Some crypto exchanges are allegedly involved in wash trade and other deceitful strategies to manoeuvre the trading volumes on their platform.

Some crypto exchanges are allegedly involved in wash trade and other deceitful strategies to manoeuvre the trading volumes on their platform.

In an unregulated market such as crypto, this information is not appalling, but a recent research report published indicates how profound the issue is and which exchanges continue to stay on the legitimate side of the tracks, regardless of the understandable allurement to generate bogus trades and volume.

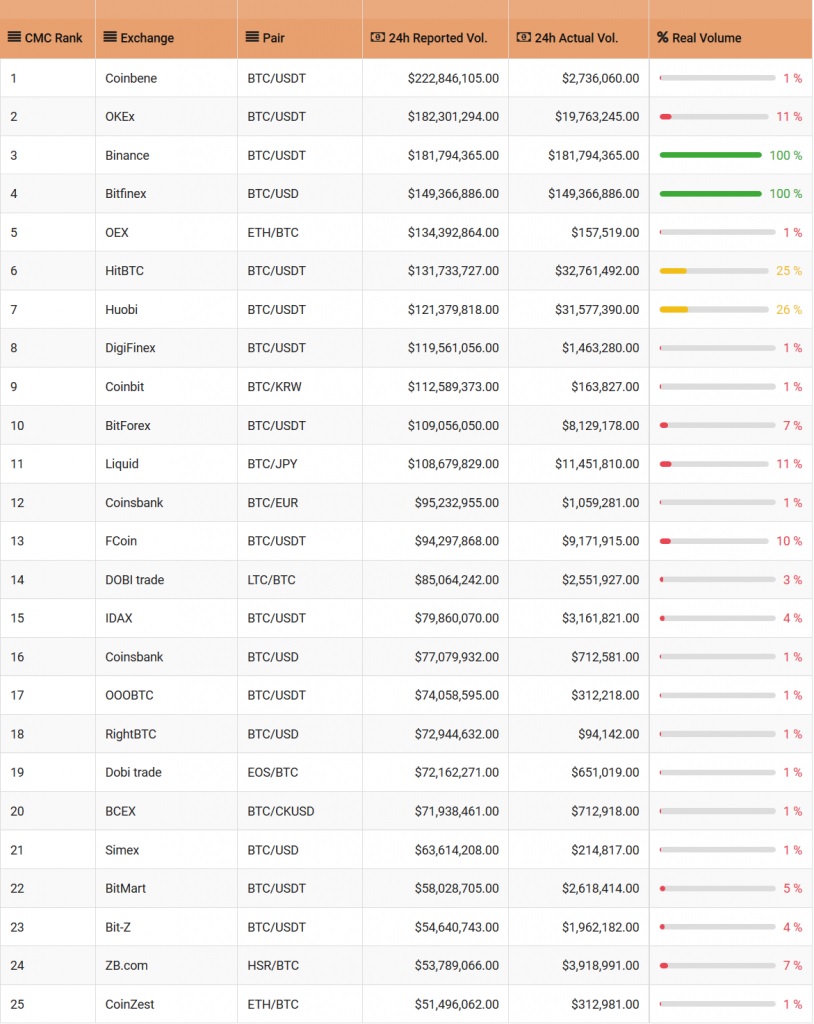

The chart below provides a record of 25 exchanges and their BTC trading pairs, the daily volume disclosed, the real volume and the percentage of the overall trading volume measured to be real:

Only two of the 25 exchanges detailed generate real trade volume of 100%. Famous exchanges such as OKEX and HitBTC illustrate that 25% or less of their volume is genuine trade.

“Based on this data over 80% of the CMC top 25 BTC pairs volume is wash traded. These exchanges continue to use these strategies as a business model to steal money from aspiring token projects”.

Additionally, a majority of these exchanges also utilize listing fees as a significant income means for washing trade. According to the report, the average venture used up more than $ 50,000 on the exchange listing charges this year. It turned out that numerous crypto ventures were burdened to list their tokens in wash trading platforms with low trading activity than was claimed.

Bitfinex and Binance seems to be the only crypto exchanges, which are not involved in washing. Bitfinex is ranked # 9 on Coinmarketcap’s 24-hour trading volume list of leading exchanges, while Binance is ranked #2 behind OKEX.

Bitfinex was caught up in the Tether hullabaloo. The exchange lists the stable coin Tether, which is alleged to have been involved in Bitcoin price rigging. Both Tether and Bitfinex share some of their executives. Earlier this year, charges were made that Tether and Bitfinex were both accountable for the increase in Bitcoin’s price in December last year, when the value of the cryptocurrency rallied to roughly $20,000.

Of late, fiat deposit facility was withdrawn on their platform because of a sticky connection with their previous bank, while the price of Tethers crashed to $ 0.95 due to investors losing their trust. Many of these contentions seem to have vanished as Bitfinex recently presented a Tether / Fiat trading pair, as well as alternative stable coins and a fresh Bahamas bank account was setup by Tether.

Tether’s listing on Bitfinex may have been adequate to provide them the genuine indispensable volume required to avoid washing. In the interim, Binance and its CEO, Changpeng Zhao, have always kept up a superior level of astuteness in their business conduct.

Binance, which had a head start in the crypto market, recently moved their operations to Malta. Furthermore, the exchange has introduced BNB, the native currency of the platform as a real utility token to establish a decentralized exchange. These are some of the main reasons why Binance would never need to resort to wash trading.