A special report on Venezuela’s Petro has been published by Reuters news agency, raising thought-provoking doubts about the feasibility of Petro, the oil-backed govcoin.

A special report on Venezuela’s Petro has been published by Reuters news agency, raising thought-provoking doubts about the feasibility of Petro, the oil-backed govcoin.

The report has been published after a four-month investigation in the country. As many had suspected, Reuters was unable to locate users, investors or verifiable resources that back the crypto.

Furthermore, the Maduro government has not been able to explain the current state of the crypto development process. Reuters has also pointed out that the crypto marketing effort is in shambles.

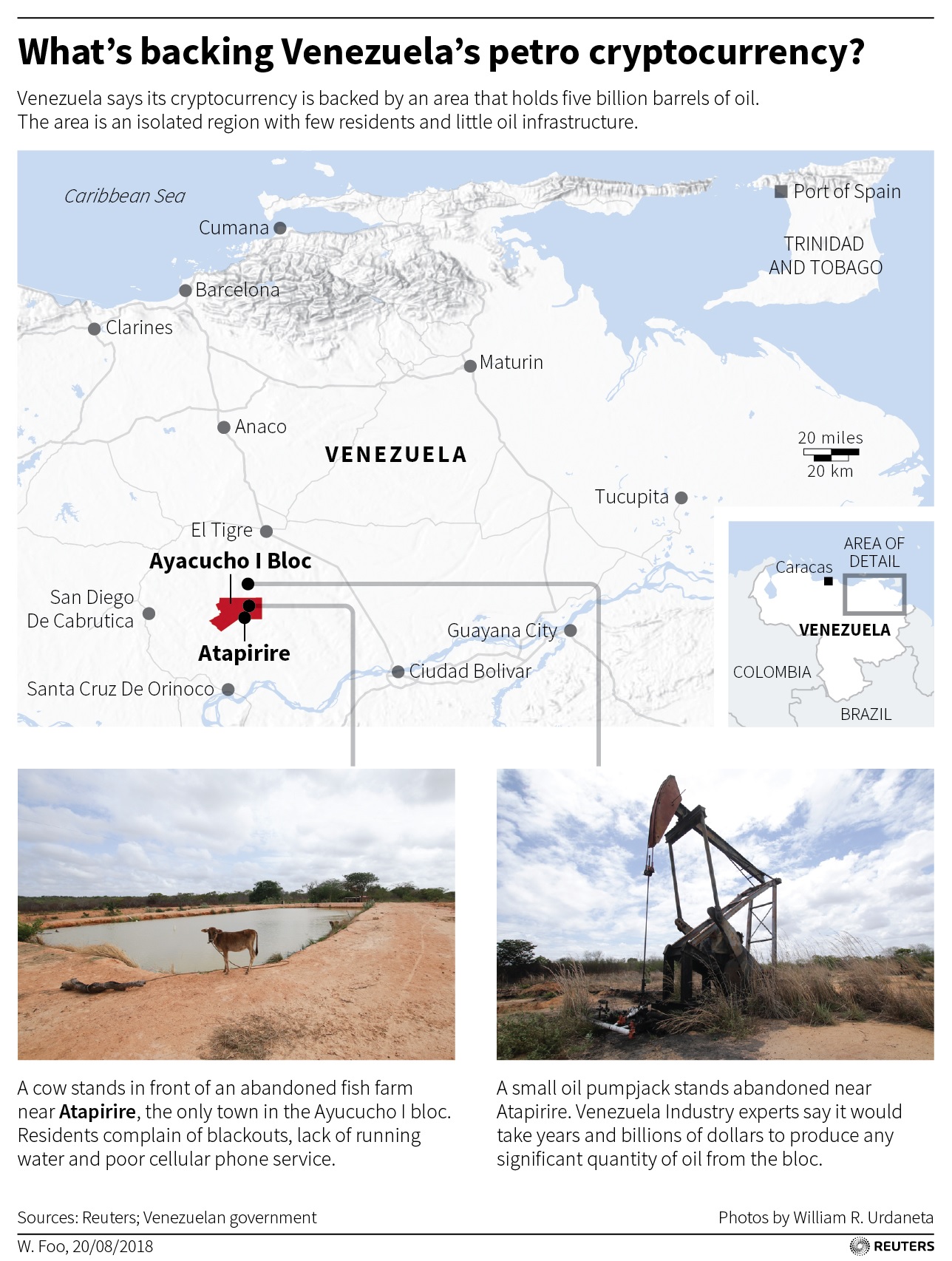

Atapirire, located in an isolated savanna in the heart of Venezuela, is the town that the government claims to be brimming with 5 billion barrels of petroleum.

Those reserves back the digital currency dubbed the “petro,” which Maduro launched in February. Earlier this month, Maduro assured that the launch is a part of a major recovery plan for the crisis-hit nation.

The residents of Atapirire, however, say that they have not seen any kind of efforts from government to unearth those reserves. The people do not believe that their village is going to lead a miracle economic recovery of Venezuela.

Homemaker Igdalia Diaz said “There is no sign of that petro here.” She also ranted about her town’s collapsing school, bumpy roads, frequent power cuts and permanently hungry citizens. Reuters has asserted that its ground investigation has shown that the country’s Petro is nearly impossible to find anywhere in the country. There is no evidence of booming petro trade. The crypto is not offered in any exchange as well. None of the shops were found to accept it.

Reuters was only able to find buyers in online forums where purchase experiences have been shared. Ironically, none of them were willing to identify themselves. While one forum user alleged of being “scammed”, another user told that he has received the tokens without any issue. Furthermore, he squarely blamed the US sanctions against Venezuela for the lack of popularity and demand for the petro.

There have been contradictory statements from the government side. While Maduro says that the token sales have raised $3.30 billion and the crypto is used as payment for imported goods, Hugbel Roa, a cabinet minister working with the project team, stated that the technology is still being worked out and that “nobody has been able to make use of the petro … nor have any resources been received.”

The Superintendece of Cryptoassets, the government association that monitors the petro has no physical presence in the Finance Ministry building. More importantly, the Superintendence’s website is not active and its president Joselit Ramirez did not respond to clarification requested by Reuters.

The confusion increased last month when Maduro announced that pensions, salaries, and exchange rate for Venezuela’s Bolivar are now pegged to the petro.

Alejandro Machado, a Venezuelan computer scientist and crypto advisor who has closely followed the petro said

“There is no way to link prices or exchange rates to a token that doesn’t trade, precisely because there is no way to know what it actually sells for.”

According to a study report published on August 19 on Aporrea, a Venezuelan analysis site, Rafael Ramirez, former oil minister, has stated that the country may require over $20 billion in investment to bring the oil rigs back to operation. The country’s state-owned oil company PDVSA cannot afford such huge investments.

Ramirez, who is currently in exile after being slapped with corruption charges by the Venezuelan government, stated

“The petro is being set at an arbitrary value, which only exists in the government’s imagination.”