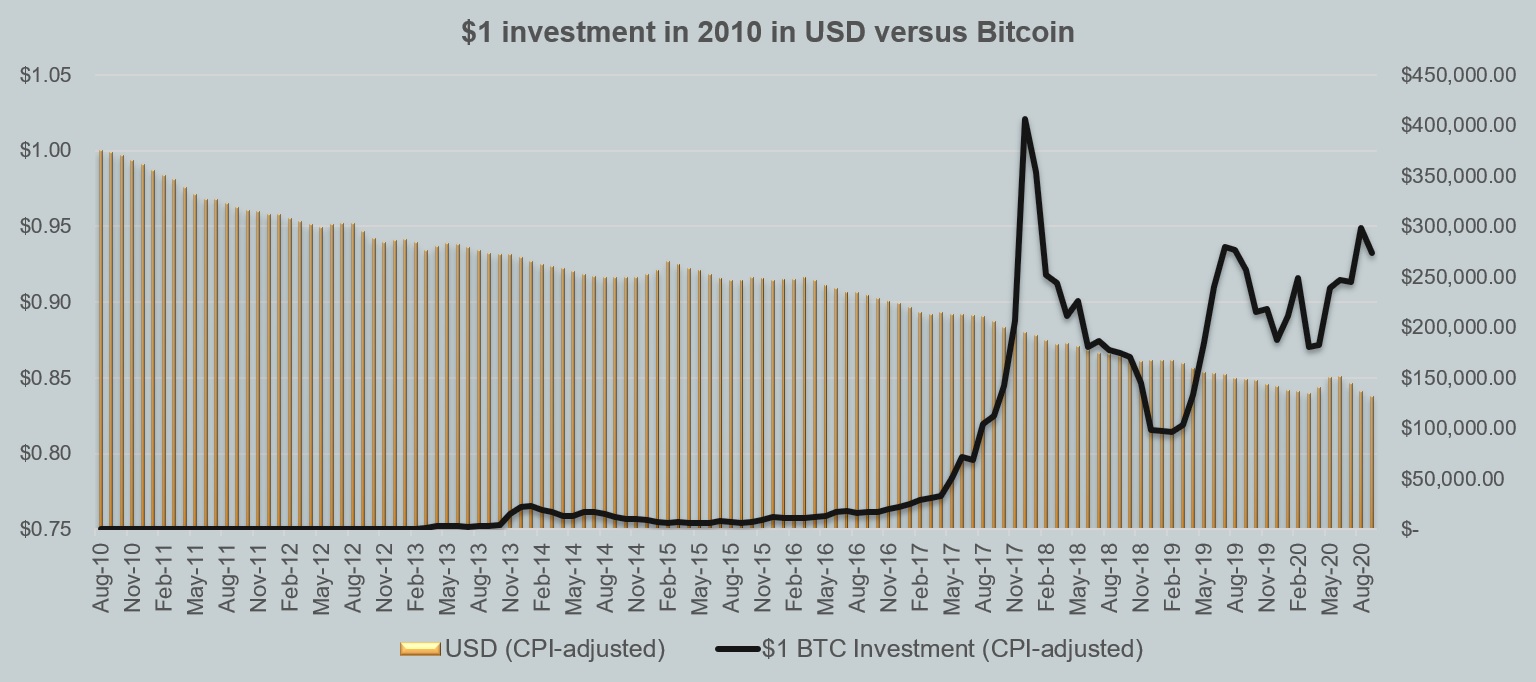

On the other hand, if we match the performance of the greenback and Bitcoin in the past decade, after adjusting for inflation, then it will give an idea of how good an investment in Bitcoin is. A dollar invested in the US dollar would have resulted in a loss of 16 cents, giving merely 84 cents to an investor.

On the contrary, a dollar invested in Bitcoin would have resulted in returns of $274,000. As it can be understood, the numero uno crypto has performed well in terms of value creation.

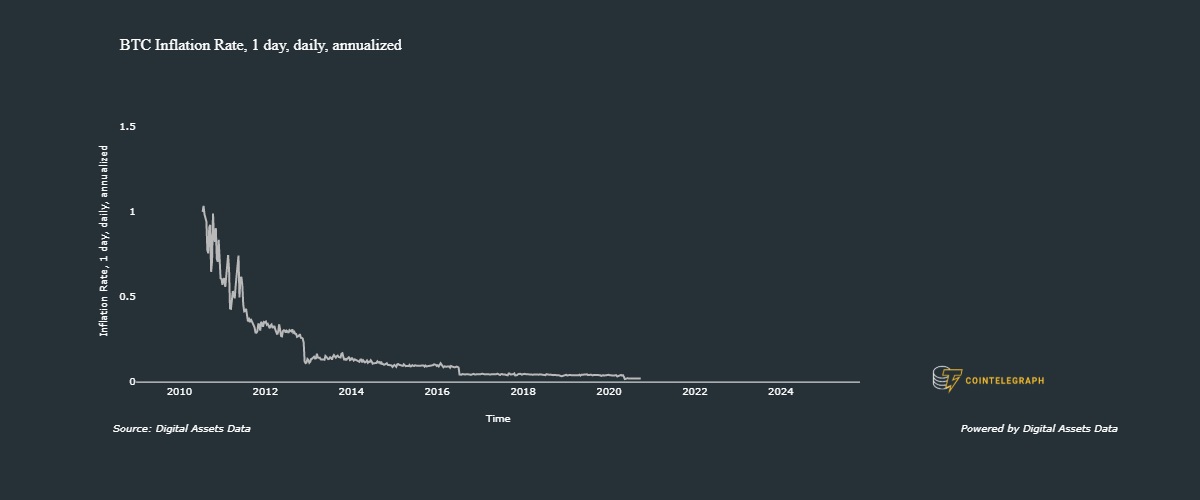

Bitcoin is not invulnerable to inflation, but there is no need to worry too much over that. As far as inflation rate remains low and Bitcoin continues to rally at a quick rate as it did in recent times, the impact of inflation would be negligible to investors who are holding for a long period of time.

The only way to wither the effect of inflation is to stop quoting Bitcoin in fiat terms. If that is done, then a decade later, we can discuss how many satoshis one can acquire with a dollar in hand.