The need for decentralized exchanges is enormous. To catch a picture of how urgently people desire them, Ethereum creator Vitalik Buterin was cited as stating, “I definitely hope centralized exchanges go burn in hell as much as possible.”

The need for decentralized exchanges is enormous. To catch a picture of how urgently people desire them, Ethereum creator Vitalik Buterin was cited as stating, “I definitely hope centralized exchanges go burn in hell as much as possible.”

With the introduction of StellarX, this dream could be moving closer to reality. All this hatred for centralized exchanges is reasonably right, after a lengthy list of hacks that have caused losses to the tune of billions of dollars’ worth of value.

Besides safety concerns, a rising number of voices amid both privacy campaigners and the cryptocurrency community maintain that the right to financial confidentiality is an indispensable human right. Exchanges are intimidated to implement KYC (know your customer) and AML (anti-money laundering) normss, even though countless people think these approaches do additional damage than good.

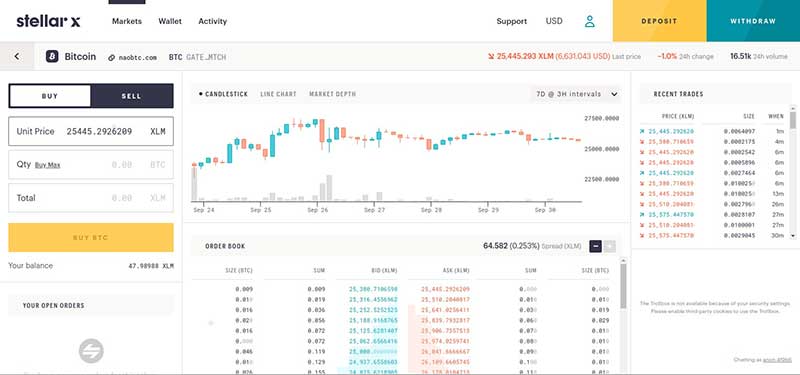

StellarX is venturing in to fill the void, and the team recently declared the conclusion of the beta validation period and authorized beginning of the facility. The facility is being introduced by Interstellar, a firm that was created out of a joint venture between Chain and Lightyear, the for-profit sister concern of the Stellar Development Foundation.

StellarX permits buying and selling of fiat currencies, tokens, and any other asset, and is being referred to as the world’s first completely zero-cost trading platform. As the trades happen on the Stellar network, there is a minute charge in Lumens (XLM), but the cost is very little that StellarX repays the amount at the end of every month. The platform is not really an exchange—it is basically a GUI for using the Stellar open marketplace.

Financial privacy not only a human right, it also underpins the rights of expression & association. Financial surveillance is fascism

— Andreas M. Antonopoulos (@aantonop) June 27, 2016

There are several benefits to this. For instance, there is effortless handling of USD deposits via StellarX’s joint venture with Changelly. Utilizing the Stellar network in addition implies transactions are extremely speedy, all devoid of having to give your keys to a confidential third party. The consumer interface is simple and comfortable to employ, which is a change for the better over several other DEXs which have let down users with lack of adequate technical expertise.

Obviously, there are also drawbacks—a decentralized exchange identical in every manner to centralized exchanges would be incredible. A majority of the assets bought and sold on StellarX are tethered. This implies they are tokens released by third parties that assure possession of the underlying asset. The whole thing apart from for XLM and Stellar-based tokens are tethered, which implies you still have to believe the suppliers of the tethered assets. The exchange site lets you understand that it will be clearly stamped which assets are tethered and which are not.

If you wish to take out any of the tethered assets, you have to perform it on the site of the real supplier instead of StellarX website, even though there are ideas to incorporate withdrawals in the StellarX site in the future. Despite the fact that StellarX doesn’t charge any fees, the issuers of the tethered tokens could charge for providing certain services, such as Bitcoin withdrawals.

This will be forgivable for many, because while it still requires trusted third parties, it doesn’t require trusting any single third party. Besides, there seems to be plenty of liquidity on the market, so it is easy enough to move any of the tethered tokens into XLM and use any other exchange where XLM is supported.

While a few of these disadvantages might repel die-hard crypto-supporters, StellarX strikes a delightful equilibrium between decentralization and consumer experience. Offering an appreciable consumer experience with decentralized protection is possibly a major boon for XLM. The exchange aids all Stellar-based tokens, which at present number 2,500 and rising at a rate of 50 per week. This is drawing in a community of traders, and combined with numerous incentives to employ XLM as the primary legal tender, StellarX is certain to be a driver for better adoption of XLM.

With extra facilities in the works, there is absolutely a chance that StellarX might turn out to be the “killer app” of the Stellar network. You can test it out by heading over to StellarX’s website.